Since Bitcoin’s (BTC) value surpassed the $100,000 mark and hit a brand new all-time excessive, there was hypothesis that the cryptocurrency may need hit this cycle’s high. Nevertheless, a number of key Bitcoin indicators counsel that this bias stems from private opinion and isn’t supported by historic knowledge.

At press time, BTC trades at $101,449. This on-chain evaluation explains why the coin’s value would possibly nonetheless have room to develop regardless of current consolidation.

Bitcoin Continues to Stay in a Bullish Part

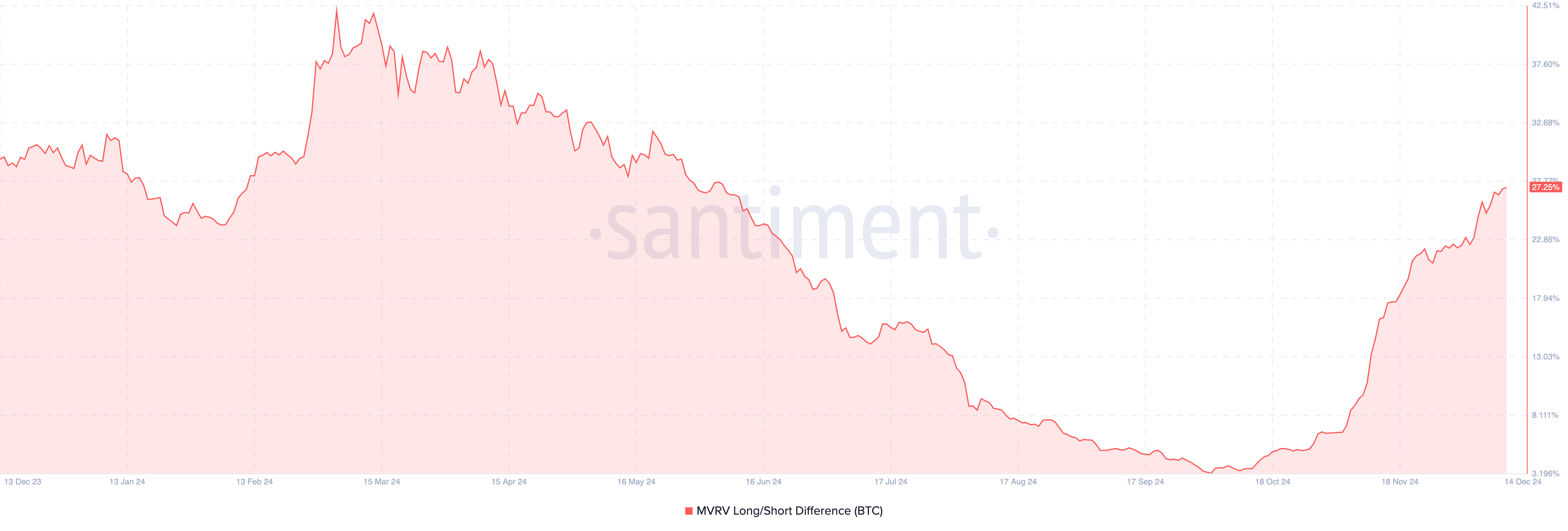

A major metric suggesting that Bitcoin’s value would possibly rally once more is the Market Worth to Realized Worth (MVRV) lengthy/quick distinction. Traditionally, this metric reveals when BTC is in a bull section or has switched to a bear market.

When the MVRV lengthy/quick distinction is in optimistic territory, it signifies that long-term holders have extra unrealized earnings than short-term holders. Value-wise, that is bullish for Bitcoin. Alternatively, when the metric is damaging, it implies that short-term holders have the higher hand, and most often, it signifies a bearish section.

In response to Santiment, Bitcoin’s MVRV lengthy/quick distinction has risen to 27.25%, indicating that the present cycle is a Bitcoin bull market. Nevertheless, the studying is much beneath 42.08, which it reached in March earlier than experiencing months of consolidation and correction. Going by historic knowledge, this present situation means that BTC is more likely to surpass its all-time excessive earlier than the highest of this cycle.

