Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has dropped 2% within the final 24 hours to commerce at $89,544 after Michael Saylor hinted that Technique might be making ready for one more main Bitcoin buy.

His feedback come simply days after the corporate introduced its largest Bitcoin acquisition since July 2025, signaling that the agency’s aggressive accumulation technique is much from over. In a publish on X, Saylor stated he was occupied with shopping for extra Bitcoin. That is vital as a result of Technique is at present on a four-week BTC shopping for streak, making one other buy extremely possible.

The trace adopted the corporate’s $2.13 billion buy of twenty-two,305 BTC at a mean worth of $95,284 per coin, elevating its whole holdings to 709,715 BTC. This milestone made Technique the primary firm to carry greater than 700,000 BTC, which is roughly 1.1 instances the quantity held by all governments mixed, in keeping with BitcoinTreasuries. To date this month, the corporate has acquired 37,218 BTC.

Fascinated about shopping for extra bitcoin.

— Michael Saylor (@saylor) January 22, 2026

The shopping for streak has fueled hypothesis within the crypto market. Polymarket information reveals a 63% chance that Technique will maintain a minimum of 740,000 BTC by February 28, with an 83% likelihood of exceeding 800,000 BTC by year-end. The agency’s rising accumulation is supported by its improved capital construction.

Its perpetual most well-liked fairness (STRC) has now surpassed convertible debt, which market analyst Rohan Hirani says reduces chapter danger and aligns long-term capital with Bitcoin’s infinite potential. STRC most well-liked fairness, paying an 11% dividend, has seen rising buying and selling volumes and now trades close to its $100 par worth, with a market cap of $3.36 billion. Insiders are additionally shopping for, with board member Jane Dietze including 1,000 shares.

The corporate raised $294 million via STRC inventory gross sales final week to fund BTC purchases. Technique continues to make use of MSTR inventory for acquisitions, and regardless of earlier declines, the inventory seems to be stabilizing. MSTR is up 5% year-to-date, reaching $179, which offers further help for the corporate’s ongoing Bitcoin accumulation technique.

Bitcoin Worth Assessments Key Help at $85K–$87K

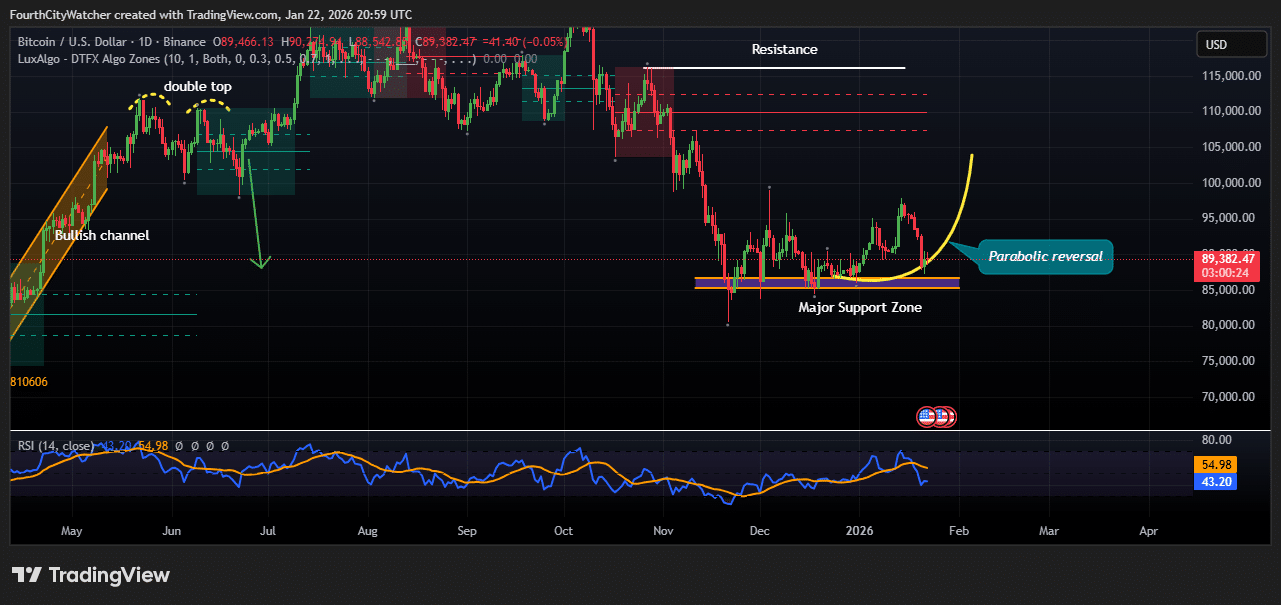

The Bitcoin worth has dropped barely to $89,382, down 2% within the final 24 hours, because it checks an essential help zone. On the day by day chart, BTC has discovered a Main Help Zone round $85,000–$87,000. This space has acted as a powerful flooring since late November 2025. If consumers step in right here, Bitcoin might see a parabolic reversal, doubtlessly shifting again towards $95,000–$100,000.

previous actions, Bitcoin shaped a double high close to $116,000, which began a powerful downward pattern. Earlier than that, it had been shifting in a bullish channel, exhibiting robust upward momentum. However after failing to interrupt larger, the worth fell as merchants took earnings.

The RSI (Relative Power Index) is now at 43.2, shifting up from oversold ranges. This means promoting strain is easing, and consumers could quickly return. Resistance remains to be essential. The $95,000–$115,000 vary might sluggish any upward strikes. Alternatively, if Bitcoin breaks beneath the $85,000 help, the worth might fall additional towards $80,000.

BTCUSD Chart Evaluation Supply: Tradingview

The chart additionally reveals a doable parabolic reversal, that means that if the help holds, Bitcoin might rise rapidly. This sample is just like earlier bounces from the identical help space.

General, the image is cautiously optimistic. Help appears robust, the RSI reveals consumers are returning, and the reversal sample suggests a doable bounce. Merchants are prone to watch the $85,000–$95,000 vary carefully. How Bitcoin behaves right here will determine if it continues rising or stays in a sideways sample.

Traders ought to keep watch over these key ranges and the general market temper. The approaching days can be essential to see if Bitcoin can begin a brand new upward transfer or proceed its consolidation.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection