In short

- Bitcoin has damaged its “golden cross” formation, dropping beneath the important thing $90K help degree.

- Solana is mimicking BTC’s actions, likewise seeing a breakdown in help with bearish momentum constructing.

- Merchants on the prediction market Myriad are adjusting their prognostications accordingly as beforehand bullish sentiment drops sharply.

The crypto market is bleeding once more. Whole market capitalization sits at $3.01 trillion as we speak, down 4.27% over the previous 24 hours as Bitcoin and Solana each broke beneath vital help ranges with decisive, heavy-bodied candles—the sort that depart little room for interpretation.

On Myriad, the prediction market constructed by Decrypt‘s mother or father firm Dastan, merchants are recalibrating quick. The percentages for Bitcoin pumping to $100,000 earlier than dumping to $69,000 now stand at 72.5%—down sharply from 85% simply yesterday. In the meantime, 90% of the cash betting on a brand new Solana all-time excessive earlier than July is saying “no.”

The charts appear to agree with the bears.

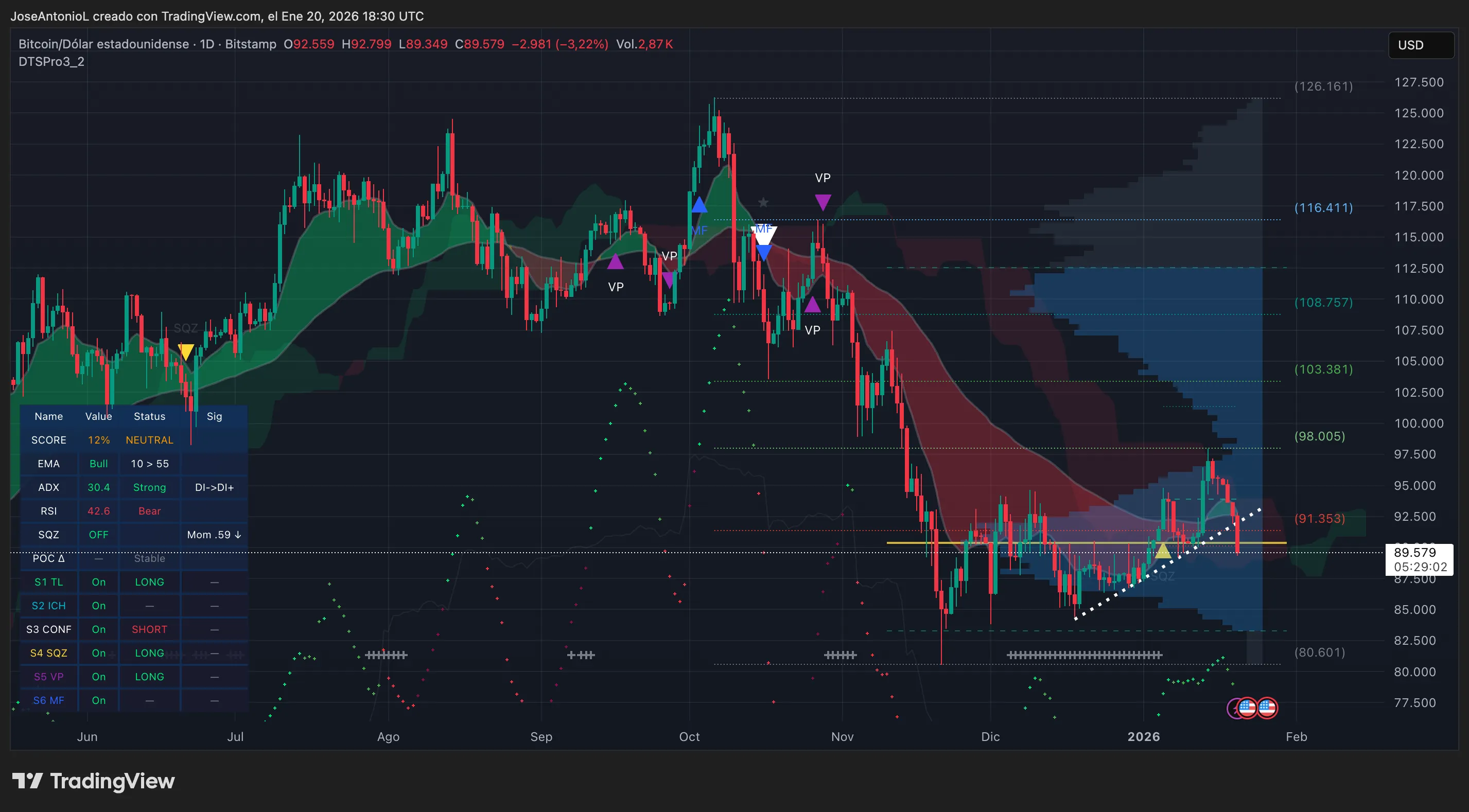

Bitcoin (BTC) worth: Trendline damaged, eyes on $80K

Bitcoin as we speak broke the psychological help of $90K and is buying and selling at $89,208 after shedding 3.62% within the final 14 hours. That implies that “golden cross” formation BTC painted on the charts only a few days in the past has now been invalidated.

Extra importantly, the king of crypto has damaged beneath an ascending trendline that had been offering help for the reason that December lows. That dotted white line on the chart beneath? It is now overhead resistance as a substitute of a flooring.

Worth help, although, just isn’t established by short-term momentum, however long-term evaluation. The Fibonacci ranges between the all-time highs and the minimal worth reached in late November are a strong reference and have been revered all through since then.

Bitcoin’s Common Directional Index, or ADX, sits at 30.5, virtually 3 factors beneath yesterday’s readings, exhibiting that the bullish bounce is shedding steam quickly. ADX measures development power, no matter path, on a scale from 0 to 100, with studying above 25 confirming a development is in place.

The Relative Energy Index, or RSI, is likewise measured on a 0 to 100 scale and offers a way of momentum, with scores above 70 signally overbought and beneath 30 oversold. So, with the ADX at 30.5 mixed with an RSI of 41.7, the charts are inserting Bitcoin in bearish territory with out being oversold. The setup would recommend to merchants there’s room for additional draw back earlier than any significant bounce.

