Be part of Our Telegram channel to remain updated on breaking information protection

The BNB value has surged 1.5% within the final 24 hours to commerce at $894 after Grayscale filed a registration assertion with the U.S. Securities and Alternate Fee (SEC) to launch a spot Binance Coin (BNB) exchange-traded fund (ETF), signaling rising institutional curiosity within the asset.

The proposed ETF, which can commerce on the Nasdaq below the ticker GBNB, is designed to supply institutional buyers with direct publicity to BNB with out the necessity to maintain or handle the token themselves. Based on the SEC submitting, Coinbase will act because the fund’s prime dealer, whereas Coinbase Custody will safeguard the underlying belongings.

📊 @Grayscale has filed an S-1 with the SEC to transform its BNB Belief right into a spot BNB ETF, following the belief’s Delaware registration on January 8.

The ETF is deliberate to commerce on NYSE Arca and could be backed 1:1 by BNB held in chilly storage. If permitted, it might give buyers… pic.twitter.com/mv4UC2Qr7D

— Watcher.Information (@watchernewsx) January 23, 2026

Grayscale additionally plans to assist in-kind creation and redemption, permitting licensed members to alternate BNB straight for ETF shares. Notably, the asset supervisor intends to introduce staking throughout the ETF construction, doubtlessly enabling buyers to earn yield on their holdings. This function may differentiate the product from different crypto ETFs, though regulatory approval for staking stays unsure.

Grayscale Joins VanEck and REX Osprey

Key particulars such because the administration payment, seed capital, and launch date haven’t but been disclosed. Grayscale’s transfer locations it alongside VanEck, which filed for a BNB ETF within the first half of final yr and has since submitted amendments that would enable it to launch forward of Grayscale. REX Osprey has additionally entered the race by submitting a BNB ETF below the Funding Firm Act of 1940.

If permitted, the BNB ETF would develop into Grayscale’s seventh single-asset crypto ETF, increasing its lineup past Bitcoin and Ethereum to incorporate XRP, Solana, Dogecoin, and Chainlink. The agency has additionally just lately filed to transform its Close to Belief into an ETF. It has pending functions for Bittensor and Zcash, underscoring its broader technique to diversify regulated crypto funding merchandise.

The modest value enhance suggests merchants are cautiously optimistic, with buyers intently watching how the SEC responds to yet one more altcoin ETF proposal.

BNB Value Technical Chart Indicators Breakout

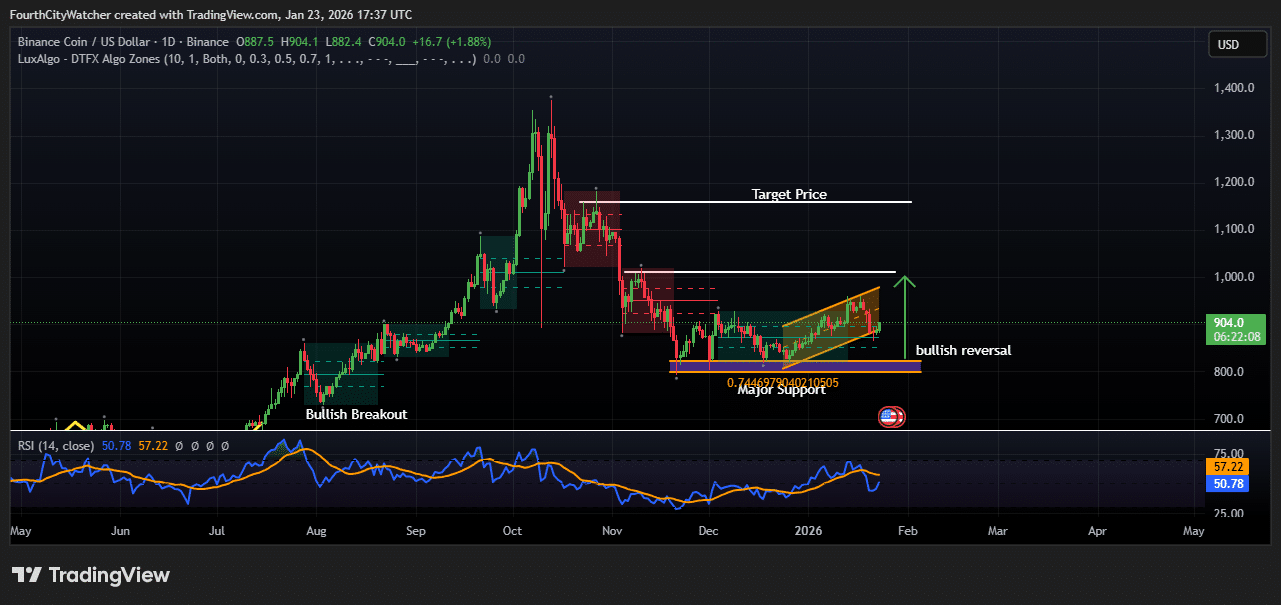

The Binance Coin (BNB) value has surged almost 2% within the final 24 hours to commerce round $904, signaling a possible bullish reversal after weeks of consolidation. Technical indicators counsel that BNB could also be constructing momentum for a stronger upside transfer, supported by enhancing market sentiment and rising institutional curiosity.

On the each day chart, BNB is buying and selling inside an ascending channel, a construction that sometimes factors to gradual accumulation by patrons. The worth just lately bounced off a well-defined main assist zone round $780–$800, which has repeatedly acted as a requirement space. This rebound reinforces the significance of the assist degree and means that draw back stress is weakening.

BNBUSD Chart Evaluation. Supply: Tradingview

The present value motion additionally exhibits BNB trying to interrupt above the mid-range resistance close to $920–$950. A decisive shut above this zone may verify a bullish continuation sample, opening the door for a rally towards the subsequent key resistance at $1,050. Past that, the chart highlights a longer-term goal close to $1,150, which aligns with a earlier consolidation space and a historic provide zone.

BNB Momentum Builds as RSI Strengthens

Momentum indicators are starting to show favorable. The Relative Energy Index (RSI) on the each day timeframe has climbed to round 57, indicating strengthening bullish momentum whereas nonetheless remaining beneath overbought circumstances. This means there could also be room for additional upside earlier than the asset faces vital promoting stress.

From a broader perspective, BNB’s construction exhibits a transition from a chronic corrective section into a possible development reversal. The formation of upper lows since December helps the bullish thesis, particularly if patrons handle to defend the rising assist line throughout the ascending channel.

Market members are actually watching whether or not BNB can maintain its transfer above the psychological $900 degree. Failure to carry this space may see a short-term pullback towards $850, although the broader outlook would stay constructive so long as the value stays above the foremost assist zone.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection