- TRX outperformed the broader market, climbing above $0.31 as different high cash weakened

- Tron’s stablecoin market cap hit a brand new all-time excessive above $84 billion

- Rising deal with exercise, transaction quantity, and treasury accumulation are supporting demand

TRX pushed as much as $0.31 earlier within the day, extending a restoration that quietly began mid-week. What made the transfer stand out was the timing, as most high cryptocurrencies have been sitting within the pink on the weekly chart. Whereas Bitcoin and Ethereum struggled to carry any actual upside momentum, TRX managed to maneuver in the wrong way, which caught merchants’ consideration fairly quick.

This wasn’t the primary time TRX has damaged away from the broader market pattern both. Since Wednesday, the token is up greater than 5%, whereas many giant caps failed to seek out traction. The shift greater started after TRX’s RSI briefly dipped beneath the 50 stage, a zone that always resets momentum. A more in-depth look suggests this bounce wasn’t simply technical noise, however tied to strengthening on-chain exercise.

Tron Community Stablecoin Depend Hits a New Excessive

TRX’s worth restoration strains up with a significant milestone contained in the Tron ecosystem. The community’s stablecoin market cap has surged to a contemporary all-time excessive, signaling renewed demand flowing by way of the chain. Information from DeFiLlama exhibits Tron’s stablecoin provide pushing previous $84 billion for the primary time this week, a stage it hadn’t reached earlier than.

What makes this extra attention-grabbing is the distinction with Ethereum. Whereas Ethereum nonetheless holds a a lot bigger stablecoin market general, its provide slipped from roughly $164 billion to $161 billion since mid-January. Tron, in the meantime, retains climbing. That pattern displays a long-term technique, as Tron has spent years positioning itself as a go-to community for stablecoin transfers, primarily as a result of transactions keep low-cost and quick, even throughout busy durations.

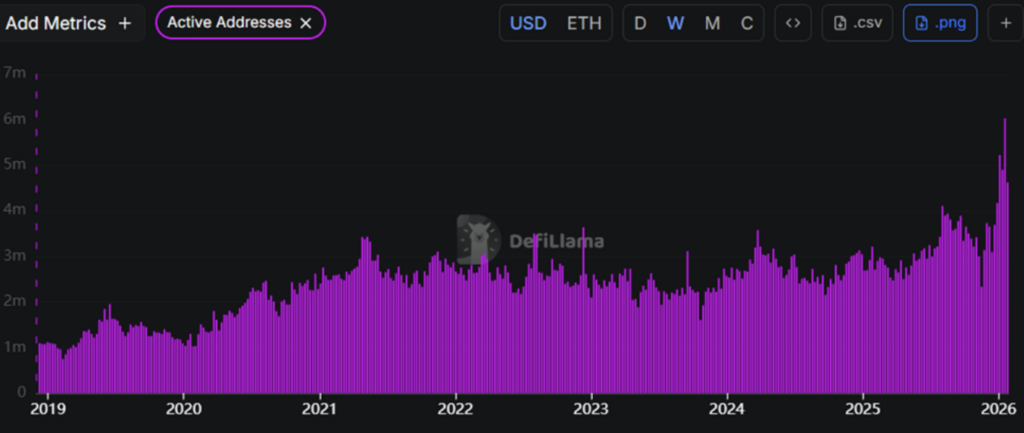

Handle Exercise and Transactions Proceed to Climb

Demand for TRX can be exhibiting up clearly in community utilization. Weekly lively addresses on Tron crossed 6 million between January 12 and 18, marking the primary time exercise has reached that stage. The build-up has been regular since November, and even earlier than this leap, the community was already on observe to exceed 5 million lively addresses this month.

Extra addresses naturally result in extra transactions, and the information confirms it. Day by day transaction counts have been sitting close to 9.2 million on the finish of December, then climbed sharply to round 12.2 million by mid-January. Exercise has stayed elevated over the previous couple of days, reinforcing the concept that TRX’s worth energy is being backed by actual utilization, not simply hypothesis. In This autumn alone, day by day transactions persistently pushed above 10 million, with deal with exercise outpacing Q3 ranges.

Tron Inc. Provides to TRX Reserves

Community progress isn’t the one issue supporting TRX proper now. Tron Inc. has additionally been including to its personal TRX reserves as a part of a longer-term treasury technique. The corporate just lately disclosed the acquisition of 165,824 TRX, bringing its complete holdings to round 677 million TRX.

Whereas this newest purchase isn’t giant sufficient to maneuver the market by itself, it does add to the broader narrative. Because the reserve grows, it helps set up a stronger perceived flooring for the asset. Mixed with rising stablecoin utilization and increasing community exercise, the latest TRX worth transfer seems much less like a random spike and extra like a response to enhancing fundamentals, even when volatility nonetheless lingers.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.