The subsequent main help zone lies close to the $80,600 Fibonacci degree seen on the each day chart. That is roughly 10% beneath present costs.

Exponential transferring averages, or EMAs, assist merchants determine tendencies by taking the common worth of an asset over the quick, medium, and long run. And Bitcoin’s 200-day EMA (common worth of the final 200 days), which generally acts as a line within the sand for longer-term bulls, has already been breached.

When Bitcoin breaks beneath this degree with a candle that has an enormous physique and minimal wicks—precisely what we noticed as we speak—it sometimes indicators extra ache forward earlier than patrons step in.

Key ranges:

- Resistance

- $91,500 (quick)

- $98,000 (robust)

- Assist

- $86,000 (quick)

- $80,500 (Fibonacci degree).

Solana (SOL) worth: Mimicking Bitcoin’s breakdown

Solana is following Bitcoin’s lead, down 5.06% to $126.61. The chart beneath exhibits SOL has additionally sliced by its 200-day EMA with authority, and the technical indicators are flashing bearish throughout the board.

The EMA configuration confirms the bearish correction: The 50-day EMA has crossed beneath the 200-day EMA, canceling the temporary entice of a golden cross and sparking dangers of resuming a bearish sign that merchants name a “demise cross.” A demise cross is shaped when the short-term 50-day EMA falls beneath the longer-term 200-day EMA, signaling bears are in management.

The strongest quick help for Solana sits across the $117 zone, marked by the dotted line close to the present worth within the chart above. If that degree fails, SOL might be a retest of $100 and even deeper. The Squeeze Momentum Indicator is off however pointing downward, suggesting the promoting strain is not completed.

For context, Solana was buying and selling above $250 again in September. The present worth represents a 50% haircut from these highs—and prediction market merchants clearly do not count on a restoration anytime quickly.

Key ranges:

- Resistance

- $140 (main quantity zone)

- $150 (quick)

- Assist

- $117 (quick)

- $100 (psychological).

Disclaimer

The views and opinions expressed by the writer are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Every day Debrief E-newsletter

Begin daily with the highest information tales proper now, plus authentic options, a podcast, movies and extra.