Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has dropped 3% within the final 24 hours to commerce at $93,324, as crypto funding merchandise proceed to draw robust curiosity from buyers with report inflows.

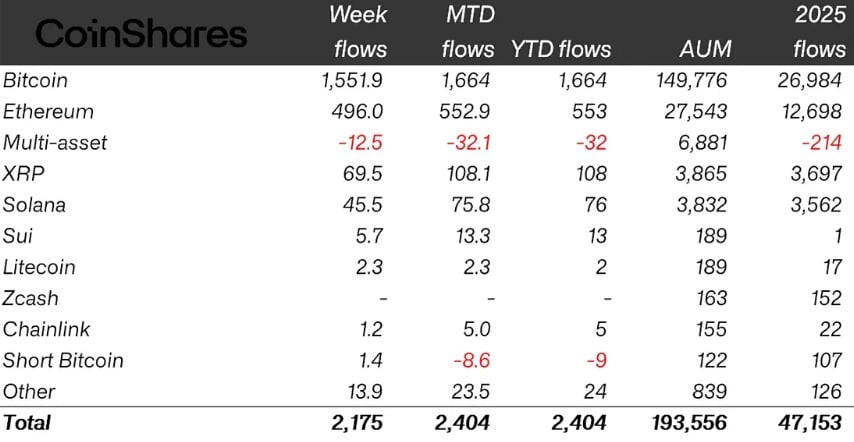

Final week, crypto funds noticed inflows of $2.17 billion, the best in 2026 thus far and the most important weekly acquire since October, in accordance with European asset supervisor CoinShares. Many of the cash entered the market earlier within the week, however Friday recorded $378 million in outflows resulting from geopolitical tensions in Greenland and recent considerations over tariffs.

James Butterfill, CoinShares’ head of analysis, additionally famous that sentiment was affected by expectations that Kevin Hassett, a number one contender for US Fed Chair, would probably stay in his present place. Bitcoin dominated final week’s fund inflows, pulling in $1.55 billion, which represented over 70% of the overall.

Ether adopted with $496 million, whereas XRP and Solana attracted $70 million and $46 million, respectively. Smaller altcoins similar to Sui and Hedera recorded minor inflows of $5.7 million and $2.6 million. Regardless of proposals underneath the US Senate’s CLARITY Act that might restrict stablecoin yields, Ether and Solana funds held up nicely.

Amongst fund sorts, multi-asset and quick Bitcoin merchandise have been the one classes to see outflows, totaling $32 million and $8.6 million. On the issuer facet, BlackRock’s iShares ETFs led the market with $1.3 billion in inflows, adopted by Grayscale Investments at $257 million and Constancy Investments at $229 million.

Geographically, the US accounted for almost all of inflows at $2 billion, whereas Sweden and Brazil noticed small outflows of $4.3 million and $1 million, respectively. With these features, complete belongings underneath administration in crypto funds surpassed $193 billion for the primary time since early November, displaying renewed investor confidence.

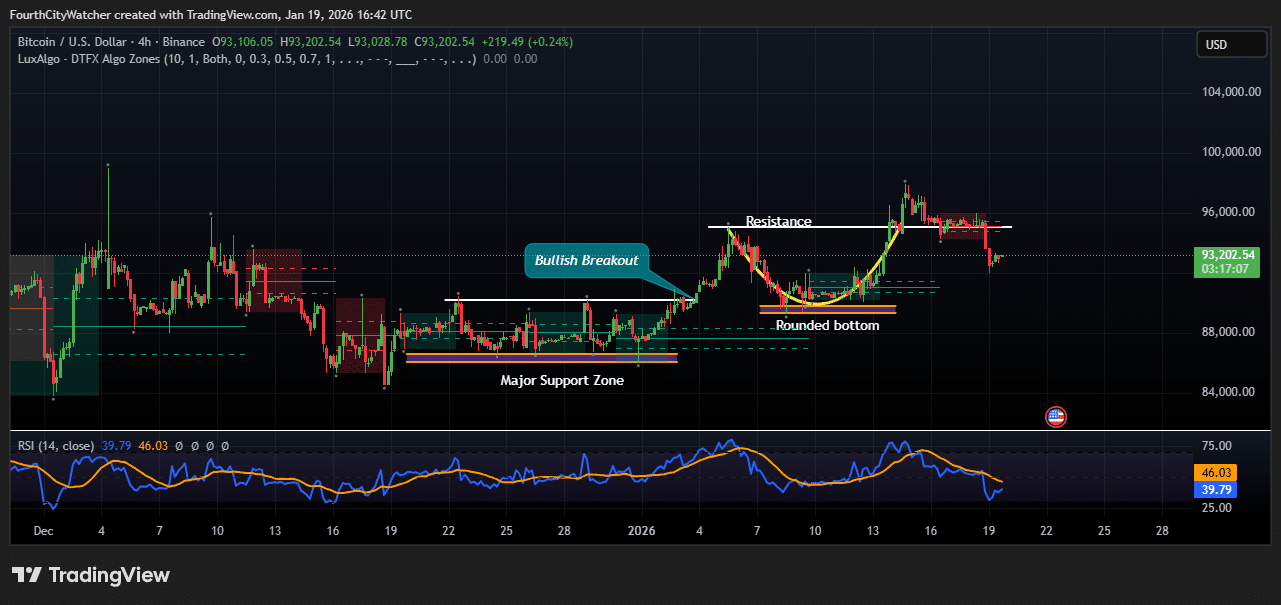

The Bitcoin value 4-hour chart exhibits a sequence of bullish developments, although current value motion signifies some short-term consolidation. Value just lately rebounded from a significant assist zone round $87,500–$88,500, which had beforehand acted as a powerful accumulation space. This degree has efficiently absorbed promoting strain a number of occasions prior to now, offering a strong basis for larger strikes.

Following this assist, Bitcoin shaped a rounded backside sample between January 6 and January 12, signaling a shift from bearish to bullish sentiment. The rounded backside displays a gradual lack of promoting momentum, permitting consumers to regain management.

A bullish breakout occurred after the rounded backside, pushing the value above prior resistance ranges round $91,000. This breakout was accompanied by robust upward momentum, with the value briefly testing the $96,000 area. The breakout confirms that consumers have been keen to step in decisively after the consolidation, signaling potential continuation of the short-term uptrend.

Presently, the value has pulled again barely after hitting the $96,000 resistance space. The minor retracement seems wholesome, because it permits consumers to enter at decrease ranges with out threatening the general bullish construction. The relative energy index (RSI), at the moment round 39.8, exhibits that Bitcoin isn’t but oversold, indicating room for additional upside as soon as consumers re-enter. The 46-level on the RSI additionally signifies earlier resistance in momentum, now appearing as a possible pivot level.

The chart exhibits a well-defined assist and resistance construction, with value respecting the $88,000–$91,000 vary earlier than making an attempt larger ranges. The rounded backside and bullish breakout spotlight a transition from accumulation to renewed upward momentum. Merchants might look ahead to a retest of $91,000–$92,000 as a key assist degree, whereas the $96,000 space stays a near-term resistance barrier.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection