- Chainlink launched real-time U.S. inventory and ETF costs on-chain, focusing on tokenized finance progress

- LINK reserve balances elevated sharply, signaling accumulation throughout infrastructure enlargement

- Rising derivatives exercise and holder progress level to growing institutional and community participation

Chainlink has taken a significant step towards reshaping blockchain infrastructure with the rollout of real-time U.S. inventory and ETF pricing on-chain. In line with the challenge’s newest replace, this transfer might unlock entry to almost $80 trillion value of fairness market information for decentralized finance. It’s a daring declare, however one which highlights simply how massive the ambition is.

By pulling conventional market information straight onto blockchains, Chainlink continues to carve out its place as a core information layer for on-chain monetary merchandise. For DeFi protocols, this implies one thing fairly essential, the flexibility to depend on stay fairness costs with out constructing fragile workarounds or trusting off-chain intermediaries.

As tokenization positive aspects momentum, reliable value information turns into non-negotiable. Merchandise tied to settlements, derivatives, or artificial property merely don’t operate with out it. In that sense, this improve feels much less like a characteristic launch and extra like foundational plumbing lastly being put in.

LINK Reserves Present Indicators of Accumulation

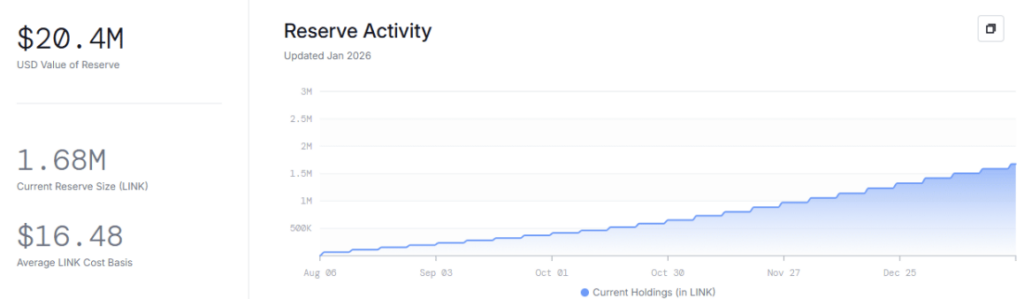

Alongside the infrastructure enlargement, exercise round LINK itself has began to shift. Reserve balances on the community jumped by practically 88,846 LINK in simply 24 hours. On the time of writing, complete reserve holdings stood at roughly 1.67 million LINK, reflecting a gentle and deliberate enhance.

Traditionally, this sort of motion has pointed to energetic treasury administration in periods of rising adoption. It’s typically seen when infrastructure suppliers align sources forward of long-term utilization fairly than short-term hypothesis. For LINK, the timing stands out, reserve accumulation is going on simply as Chainlink broadens its position in tokenized finance.

It’s not loud accumulation, however it’s constant, and people are often the strikes that matter afterward.

Derivatives Information Counsel Rising Institutional Curiosity

Derivatives markets are telling an analogous story. LINK’s Open Curiosity climbed to round $233 million, signaling rising capital engagement from merchants and buyers. Rising Open Curiosity sometimes displays elevated participation, not simply value motion, however conviction on either side of the commerce.

What’s fascinating is how carefully this uptick traces up with Chainlink’s newest infrastructure rollout. Institutional gamers typically anticipate clear utility upgrades earlier than growing publicity, and this timing hints that LINK’s increasing position is being taken critically. Over the long term, that sort of alignment tends to assist value stability fairly than short-lived spikes.

Holder Progress Provides One other Layer

Past reserves and derivatives, holder information paints a supportive image too. The variety of LINK holders has continued to climb steadily, reaching round 177,000 ultimately depend. That gradual, persistent progress suggests broader distribution fairly than focus.

Holder enlargement typically accelerates when adoption narratives begin gaining visibility, and that seems to be taking place right here. Extra contributors, extra use instances, and extra infrastructure often reinforce one another, even when value doesn’t react instantly.

Chainlink’s Position Retains Increasing

Taken collectively, the transfer into real-time fairness pricing, the rise in reserve balances, elevated derivatives exercise, and regular holder progress all level to 1 factor. Chainlink’s relevance throughout the tokenized finance ecosystem is rising, quietly however persistently.

Because the boundary between conventional markets and DeFi continues to blur, dependable information turns into the connective tissue holding every thing collectively. That’s the place Chainlink retains displaying up. And so long as that continues to be the case, its position as a spine for on-chain finance is prone to keep firmly in focus.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.