- The Fed is injecting $55B in liquidity by means of Treasury invoice purchases

- Bitcoin has pulled again however traditionally responds properly to liquidity growth

- Geopolitical rigidity and risk-off sentiment stay main obstacles

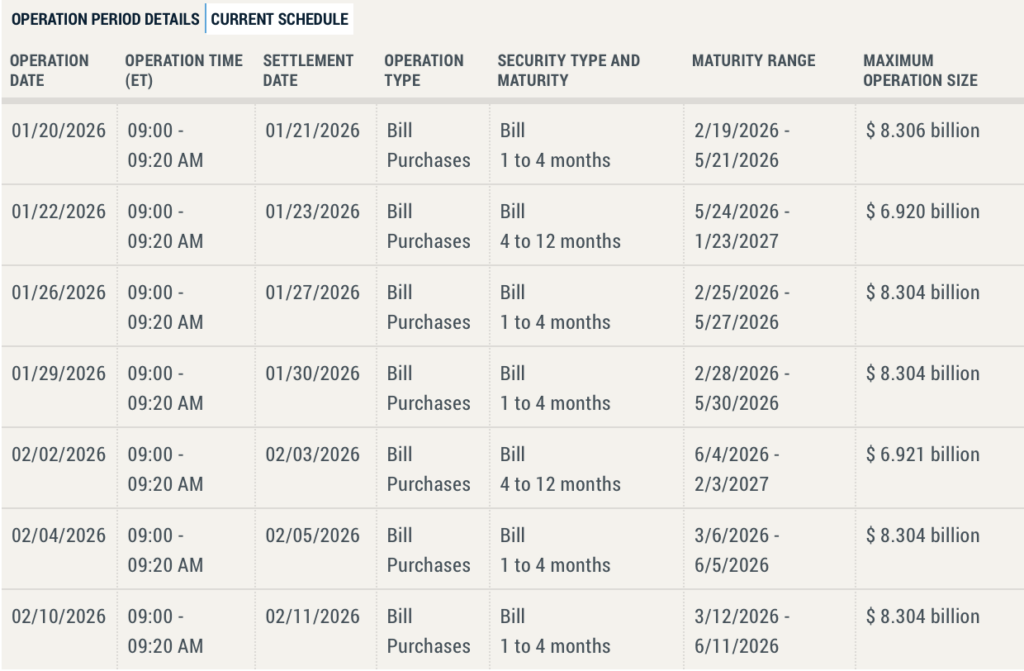

The US Federal Reserve is stepping again into the market with a recent liquidity injection, asserting plans to purchase $55 billion value of Treasury payments beginning at this time, January 20, 2026. In line with the official schedule, the primary operation alone will see $8.3 billion injected into the system. That transfer has instantly reignited hypothesis round Bitcoin, with many merchants watching carefully to see whether or not added liquidity can flip latest bearish momentum.

Why Liquidity Issues for Bitcoin

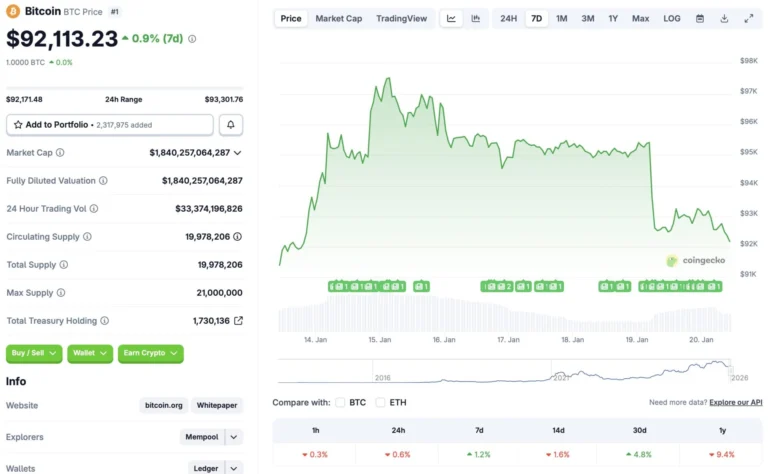

Bitcoin has struggled over the previous a number of days, regardless of briefly reclaiming the $97,000 degree on January 15. Since then, the asset has slipped again towards $92,000 as broader markets turned cautious. CoinGecko information exhibits BTC down 0.6% within the final 24 hours, 1.6% throughout the 14-day chart, and roughly 9.4% since January 2025. On the identical time, Bitcoin stays up 1.2% on the week and practically 5% over the previous month, suggesting the longer development hasn’t absolutely damaged.

Traditionally, Bitcoin has responded positively to durations of increasing liquidity. When central banks enhance stability sheets or ease monetary situations, danger property usually profit, and BTC has continuously moved alongside these shifts. That historic context is what’s driving renewed optimism round this Fed operation.

Geopolitics Are Nonetheless Holding the Market Again

The latest pullback hasn’t been pushed by crypto-specific weak spot alone. Rising geopolitical tensions between the US and Greenland have unsettled international markets, particularly after France, Germany, and Norway moved to assist Greenland with troop deployments. In response, the US imposed extra tariffs on international locations backing Greenland, amplifying uncertainty and pushing buyers towards defensive positioning.

That risk-off setting has been evident in capital flows. Gold and silver have each surged to new all-time highs as buyers search security, whereas cryptocurrencies and equities have confronted strain.

Can BTC Nonetheless Push Increased in 2026?

Regardless of near-term headwinds, long-term expectations for Bitcoin stay sturdy. A number of analysts and establishments are nonetheless projecting a bullish 2026, with Bernstein even forecasting BTC may surpass $150,000 later this 12 months. A sustained liquidity growth may assist revive momentum, particularly if geopolitical stress eases and buyers rotate again into danger property.

That stated, liquidity alone doesn’t assure an instantaneous rally. If macro uncertainty persists, Bitcoin may proceed consolidating round present ranges and even face additional draw back earlier than a clearer development emerges.

What to Watch Subsequent

The important thing sign will probably be how markets reply after the primary few rounds of Treasury invoice purchases. If liquidity finds its method into danger property, Bitcoin may regain energy shortly. If concern continues to dominate, the Fed’s actions might solely soften draw back slightly than spark a breakout.

For now, Bitcoin sits at a crossroads, caught between supportive liquidity and restrictive geopolitics.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.