- XRP is holding a traditionally robust $1.80–$2.00 help zone that has fueled previous rallies

- Onchain metrics counsel undervaluation, but in addition level to prolonged sideways motion

- Earlier cycles present XRP tends to consolidate for lengthy intervals earlier than explosive upside

XRP has persistently defended the $1.80–$2.00 vary since December 2024, a degree that aligns carefully with its prior cycle highs. Traditionally, each main retest of this zone has resulted in rebounds ranging between 35% and 90%, reinforcing its significance as a long-term accumulation space. If the sample holds, XRP may nonetheless push increased earlier than the yr ends, however the transfer is unlikely to be fast.

A number of analysts argue that value habits round former all-time highs isn’t weak point, however structural power. XRP’s capacity to carry above this band suggests robust purchaser conviction, at the same time as momentum cools within the broader market.

Why Analysts Anticipate Extra Accumulation First

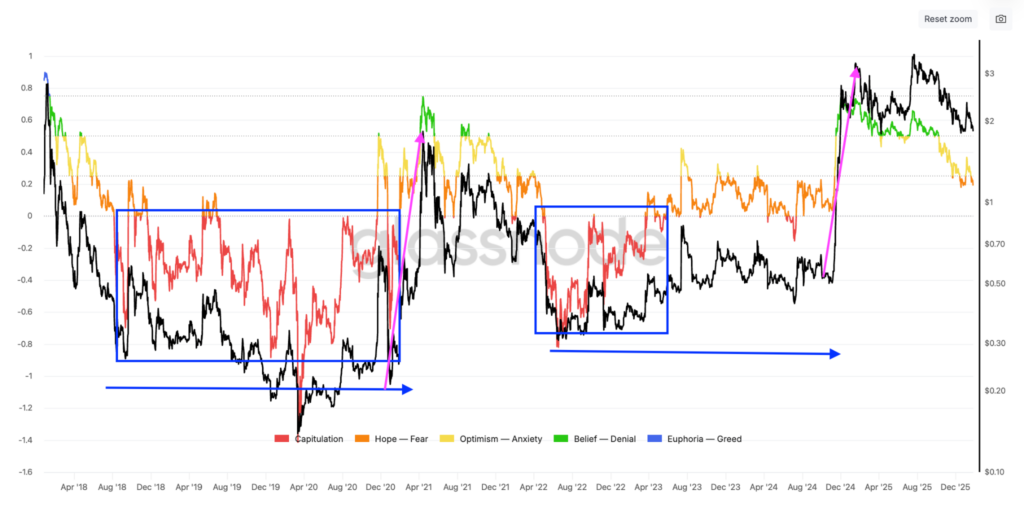

Technical analysts level to similarities with XRP’s 2017 and 2022 market constructions. In each instances, the asset spent prolonged intervals shifting sideways close to key resistance earlier than breaking out aggressively. After slipping beneath its highs in 2022, XRP traded between $0.30 and $0.70 for greater than three years earlier than launching a 390% rally in late 2024.

Present chart patterns counsel XRP could repeat this habits, consolidating across the $2 degree earlier than any sustained breakout. Analysts emphasize that point, not value, is the lacking ingredient for the subsequent main leg increased.

Onchain Knowledge Backs the Consolidation Thesis

Onchain indicators reinforce the concept XRP is early in a bigger setup. The Internet Unrealized Revenue/Loss metric has entered a zone traditionally related to cycle bottoms, which in prior cycles coincided with extended sideways value motion. This part usually permits weaker arms to exit whereas long-term holders accumulate.

The Market Worth to Realized Worth ratio additionally helps this view. At present ranges, XRP seems considerably much less overheated than throughout prior peaks, implying decreased promoting stress but in addition slower short-term upside. These situations usually precede robust rallies, however solely after persistence is examined.

What This Means for XRP’s Larger Targets

Whereas some analysts undertaking long-term targets properly into double digits, the trail there doubtless entails consolidation reasonably than a right away surge. XRP’s construction means that increased costs are potential, however solely after adequate accumulation round present ranges.

For now, XRP appears much less like an asset able to explode and extra like one quietly constructing a base. If historical past repeats, the wait could also be irritating, however the eventual transfer might be substantial.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.