XRP is again in a well-known spot: social chatter has turned sharply bearish even because the market probes assist after an early-January surge. Analytics agency Santiment mentioned its social information exhibits XRP slipping into “Excessive Concern” after a roughly 19% pullback from its early-month excessive, a setup it argues has traditionally preceded rallies.

Santiment wrote on Jan. 22 by way of X: “In response to our social information, XRP has fallen into ‘Excessive Concern’ territory. Small retail merchants have develop into pessimistic towards the #5 market cap cryptocurrency after a -19% drop because the excessive again on January fifth. Traditionally, this excessive stage of bearish commentary results in rallies. Costs transfer the other to retails’ expectations as a rule.”

Associated Studying

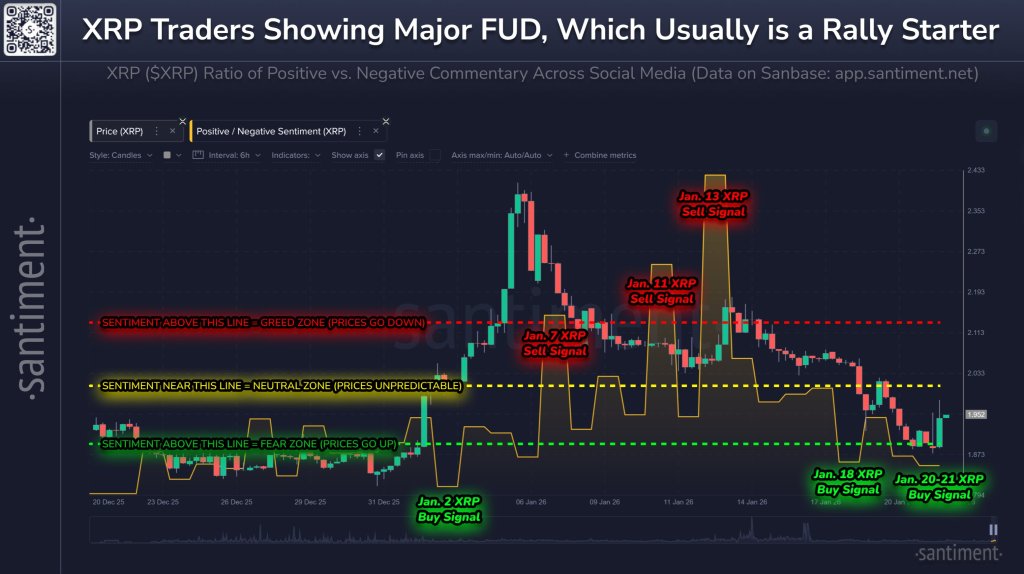

The chart Santiment shared pairs XRP’s 6-hour candles with a social ratio measuring optimistic versus detrimental commentary, and overlays three “purchase” and three “promote” markers tied to sentiment bands. These bands are explicitly labeled as a “worry zone” (the place costs “go up”), a impartial zone, and a “greed zone” (the place costs “go down”).

How Dependable Is The XRP Social Sentiment Sign?

To examine the timing, day by day XRP spot information for a similar late-December-to-January window broadly helps the chart’s declare that excessive sentiment readings typically present up close to inflection factors, with an necessary caveat: not each sign front-runs a flip cleanly, and a few arrive early.

The primary “purchase” marker on the chart is dated Jan. 2. On that day, XRP closed round $2.01 after buying and selling as little as roughly $1.87, and the market proceeded to speed up into the week’s blow-off transfer: by Jan. 5 XRP closed close to $2.35, and the Jan. 6 session printed a excessive round $2.42. In different phrases, the Jan. 2 “purchase” name landed forward of the sharp leg increased that set the interval’s excessive.

Associated Studying

The primary “promote” marker is dated Jan. 7, instantly after the height. XRP closed round $2.16 that day after which bled decrease throughout the subsequent classes, sliding towards the low-$2.00s by Jan. 12. On sequence alone, that promote sign aligns with the market shifting from post-spike distribution right into a steadier downtrend.

The second “promote” marker, Jan. 11, is much less easy. XRP closed close to $2.07 on Jan. 11 and dipped once more on Jan. 12, however then logged a pointy rebound on Jan. 13, closing round $2.17. Merchants treating the Jan. 11 marker as a direct prime sign would have confronted a short-term whipsaw earlier than draw back resumed.

That brings the chart’s third “promote” marker (Jan. 13) which seems to focus on that rebound itself. From Jan. 13’s shut close to $2.17, XRP rolled again over: it pale by way of mid-month and in the end slid into the Jan. 20 low round $1.87 (intraday), which maps cleanly to the chart’s competition that “greed-zone” sentiment can coincide with native exhaustion.

On the “purchase” facet late within the window, Santiment flags Jan. 18 and Jan. 20–21. The Jan. 18 marker arrived early: XRP closed round $1.99 on Jan. 18 however continued decrease into Jan. 20 earlier than rebounding. The present Jan. 20–21 marker matches higher within the brief time period, with XRP bouncing from the Jan. 20 shut close to $1.89 to roughly $1.95 by right now. Even so, that rebound has thus far been modest relative to the broader drawdown from the $2.4 space peak.

Santiment’s broader level is contrarian: when social feeds tip into one-sided pessimism, marginal promoting stress might already be exhausted, establishing imply reversion. The latest sign historical past partially helps that whereas additionally displaying the sensible threat: entries will be early, and “excessive worry” can persist if development situations stay heavy.

At press time, XRP traded at $1.9498.

Featured picture created with DALL.E, chart from TradingView.com