- Chainlink’s social quantity hit a five-week excessive following upgrades to its Information Streams product

- Sentiment is popping extra cautious, at the same time as growth exercise stays robust

- Trade leaders argue Chainlink’s infrastructure function should be undervalued

Chainlink has pushed its manner again into the highlight throughout crypto social channels, and never accidentally. Recent information exhibits the oracle community simply hit a five-week excessive in social quantity, pushed largely by renewed curiosity in its rising function inside tokenized finance. Whereas the broader market stays shaky, LINK has turn out to be a speaking level once more, for causes that transcend short-term value strikes.

The timing strains up with a latest infrastructure improve. Chainlink rolled out enhancements to its Information Streams product, enabling close to real-time pricing for U.S. shares and ETFs, obtainable 24 hours a day, 5 days every week. That improve permits DeFi protocols to trace pre-market, common buying and selling hours, after-hours, and even in a single day periods, closing a long-standing hole between conventional finance and on-chain methods.

Social Quantity Spikes, However Sentiment Turns Cautious

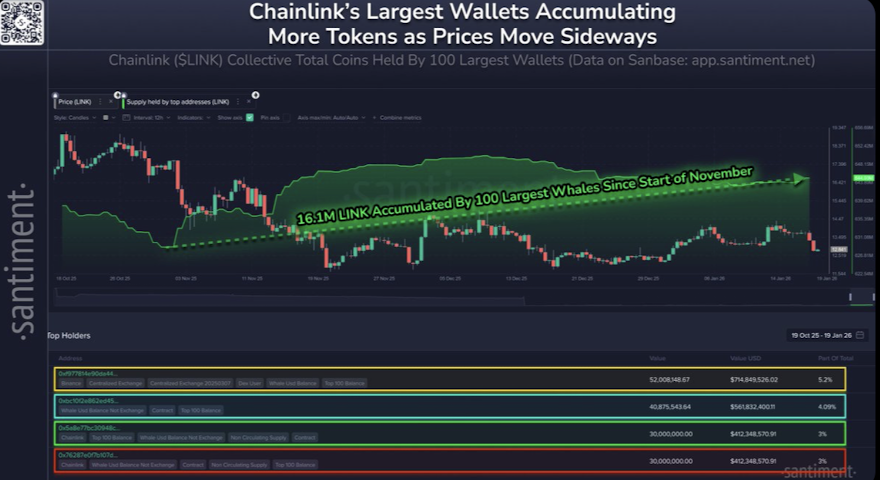

Unsurprisingly, the replace sparked a wave of consideration round LINK. In line with Santiment, Chainlink’s social quantity jumped at the same time as the broader crypto market stayed below stress. That divergence issues. It suggests merchants and buyers are being attentive to Chainlink’s infrastructure narrative, not simply lumping it in with the remainder of the altcoin market transferring alongside Bitcoin.

Nonetheless, the tone of the dialog is shifting. Over the previous month, the stability between buying-focused and selling-focused mentions has steadily tilted towards warning. Bearish commentary is now approaching ranges not seen in over a 12 months. Excessive engagement stays, however the temper is clearly extra skeptical, much less euphoric than earlier than.

On the identical time, Chainlink’s growth exercise hasn’t slowed. By a number of measures, together with weekly important GitHub occasions, it continues to rank as essentially the most actively developed DeFi mission by a large margin. That pattern has been constant since launch, quietly reinforcing the concept that progress is occurring no matter short-term sentiment swings.

Is Chainlink Nonetheless Being Mispriced?

At the same time as social chatter grows extra cautious, some trade voices imagine the market is lacking the larger image. Bitwise CIO Matt Hougan lately described Chainlink as one of the crucial vital, but most misunderstood, crypto belongings within the house. In his view, LINK could also be deeply undervalued, a remark that stood out given the timing.

Hougan’s remarks got here shortly after Bitwise launched a brand new Chainlink ETP, which noticed comparatively modest early buying and selling in comparison with Bitcoin-focused merchandise. He argues that many buyers nonetheless scale back Chainlink to “only a information oracle,” a label that now not suits. As an alternative, he frames it as a quickly increasing software program platform that connects blockchains to one another and to real-world methods.

In line with Hougan, Chainlink now holds a dominant place throughout essential infrastructure layers supporting stablecoins, DeFi, tokenization, and prediction markets. He additionally pointed to adoption by main establishments comparable to SWIFT, JPMorgan, Visa, Constancy, and DTCC. Whether or not the market totally costs that in anytime quickly is one other query, however the disconnect between fundamentals and notion is turning into more durable to disregard.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.