Onchain earnings flip destructive as Bitcoin loses key price bases, elevating bear market threat and give attention to assist zones.

Bitcoin has fallen under the $90,000 degree, pushing a number of onchain profitability measures into destructive territory. Market knowledge now factors to rising draw back stress after an extended interval of sturdy good points.

Analysts clarify that this present pattern resembles early phases of previous BTC bear markets. And for now, focus has turned towards main assist zones as promoting stress builds.

Onchain Metrics Level to Early Bear Market Situations

Bitcoin’s latest value motion displays a transparent shift in short-term market construction. As per knowledge from TradingView, consolidation is breaking decrease. As such, this has positioned consideration on value ranges beneath present ranges. Onchain indicators additionally recommend investor habits is altering as earnings weaken.

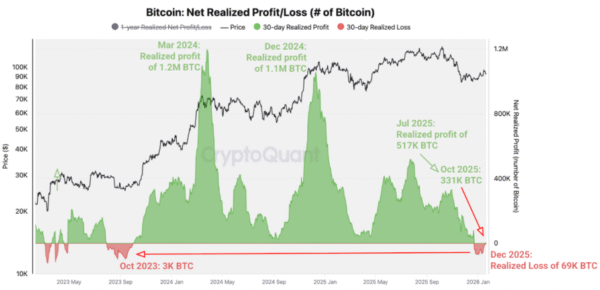

CryptoQuant reported that Bitcoin holders have moved from realizing earnings to locking in losses for the primary time in over two years. Moreover, web realized revenue and loss have turned destructive.

For context, web realized revenue tracks good points or losses when cash transfer onchain. This metric dropped to 69,000 BTC over the previous 4 weeks, reflecting fading market energy.

Picture Supply: CryptoQuant

Market commentators at CryptoQuant stated Bitcoin holders started realizing web losses for the primary time since October 2023. Declining peaks in realized earnings since March 2024 level to slowing value momentum because the prior bull cycle fades. Annual web realized earnings have additionally fallen sharply in latest months.

Bitcoin Loses Key Price Foundation Ranges as Bearish Alerts Multiply

Information reveals annual realized earnings dropped to about 2.5 million BTC, down from 4.4 million BTC in October. Comparable ranges final appeared in March 2022 throughout a chronic market downturn. Analysts famous that present onchain revenue habits aligns with early bear market circumstances.

Previous cycles present comparable patterns, although analysts warned that revenue metrics may give false alerts throughout sideways markets. An analogous setup occurred through the 2021 to 2022 transition from bull to bear. Realized earnings peaked early in 2021 and fashioned decrease highs earlier than turning destructive forward of the 2022 decline.

With this in thoughts, a number of analysts now predict a broader bear market part this 12 months. Actually, some forecasts recommend that the OG coin might contact lows under $58,000 if sellers achieve sustained momentum.

Apparently, technical alerts have added weight to bearish expectations in latest classes. As noticed by market commentator Titan of Crypto, Bitcoin just lately flashed a bear market sign on larger time frames.

Picture Supply: X/Titan of Crypto

A bearish MACD crossover on the two-month chart helps that view. On prime of that, historic knowledge reveals that comparable setups typically preceded drawdowns between 50% and 64%.

Sturdy promoting exercise has already pushed Bitcoin down about 9% from its 2026 excessive close to $97,930. Worth motion has damaged a number of key assist ranges through the transfer decrease. One main loss occurred on the seventy fifth percentile price foundation, situated close to $92,940.

Bitcoin Help Zones in Focus as Worth Checks $89,000–$90,000 Vary

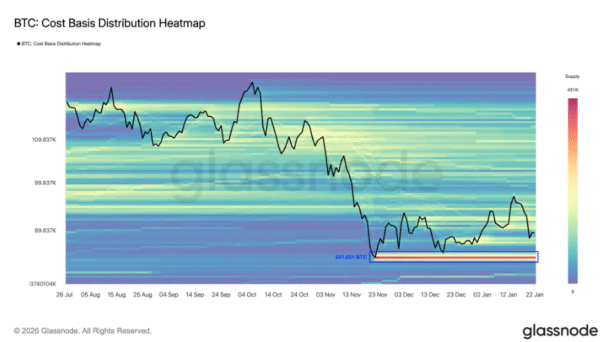

Glassnode famous that Bitcoin now trades under the price foundation of 75% of circulating provide. Such circumstances level to rising distribution stress amongst holders. Threat has shifted towards additional draw back until costs reclaim that degree.

Technical merchants are additionally watching trendline assist close to present costs:

- Analyst Merlijn The Dealer noticed that Bitcoin is testing rising assist between $89,000 and $90,000.

- A break under might ship value again towards vary lows close to $84,000.

- Onchain price foundation knowledge reveals heavy purchaser exercise between $80,000 and $84,000.

- Round 941,651 BTC had been acquired in that zone over the previous six months.

Picture Supply: Glassnode

Many merchants view the OG crypto’s present buying and selling space because the strongest assist within the close to time period. However one other main assist degree sits just under that vary, close to $80,000. As noticed by onchain observers, roughly 127,000 BTC had been beforehand collected at that value.

Technically, a broader downtrend might resume assuming the firstborn coin breaks under this degree.

Based on analysts, weak derivatives demand and long-term holders shedding coils additional gasoline a draw back threat. In the meantime, rising BTC transfers to exchanges might enhance close to time period provide. And in such situations, these components might stress costs additional as market sentiment cools.