The president of sell-side Wall Avenue agency Yardeni Analysis says he’s seeing indicators of a broadening bull market as momentum shifts to small and mid-cap (SMID) shares.

Ed Yardeni says the ratio of the S&P 100 to the S&P 500 could have peaked on the finish of final yr.

“If that’s the case, then the chances of a bubble bursting now are a lot decrease than they have been again then, when the inventory market was far more concentrated in tech names than it’s now, in response to this ratio.

So as an alternative of a bursting bubble, we could also be seeing a broadening bull market.”

Final month, Yardeni shifted to underweight on the Magnificent 7 shares, arguing that the tech giants at the moment are competing with each other in a “Sport of Thrones” atmosphere. The shift represented the agency’s first transfer away from being chubby on the sector in 15 years.

Yardeni says in his new evaluation that the brand new thesis is working to this point.

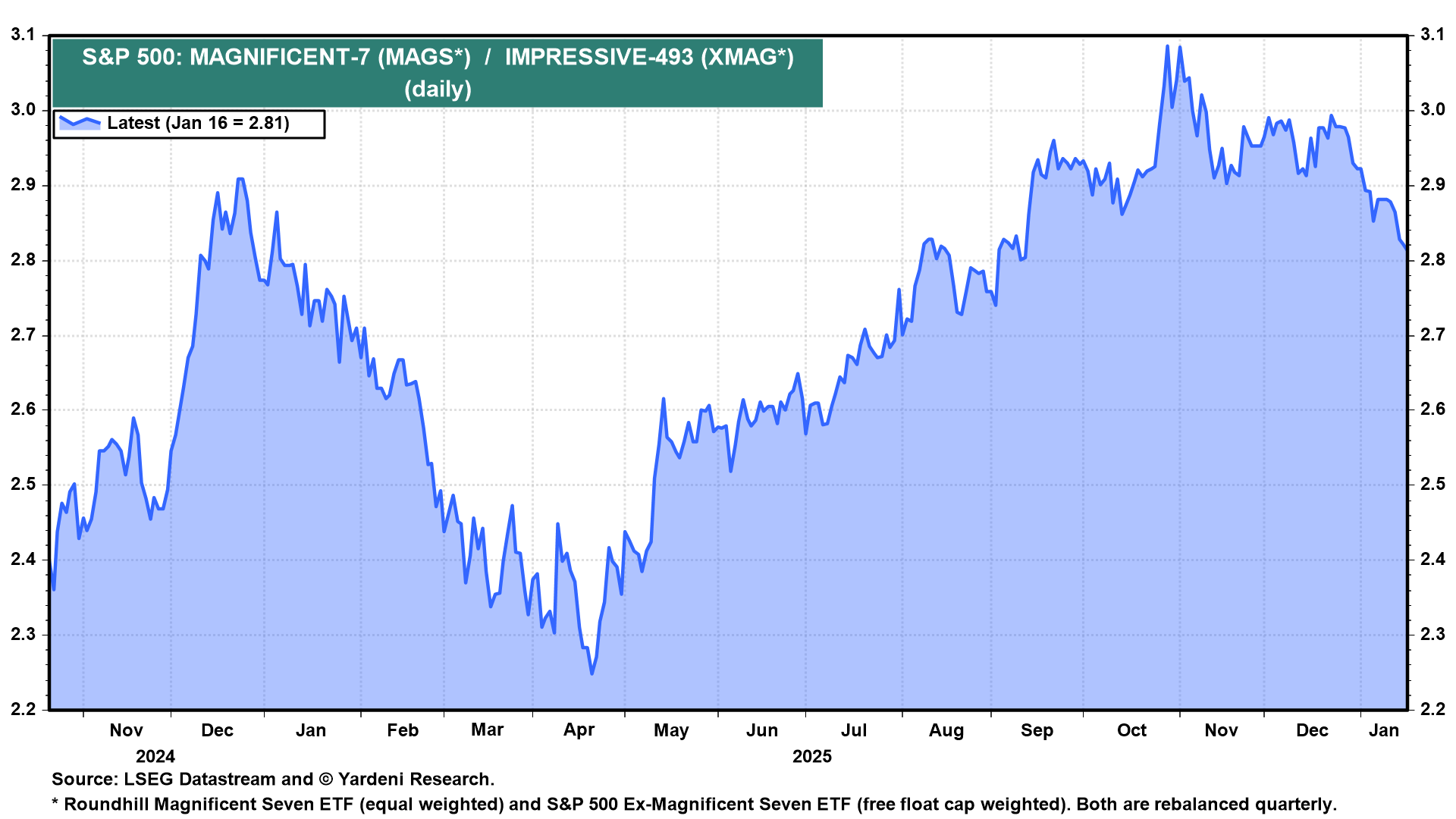

“Till late final yr, the Magnificent-7 operated as seven impartial kingdoms protected by massive moats. Every prospered with its personal distinctive monopoly. Nevertheless, the AI arms race has upended that peaceable coexistence by tremendously growing competitors amongst them. The ratio of the S&P 500 MAGS to XMAG ETFs peaked after Michael Burry famously tweeted on October 31, 2025, ‘Typically, we see bubbles. Typically, there’s something to do about it.”

The Wall Avenue veteran notes that SMID shares have outperformed massive caps, although he acknowledges that this growth might be a head pretend.

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Value Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney