The early 2026 good points had been rapidly erased from the markets attributable to escalating geopolitical pressure that has harmed crypto greater than another monetary area.

Traders have began to stroll away from the trade, which is obvious from the ETF flows within the US on Tuesday, which was the primary enterprise day for the week.

Ripple ETFs Flip Pink

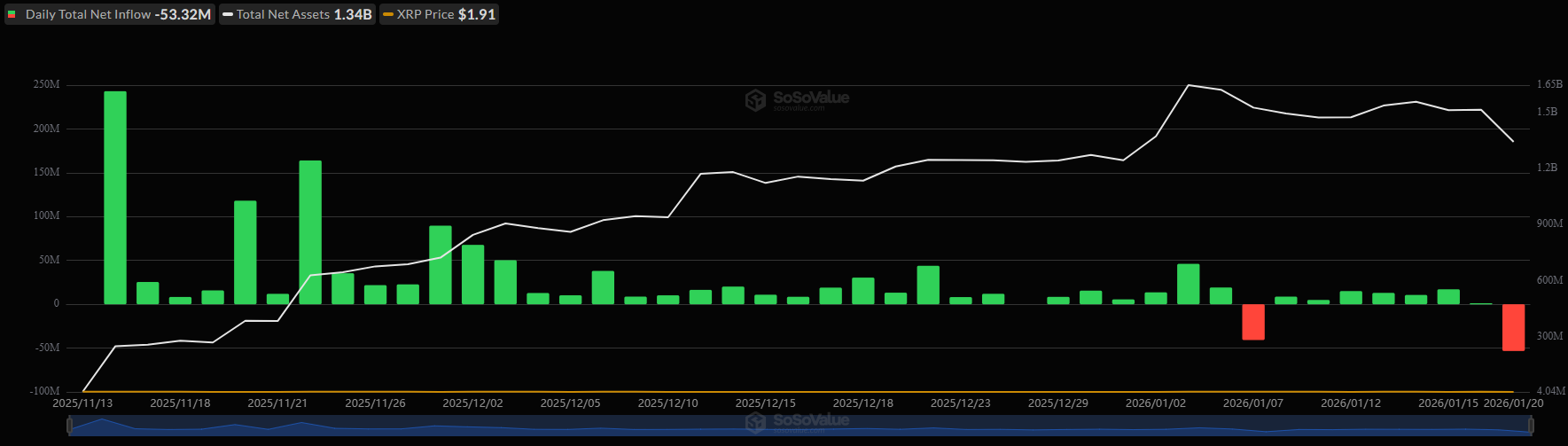

Recall that the primary XRP-focused ETF with 100% publicity to the asset launched simply over two months in the past, adopted by 4 extra by the top of the yr. The demand was substantial, as Canary Capital’s XRPC set a file for the best buying and selling quantity on its debut day in 2025. The inflows had been fixed, and there was not a single day within the crimson till January 7.

Though the XRP ETFs bled out over $40 million then, the inexperienced streak returned, they usually marked solely web inflows from January 8 to January 16. Nevertheless, that modified yesterday when the markets opened within the US for the primary time because the geopolitical pressure between the US and the EU had escalated over the weekend.

Information from SoSoValue exhibits that traders pulled out $53.32 million from the funds on what turned their worst buying and selling day, with the most important web outflow. The cumulative web inflows dropped from $1.28 billion to $1.22 billion in only one session, erasing nearly all of the funds attracted in your complete earlier enterprise week.

XRP Tumbles

The aforementioned outflows have solely exacerbated XRP’s bearish development recently. The asset flew to a multi-month peak of simply over $2.40 on January 6, gaining roughly 30% in days. Nevertheless, it has been largely downhill since then, because it misplaced the $2.00 assist on Monday morning and even dipped to $1.84 on some exchanges.

It at present struggles to stay above $1.90 after it fell to $1.86 durng the midnight sell-off. CryptoWZRD highlighted the bearish closure, particularly in opposition to BTC, and indicated that the market chief “can be in cost.”

XRP Every day Technical Outlook:$XRP closed bearish whereas XRPBTC closed indecisively. Bitcoin can be in cost. My focus will stay on the decrease time-frame chart for a scalp. A bullish transfer in the direction of the $1.9750 resistance adopted by weak point would supply a brief

pic.twitter.com/jeBwxH9xh8

— CRYPTOWZRD (@cryptoWZRD_) January 21, 2026

The submit XRP ETFs See Greatest Outflows to Date as Ripple Value Dumps Once more appeared first on CryptoPotato.