- SUI has fallen greater than 30% in 17 days and is now testing a key each day help zone

- Value motion exhibits purchaser reactions, although indicators stay firmly bearish

- The subsequent transfer will probably decide whether or not SUI kinds a base or continues decrease

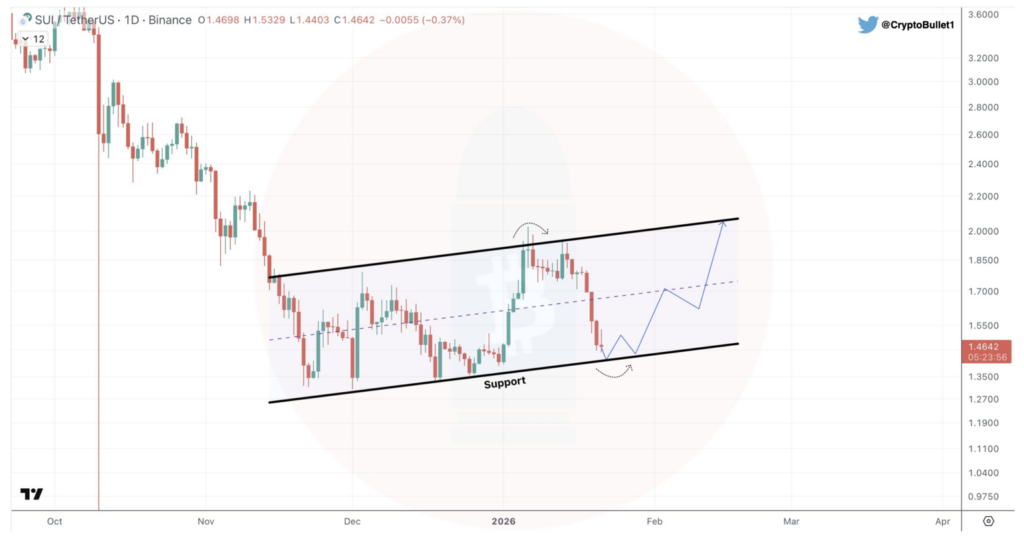

SUI has spent the previous few weeks drifting decrease, irritating nearly anybody watching the chart. Each bounce regarded longing for a second, then light, with sellers conserving management of the broader construction. That gradual grind has now pushed worth into an space that truly issues, and the chart is beginning to trace that one thing totally different may be forming.

Over the past 17 days alone, SUI has dropped greater than 30%. Strikes of that measurement often go away a visual emotional footprint, particularly when worth revisits ranges the place patrons beforehand stepped in with confidence. SUI is now hovering proper round that territory.

Consumers Start Reacting at Every day Help

A current commentary from crypto analyst Sui Insiders famous that SUI has returned to each day help. The chart confirms it. Value is sitting close to the decrease boundary of its channel, an space the place liquidity was absorbed up to now and the place sharp upside strikes as soon as started.

As SUI slides again into this zone, the market is being compelled to decide. Both patrons defend help once more, or the extent offers method and momentum accelerates decrease. For now, the construction stays intact.

Compression Builds because the Channel Holds

The chart suggests a possible bounce towards the $2.05 space, which aligns with the highest of the channel and a trendline that has rejected worth a number of occasions earlier than. Value motion is compressing close to help, and up to date candles are displaying lengthy decrease wicks, an indication that patrons are reacting even whereas the broader development stays weak.

This doesn’t affirm a reversal by itself, but it surely does recommend sellers are not pushing worth freely. That lack of management is commonly the very first thing that adjustments earlier than anything does.

Indicators Nonetheless Lean Bearish

Regardless of the help response, technical indicators stay firmly cautious. Momentum readings are weak, development indicators nonetheless level decrease, and there’s no confirmed reversal sign but. RSI stays under impartial, stochastics are oversold with out turning, and MACD continues to favor draw back momentum.

Indicators usually lag worth, particularly throughout potential transition phases, however for now they reinforce the necessity for persistence. Value motion is bettering barely, but affirmation continues to be lacking.

Why This Isn’t a Confirmed Reversal But

Help reactions alone aren’t sufficient to name a backside. Sturdy reversals often include increased lows, bettering momentum, or increasing quantity, none of which have clearly proven up but. With out these, help can fail simply as simply as it could maintain.

For now, SUI is at a real crossroads. Consumers are displaying up, sellers are shedding some management, however the broader development hasn’t flipped. The subsequent transfer from this stage ought to reveal whether or not this zone turns into a base, or just one other pause earlier than continuation.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.