Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin remained on the again foot on Friday, below the $90,000 degree, capping off every week of weak point as cooling tensions over the US and Greenland, and a serious purchase by Technique, did little to shore up urge for food for cryptocurrencies.

Threat sentiment in the course of the Asian session was additionally constrained by the Financial institution of Japan assembly and the US President’s warning of potential army motion in Iran.

BTC is down 6% over the past week, regardless of edging up a fraction of a share within the final 24 hours to commerce at $89,501 as of 02:59 a.m. EST, with buying and selling quantity dropping over 1% to $39.2 billion, a sign of fading buying and selling exercise, in keeping with Coingecko knowledge.

The stall under the $90,000 space comes as Binance co-founder Changpeng Zhao (CZ) says BTC will break the four-year cycle this yr.

CZ Predicts Bitcoin ‘Tremendous-Cycle’ in 2026

CZ, talking on CNBC’s Squawk Field on January 23, mentioned that he expects BTC to enter a “super-cycle” in 2026, doubtlessly breaking the cryptocurrency’s historic four-year sample of value peaks and crashes.

Zhao attributed the bullish sentiment to what he described as more and more pro-crypto insurance policies in the USA and different nations, which he mentioned are enhancing the worldwide setting for digital belongings.

Bitcoin has, previously, adopted four-year cycles tied to halving occasions that cut back mining rewards and new provide. These cycles usually produce an all-time excessive adopted by important value corrections.

“I feel this yr, given the US being so pro-crypto and each different nation is type of following, I do suppose we are going to see this. We are going to in all probability break the four-year cycle,” Zhao mentioned.

Zhao additionally pointed to what he sees as a broader political shift round digital belongings, saying that the more and more pro-crypto stance worldwide is “good for the crypto trade and good for America as properly.”

CZ on Bitcoin’s subsequent part

Talking with CNBC on the World Financial Discussion board in Davos, CZ shared his view on the place Bitcoin could possibly be headed over the long run

His key level was easy however vital: short-term value strikes are unpredictable, however zooming out modifications the… pic.twitter.com/AMvp8OJxQv

— Crypto Eagles (@CryptoProject6) January 24, 2026

His feedback come as BTC holds fort above $89,000, pulling again from its $97,00-$98,000 peak earlier this month.

Bitcoin Worth Dangers A Sustained Drop

Whereas BTC noticed some positive aspects after Trump softened his rhetoric on Greenland earlier this week, the world’s largest crypto largely reversed course, returning to one-month lows.

Retail urge for food for BTC stays largely weak after dropping under the ascending triangle sample.

