Through the years, Ethereum staking has grow to be one of the vital important and profitable points of the broader ETH ecosystem, with large firms steadily leaping into the sphere. Nearly all of these firms, particularly Bitmine Immersion, are revolutionizing ETH staking, turning it into a large monetary sector and edge.

Bitmine Monetized Ethereum Staking At Scale

After the entry of institutional traders, Ethereum staking has been remodeled into a major enterprise alternative from a technical requirement. On the forefront of this evolution is Bitmine Immersion Applied sciences Inc. (BMNR), a number one digital asset platform devoted to enhancing the ETH ecosystem.

With its exceptional involvement in ETH staking, Bitmine Immersion is proving simply how massive this chance could be. The digital asset platform has efficiently remodeled Ethereum staking right into a multi-billion-dollar enterprise by rising its validator operations and staking infrastructure.

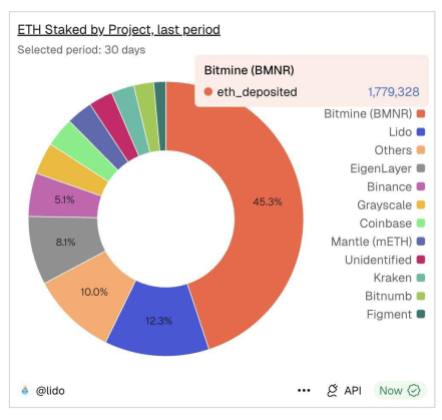

As outlined by Milk Street on the social media platform X, the corporate intends to extend its current funding of 1.83 million ETH, valued at roughly $6 billion at present charges, to 4.2 million ETH. Bitmine’s plan and strong participation in ETH staking are a transparent signal of the rising institutional urge for food for on-chain yield.

This enlargement demonstrates how staking is now about creating worthwhile, long-lasting companies round ETH’s proof-of-stake financial system slightly than simply defending the community. Over the previous month, Bitmine has been chargeable for nearly half of all new ETH coming into the staking queue.

Milk Street acknowledged that staking at this scale removes Ethereum from the liquid provide and locks it away in long-term infrastructure slightly than short-term buying and selling. When a single participant expresses a willingness to commit billions of {dollars}’ price of ETH to staking, it factors to an elevated confidence in ETH’s future economics.

In response to the professional, structural strain is created by a lowered liquid provide and ongoing community demand over time. Given the sustained progress in institutional staking, Milk Street is assured that ETH’s worth will transfer larger within the foreseeable future.

ETH Powering Crypto Native Monetary Rails

With crypto native monetary rails increasing, Ethereum is more and more being positioned because the core infrastructure for main monetary companies. JP Morgan asset administration agency has confirmed this narrative with its newest fund launched on the ETH community.

Milk Street has reported that JP Morgan has launched a tokenized cash market fund on ETH, which is now stay and already holds over $100 million in US treasuries. The rails are native to cryptocurrency, and the product seems to be conventional finance.

In actuality, there isn’t any separation, and there may be solely a monetary product working on the trains that take advantage of sense. Apparently, that is how establishments transfer into new techniques. “Incrementally, and solely after the foundations are clear sufficient to deploy actual capital. As soon as they’re stay, they don’t go away,” Milk Street acknowledged.

Featured picture from Pxfuel, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.