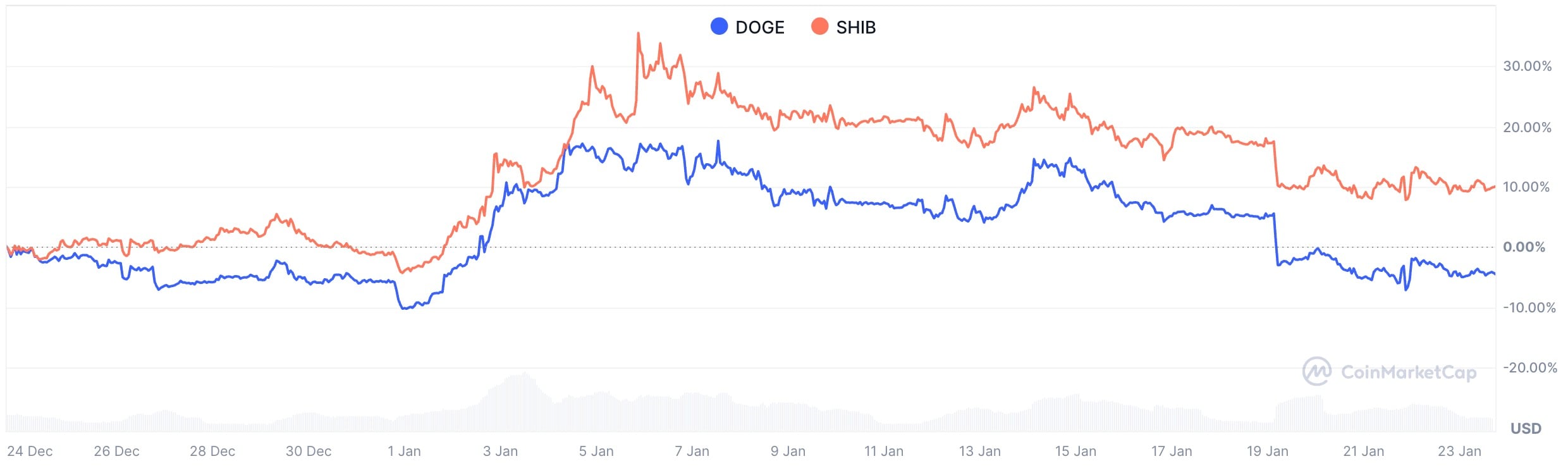

On the planet of meme cash, Dogecoin would possibly nonetheless have the unique fanbase, however in terms of February’s efficiency, Shiba Inu (SHIB) is leaving DOGE within the mud.

CryptoRank’s historic return information exhibits an surprising however constant divergence: whereas Dogecoin has averaged unfavourable returns in February at -2.33%, Shiba Inu has delivered a strong common of +9.26% since 2021. That may be a 397% imbalance between the 2 cash on this explicit month.

In 2024, SHIB surged by 41.3% in February, whereas DOGE took a nosedive of virtually 39%. In 2023, the previous stayed inexperienced once more, whereas the latter misplaced 16%. Even in 2022, when everybody was getting nervous and avoiding threat, SHIB went up by 20.3%, whereas DOGE dropped by 6.05%.

Three years in a row with the identical consequence — SHIB has by no means had a worse February than DOGE since its existence. Not as soon as.

DOGE and SHIB are now not taking part in identical sport

The 21Shares Dogecoin ETF (TDOG) launched earlier this week, and it has even additional established DOGE right into a beta proxy for Nasdaq flows. Grayscale belief merchandise and 2x leveraged DOGE autos are drawing in institutional capital and lowering volatility.

Dogecoin has turn into a meme in identify solely, mirroring regulated index performs and changing into moderately a “secure haven” meme asset. Shiba Inu, however, remains to be what DOGE was: speculative and unregulated.

And in February, that profile pays off.

SHIB’s seasonal anomaly — a sample of post-January decoupling and double-digit rallies — exhibits an everyday liquidity rotation into high-beta outperformers. Based mostly on historic heatmaps, there’s a good likelihood that if the fractal persists, Shiba Inu could have a 15-20% lead.

So, as February nears, issues are trying fairly clear for main meme cash: Dogecoin provides ETF stability, however the Shiba Inu coin has a seasonal benefit.