- Portugal blocked Polymarket after election bets surged forward of official outcomes.

- The transfer seems pushed extra by narrative management than by playing considerations.

- Prediction markets unsettle establishments as a result of they reveal sentiment sooner than official channels.

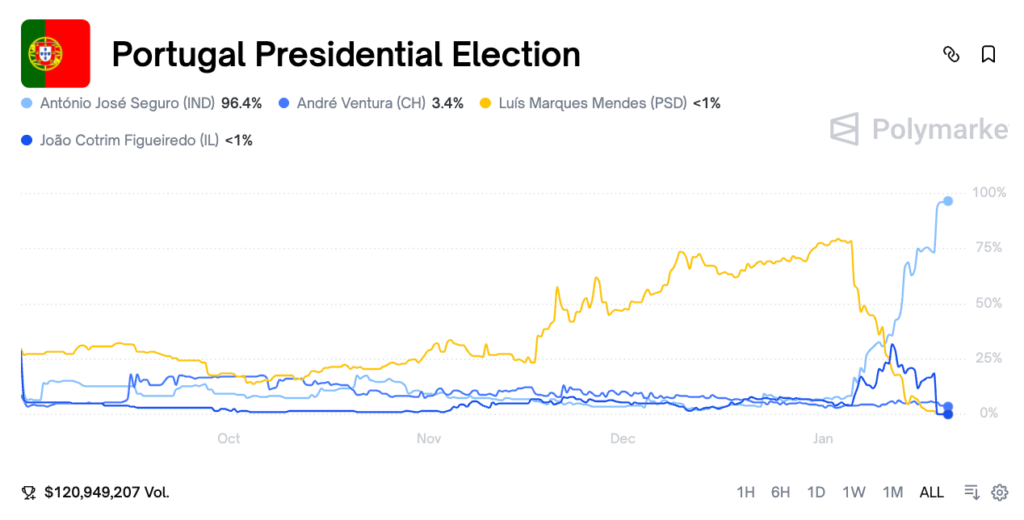

Portugal’s regulator moved rapidly to dam entry to Polymarket after a sudden surge of cash flowed into election contracts simply earlier than official outcomes have been introduced. On the floor, the reason was easy: unlicensed playing and a nationwide ban on political betting. However the timing tells a extra sophisticated story. When tens of millions instantly cluster round one end result, it highlights how skinny the data barrier actually is — and that’s what tends to make establishments uneasy.

Markets Don’t Leak Info, They Combination It

Authorities floated considerations about leaked exit polls or entry to private information. That’s doable, however it’s not the one rationalization. Prediction markets are designed to soak up 1000’s of small indicators directly — conversations, turnout cues, native chatter, quiet shifts in sentiment — and switch them right into a worth. If insiders have been leaking delicate information, that factors to weaknesses in election safeguards, not proof that prediction markets themselves are doing one thing mistaken.

Blocking Entry Doesn’t Remedy the Drawback

Community-level blocking seems like punishing the messenger. Prediction markets don’t create outcomes, they floor expectations. Shutting them down doesn’t shield democracy, it protects appearances. Much more regarding is the warning that customers won’t be capable to retrieve funds after entry is blocked. That sort of regulatory whiplash doesn’t seem like shopper safety, it appears to be like reactive and unsure.

This Isn’t Only a Portugal Story

Portugal isn’t alone right here. Comparable scrutiny has appeared throughout France, Germany, Hungary, and even components of america. The sample is acquainted. When a market produces indicators sooner than establishments can reply, enforcement instantly accelerates. It’s onerous to not discover how typically regulation tightens exactly when prediction markets make officers look outpaced.

Why This Makes Regulators Nervous

Prediction markets are blunt, typically messy, and infrequently uncomfortable. That’s their energy. They floor collective perception in actual time, with out ready for press conferences or official affirmation. Portugal’s transfer suggests a deeper concern — not of betting, however of knowledge escaping conventional channels. If democratic techniques can’t tolerate clear indicators about public expectation, the problem isn’t the market. It’s confidence within the system watching it.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.