- XRP has fallen sharply from its July 2025 excessive, pushing market sentiment into Excessive Concern

- Damaging funding charges present brief positions dominating, which can construct hidden upside strain

- Analysts are watching key help close to $1.78 and resistance round $2.00 for development shifts

Ripple’s XRP has stayed below strain since setting an all-time excessive of $3.65 in July 2025, adopted by a gradual and, at instances, irritating decline. An tried rebound in early January briefly pushed the value towards $2.40, however momentum pale shortly and patrons did not observe via. Since then, the asset has struggled to regain confidence.

Broader market uncertainty has solely made issues worse. Rising geopolitical tensions have pushed traders right into a defensive stance, draining urge for food for threat throughout crypto markets. As sentiment weakens, XRP has change into a goal for rising pessimism, though historical past suggests these moments don’t at all times final so long as merchants anticipate.

Sentiment Hits Excessive Concern as Key Ranges Come Into Focus

In keeping with Santiment, XRP has now entered “Excessive Concern” territory based mostly on social sentiment knowledge. Retail merchants have grown more and more bearish after a roughly 19% drop from the January 5 excessive, and damaging chatter has accelerated shortly. In previous cycles, nevertheless, related spikes in concern have usually preceded rebounds, as costs moved sharply towards retail expectations.

Santiment famous that heavy FUD round XRP has traditionally acted as a rally set off quite than a breakdown sign. Analyst Ali Martinez echoed this view by highlighting key value zones to look at. He pointed to $1.78 as a essential help space, whereas figuring out $1.97 and $2.00 as the subsequent main resistance ranges if value energy returns.

Distribution Part Follows a Historic Rally

XRP is at the moment buying and selling about 47% beneath its July 2025 peak, which comes after an explosive 600% rally that started in November 2024. CryptoQuant describes the present part as a pure interval of distribution and correction, one thing markets usually want after such aggressive upside strikes. In that sense, the pullback itself isn’t uncommon.

What stands out is the timing of the bearish sentiment. Relatively than peaking close to the highest, negativity intensified after XRP had already fallen greater than 50%. That imbalance suggests concern could also be overstretched, particularly as positioning knowledge begins to lean closely in a single route.

Damaging Funding Charges May Flip the Script

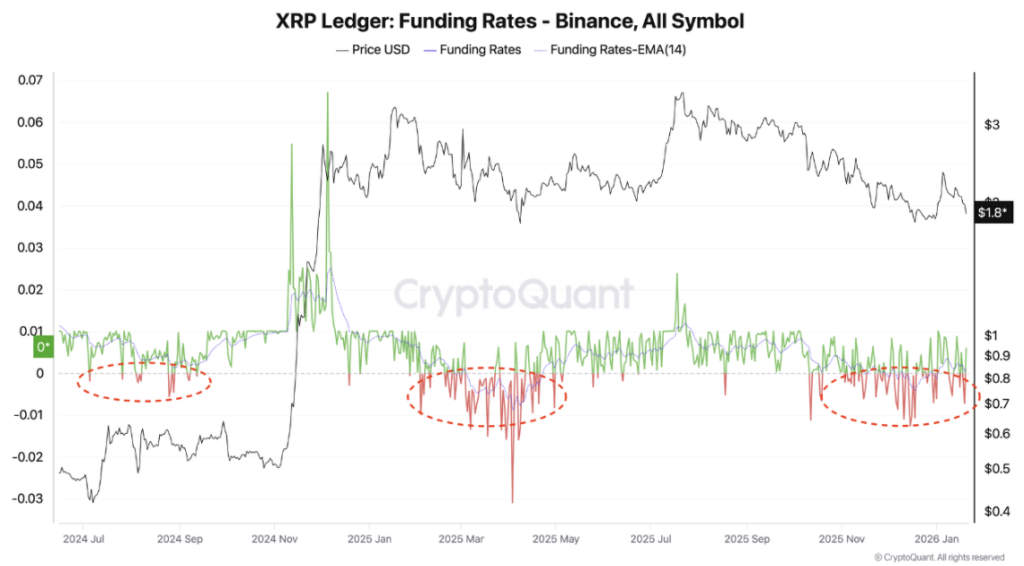

On Binance, XRP funding charges have remained principally damaging since December, signaling that brief positions now dominate leveraged buying and selling. Traditionally, markets have a tendency to maneuver towards crowded consensus, and extreme brief positioning can quietly construct latent shopping for strain. It’s uncomfortable whereas it lasts, however it will probably change shortly.

If XRP begins to rise, brief sellers could also be compelled to shut positions, accelerating upward momentum. Comparable dynamics performed out through the August–September 2024 interval and once more through the April 2025 correction. In each circumstances, damaging funding charges had been adopted by sharp rebounds as soon as sentiment flipped.

Taken collectively, analysts see the present setup as one which deserves shut consideration. If shopping for strain begins to return, XRP may very well be positioned for an surprising reversal, even because the broader temper stays cautious for now.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.