MicroStrategy, the most important publicly traded company holder of Bitcoin, is making its debut within the Nasdaq-100 Index.

This milestone highlights the corporate’s rising prominence, fueled by a major rise in its inventory worth alongside Bitcoin’s worth surge this 12 months

MicroStrategy’s Nasdaq-100 Debut Marks a Crypto Milestone

MicroStrategy’s inclusion follows the elimination of Illumina, Tremendous Micro Pc, and Moderna, with Palantir Applied sciences and Axon Enterprise additionally becoming a member of the index. These modifications are set to take impact earlier than the market opens on December 23.

The Nasdaq-100 tracks the highest 100 non-financial companies listed on the Nasdaq alternate, that includes giants like Apple, Microsoft, Tesla, and Nvidia. The addition of MicroStrategy to this elite group indicators a rising institutional acknowledgment of crypto-related corporations.

Trade-traded funds (ETFs) that replicate the Nasdaq-100, such because the Invesco QQQ, will now incorporate MicroStrategy into their portfolios. This transfer might amplify the corporate’s publicity to passive investments and deepen its hyperlink to Bitcoin’s efficiency.

Monetary analysts see this growth as pivotal. Rajat Soni highlighted that MicroStrategy’s inventory advantages from Bitcoin’s upward trajectory, making a cycle the place elevated passive funding inflows might enhance its capital-raising means. This, in flip, permits the corporate to amass extra Bitcoin, doubtlessly driving additional cryptocurrency worth good points.

“As Bitcoin’s worth rises, MicroStrategy’s inventory worth rises, and its rating within the NASDAQ rises. [This] means the allocation to its inventory rises and more cash has to passively circulation into MSTR. MicroStrategy can then situation extra debt and purchase extra Bitcoin,” Soni acknowledged.

Nevertheless, some warning stays. Bloomberg ETF analyst James Seyffart warned that MicroStrategy would possibly face reclassification as a monetary entity by March, which might end in its elimination from the index. This reclassification threat stems from the corporate’s heavy reliance on Bitcoin for its valuation fairly than its core enterprise operations.

MicroStrategy’s transformation has centered on Bitcoin as its main treasury asset. The corporate at present holds over 423,650 Bitcoin, valued at roughly $43.18 billion. Remarkably, 40% of this complete was acquired within the final month, demonstrating its aggressive dedication to cryptocurrency accumulation.

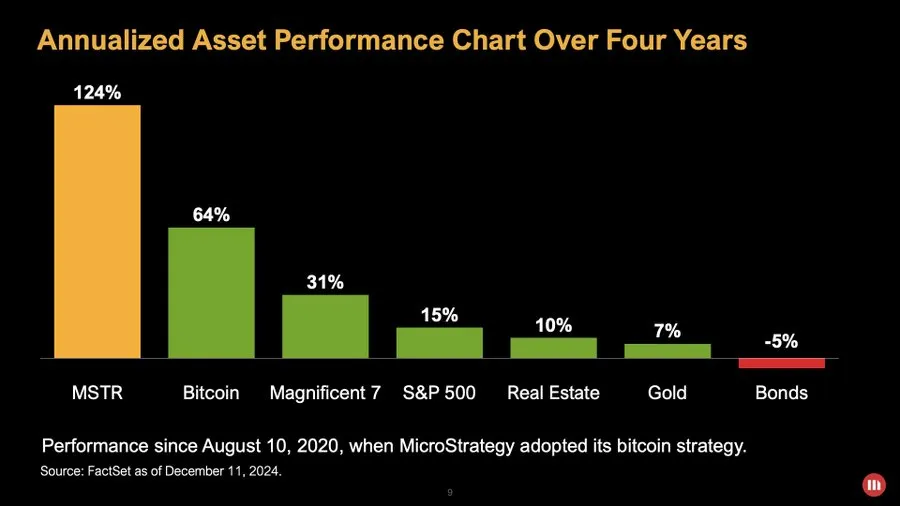

In the meantime, Government Chairman Michael Saylor attributes the corporate’s success to its Bitcoin-focused technique. Over the previous 4 years, MicroStrategy’s inventory has surged by 124%, outperforming main benchmarks just like the S&P 500.

Saylor has emphasised that Bitcoin adoption has strengthened the corporate’s aggressive place, solidifying its function as a pacesetter within the evolving monetary ecosystem.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.