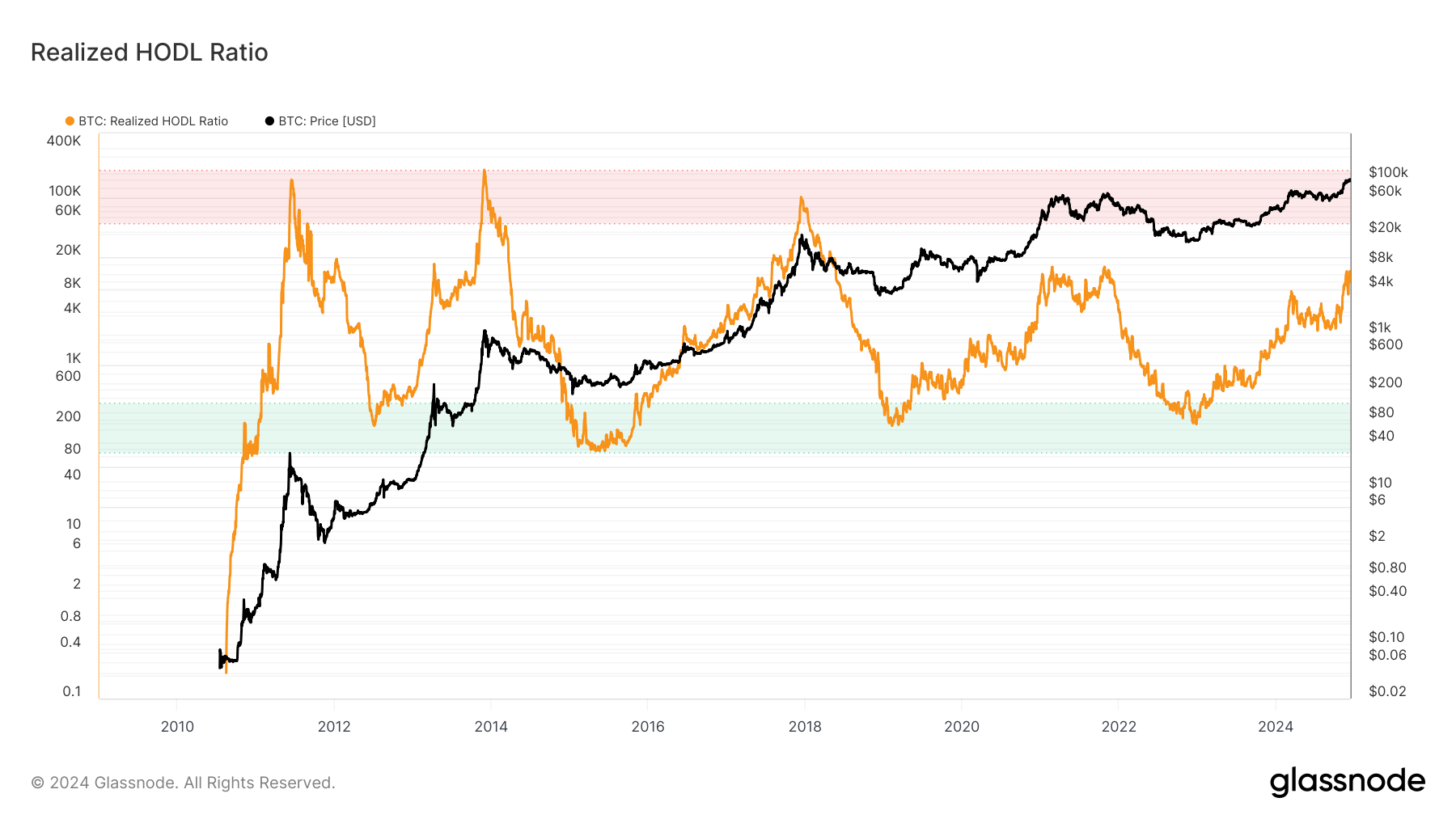

The Realized HOLD ratio, generally known as the RHODL ratio, is one other key Bitcoin indicator supporting this bias. The RHODL ratio is a extensively regarded market indicator designed to investigate Bitcoin’s market bottoms and tops.

A excessive RHODL Ratio suggests the market is overheated with vital short-term exercise, typically used to sign cycle tops or impending corrections. A low RHODL ratio, however, signifies sturdy long-term holding sentiment, implying undervaluation.

Primarily based on Glassnode’s knowledge, the Bitcoin RHODL ratio is above the inexperienced zone, indicating that it’s not on the backside. On the similar time, it’s beneath the pink space, signifying that BTC value has not hit the highest. If this stays the identical, then Bitcoin would possibly rally above its all-time excessive of $103,900.

BTC Value Prediction: Coin to Hit Increased Values

A take a look at the each day chart exhibits that Bitcoin has shaped a bull flag. A bull flag is a technical sample that signifies a possible continuation of an uptrend. The sample exhibits the flagpole, which represents the preliminary sturdy upward value motion

The uptrend presently signifies aggressive shopping for and elevated buying and selling quantity. The sample, nevertheless, is adopted by sideways or downward consolidation close to the excessive of the preliminary transfer. That is referred to as the flag and takes the form of both a rectangle or a pennant, shaped by barely decrease highs and decrease lows.

Bitcoin seems to have damaged above the flag’s higher boundary. With this place, the cryptocurrency’s worth may rise to $112,500.

Nevertheless, if the BTC value drops beneath the flag’s decrease boundary, this prediction is likely to be invalidated. It may additionally occur if the important thing Bitcoin indicators flip bearish. In that case, the worth may slide to $89.867.

Disclaimer

Consistent with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.