- Silver hit $100 per ounce for the primary time, extending a historic rally

- Gold is approaching $5,000 as traders search security

- The metals surge alerts a defensive market surroundings crypto is feeling

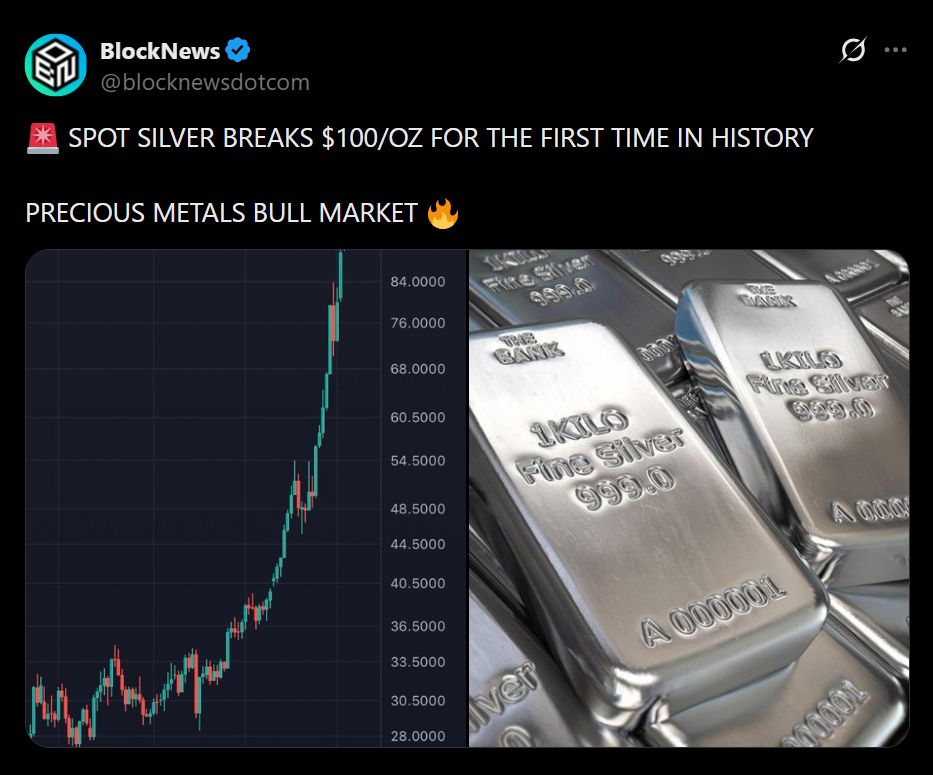

Valuable metals are rewriting the report books, and markets are paying consideration. Silver surged previous the $100-per-ounce mark for the primary time, whereas gold pushed nearer to $5,000, extending one of many strongest rallies the sector has ever seen. The transfer isn’t taking place in isolation. It displays a broader shift in how traders are positioning amid geopolitical pressure, coverage uncertainty, and rising discomfort with threat belongings.

Why Silver’s Transfer Is Turning Heads

Silver’s breakout is very hanging. The metallic jumped greater than 4% in a single session, including to features that now complete roughly 40% in 2026 and greater than 230% over the previous 12 months. That surge has pushed silver’s market capitalization into multi-trillion-dollar territory, placing it firmly again on the radar as each an industrial metallic and a retailer of worth.

Not like gold, silver sits on the intersection of monetary concern and real-world demand. When each forces align, value strikes can speed up rapidly, and that’s precisely what markets are witnessing now.

Gold Continues to Worth Uncertainty

Gold’s march towards $5,000 has been steadier however simply as telling. Costs are up sharply this 12 months and have almost doubled over the previous twelve months. Traders are leaning into conventional protected havens as commerce tensions, unresolved international conflicts, and questions round financial coverage proceed to stack up.

Considerations over central financial institution independence have additionally performed a task. When confidence in coverage neutrality wobbles, gold tends to profit, and up to date political alerts have solely bolstered that dynamic.

What This Means for Crypto Markets

Crypto merchants are watching metals intently for a purpose. When gold and silver outperform this decisively, it normally alerts a defensive market regime. Capital is prioritizing preservation over progress. In these environments, liquidity tightens and speculative belongings typically battle to achieve traction.

This doesn’t invalidate the long-term crypto thesis, however it does clarify why rallies can stall whereas protected havens run. Gold absorbs concern. Crypto reacts to liquidity. Proper now, concern is clearly being priced first.

The Broader Commodities Image

The power isn’t restricted to gold and silver. Palladium has rebounded towards key ranges after years of weak spot, platinum is up solidly this 12 months, and even lithium has staged a pointy restoration. Collectively, these strikes level to a market more and more hedged towards instability relatively than chasing upside narratives.

Conclusion

Silver breaking $100 and gold nearing $5,000 aren’t simply milestones, they’re alerts. They present the place capital is searching for security as uncertainty dominates the macro backdrop. For crypto traders, watching metals isn’t non-obligatory proper now. It’s context. And that context explains quite a bit in regards to the present market temper.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.