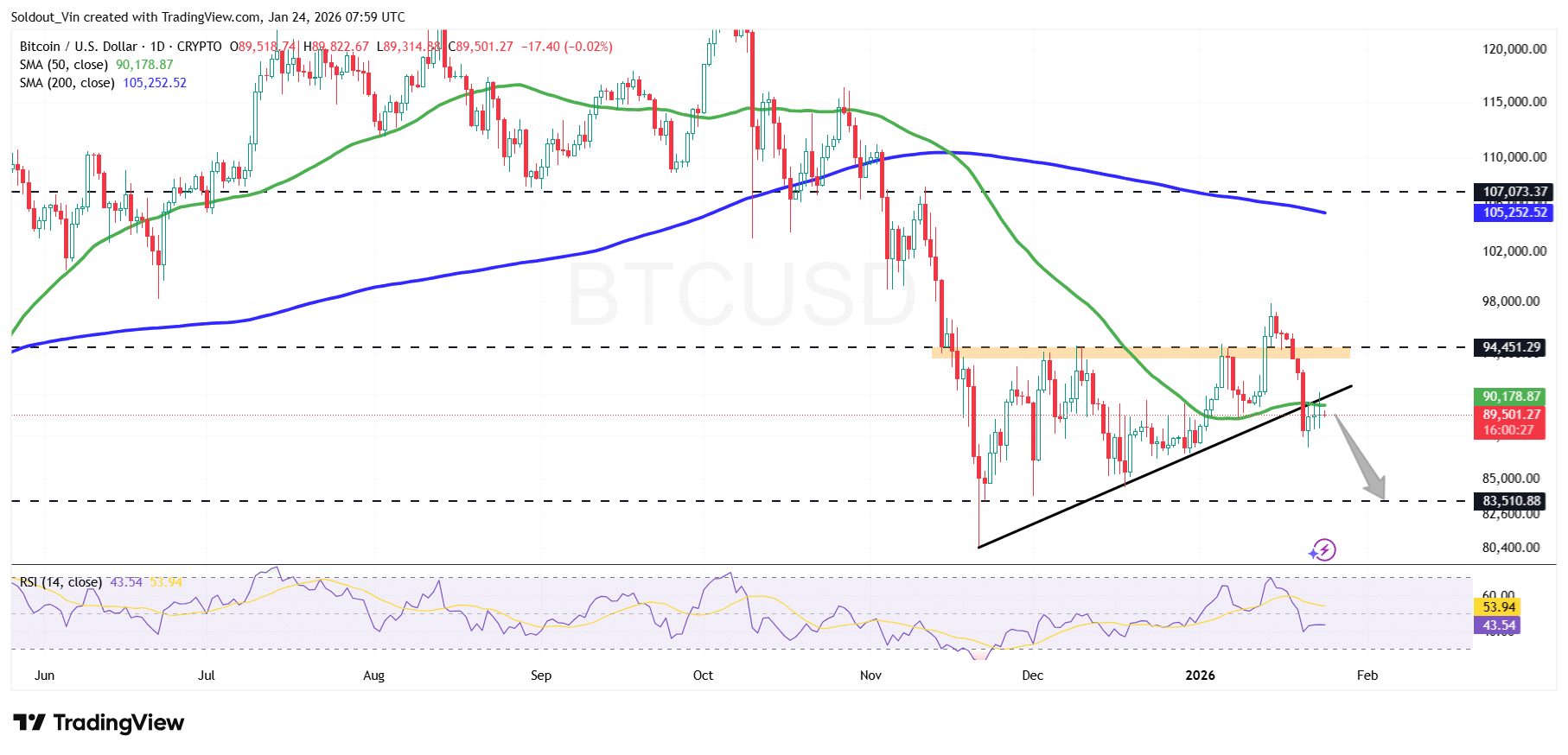

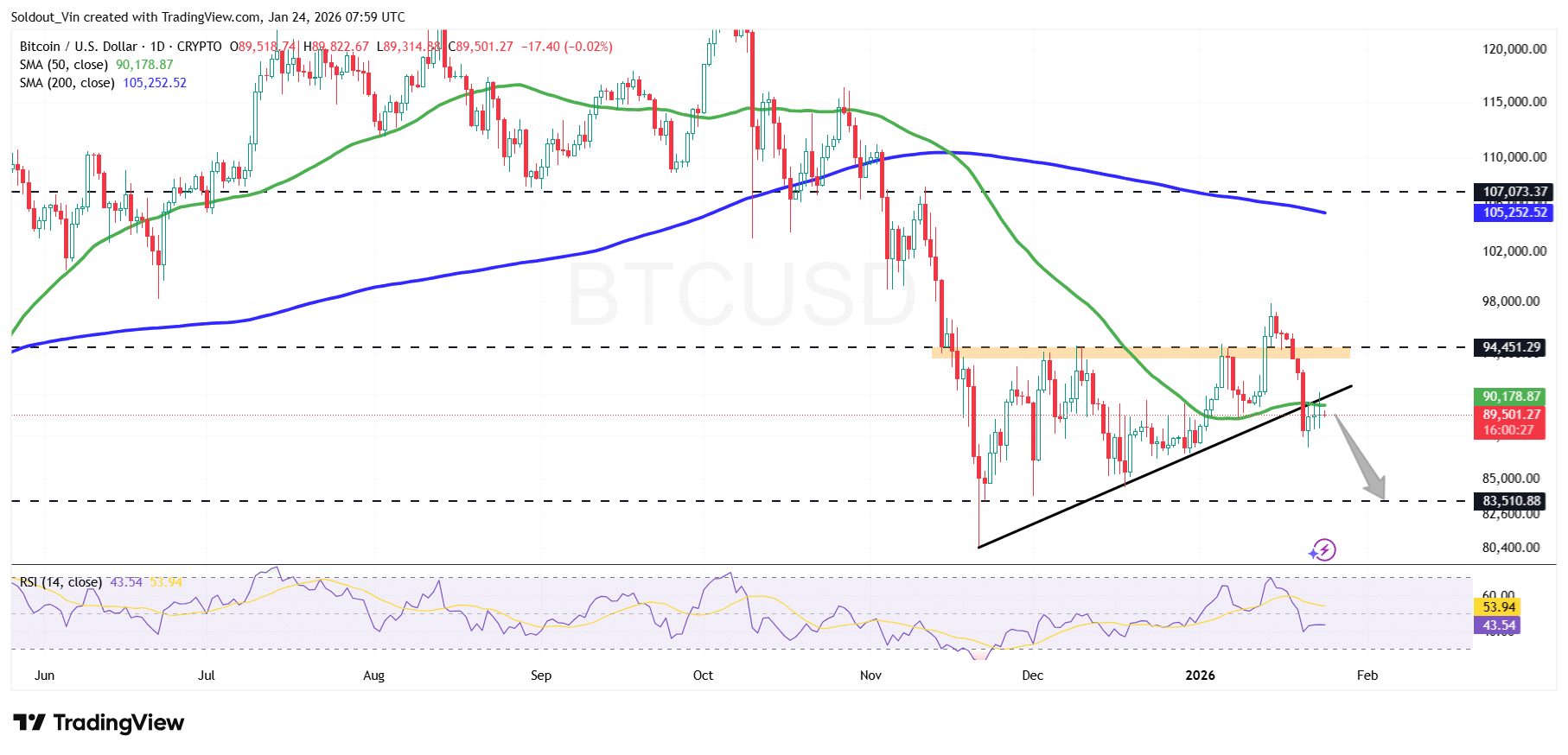

Bitcoin’s value has additionally fallen under the 50-day Easy Transferring Common (SMA) at $90,178, confirming the general bearish construction. The 200-day SMA at $105,252 serves because the long-term resistance space, simply throughout the $107,000-$106,000 earlier provide zone.

The value additionally reveals indecision, remaining throughout the sideways sample of between $83,510 and $94,451 from late November, as each transfer has been capped between a rising assist degree and the same-level resistance zone.

In the meantime, the Relative Power Index (RSI) reveals that patrons are presently holding the worth above assist, with the RSI presently transferring in a near-straight line round 43.

BTC Worth Prediction: $83,000 Degree In Sight

With BTC dropping under the important thing $90,000 degree and the decrease boundary of the ascending triangle, it dangers a sustained decline.

If the worth of Bitcoin drops under the earlier demand zone round $85,000, the subsequent key assist space, which is now appearing as a cushion in opposition to downward stress, shall be at $83,510.

Polymarket reveals the probability of BTC hitting $85,000 has risen to round 34%, as quoted by distinguished analyst Michaël van de Poppe on X.

It is nearly the tip of the month, which suggests: There are going to be new bets on #Bitcoin for the upcoming month, and but, there are some fascinating ones for this month.

The percentages of $BTC hitting $85,000 at the moment are 34%, whereas betting on $BTC hitting $100,000 at the moment are 5%.

What do… pic.twitter.com/1und9SB2oV

— Michaël van de Poppe (@CryptoMichNL) January 23, 2026

This bearish sentiment can also be supported by US spot BTC exchange-traded funds (ETFs), which have recorded web outflows for 5 consecutive days and $103.5 million within the final 24 hours, in keeping with Coinglass knowledge.

In the meantime, any try and push BTC above $91,000 and preserve it above the 50-day SMA might sign a bullish transfer. On this case, Bitcoin might climb again to its goal costs above $94,500, with a long-term goal of the $107,000 zone.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection