- XRP stays underneath stress as broader market weak spot and retail promoting weigh on sentiment

- Ripple’s RLUSD itemizing and ecosystem progress help long-term fundamentals, not short-term worth

- Institutional inflows distinction retail warning and will assist XRP kind a restoration base

XRP continues to commerce underneath stress, weighed down by broader weak spot throughout the crypto market. The token continues to be locked in a short-term downtrend, formed by macro uncertainty and lingering skepticism from buyers who stay unconvinced a couple of near-term turnaround. That hesitation is seen in worth motion, which has struggled to seek out constant upward momentum.

Nonetheless, not the whole lot underneath the floor appears to be like damaging. Ripple’s ongoing operational progress continues quietly within the background, providing a possible basis for longer-term worth stability. Whereas the market stays centered on short-term strikes, fundamentals are slowly constructing.

Ripple Expands RLUSD With Binance Itemizing

Ripple not too long ago confirmed that its U.S. dollar-backed stablecoin, RLUSD, has been listed on Binance. It is a significant step, as broader alternate entry improves visibility and makes the stablecoin simpler to make use of at scale. As stablecoin adoption accelerates globally, publicity on a serious platform like Binance issues greater than it might sound at first look.

For now, RLUSD operates on Ethereum, however future growth to the XRP Ledger may very well be a turning level. An XRPL integration would seemingly enhance on-chain exercise, transaction demand, and actual utility throughout Ripple’s ecosystem. That type of progress wouldn’t elevate XRP in a single day, nevertheless it does strengthen the long-term narrative across the community.

XRP Holders Proceed to Promote Into Weak spot

Regardless of these developments, XRP holders stay cautious. On-chain information exhibits web realized revenue and loss has turned damaging in current periods, that means buyers are promoting at a loss. This habits normally indicators concern of additional draw back relatively than confidence in a fast rebound.

Retail hesitation could be cussed. Promoting into weak spot typically slows momentum shifts, even when fundamentals are bettering elsewhere. Till confidence begins to stabilize, Ripple’s progress could wrestle to translate into rapid worth appreciation for XRP.

Institutional Traders Present a Totally different Story

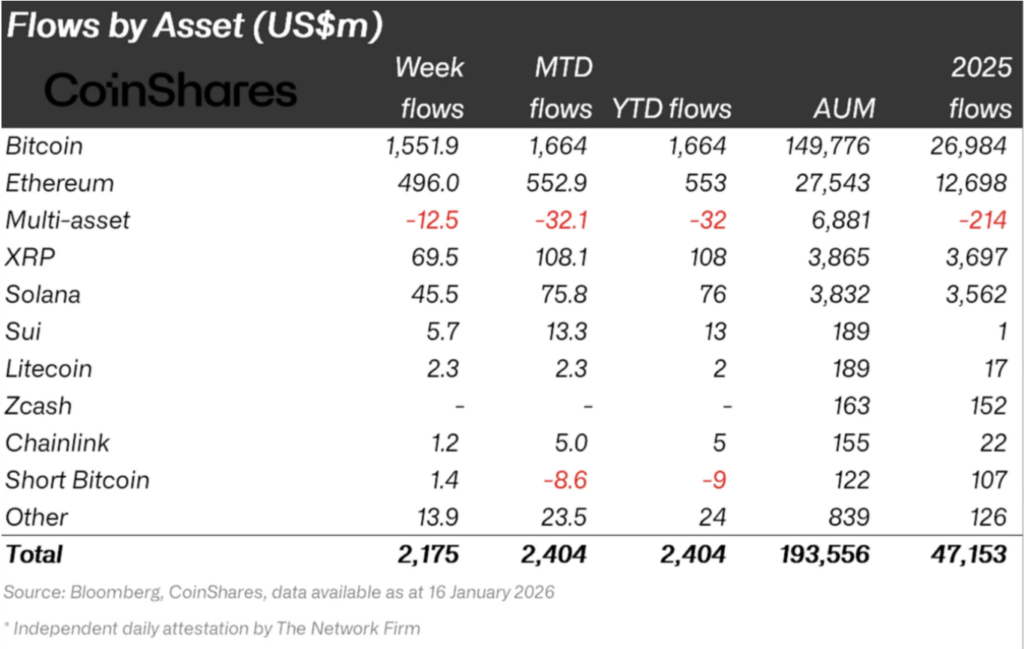

Institutional flows inform a really completely different story. For the week ending January 16, XRP recorded $69.5 million in inflows, with month-to-date figures reaching $108.1 million. That accumulation has continued whilst XRP stays caught in a downtrend, which is notable.

Massive buyers typically construct positions during times of pessimism, effectively earlier than sentiment shifts. Constant inflows assist help liquidity and cut back draw back danger over time. This rising hole between cautious retail habits and regular institutional demand may ultimately assist XRP kind a restoration base.

XRP Should Break Its Downtrend to Shift Momentum

XRP is buying and selling close to $1.96 on the time of writing, nonetheless capped by a downtrend line that has held for greater than two weeks. Technical stress hasn’t disappeared, however bettering fundamentals and institutional accumulation improve the percentages of a breakout try. A clear transfer above the downtrend would mark a significant change in short-term construction.

If XRP can reclaim the $2.00 stage, momentum may carry it towards $2.03 and doubtlessly $2.10. With stronger follow-through, a restoration towards the $2.35 space turns into reasonable. On the flip aspect, failure to carry above $2.00 may invite renewed promoting stress, opening the door to $1.86 or decrease and increasing the present downtrend.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.