- Crypto treasuries on Sui are shifting from passive holders to energetic protocol individuals

- Managed token unlocks and steady circulation help long-term ecosystem progress

- Rising stablecoin liquidity and yields are reinforcing Sui’s function as a yield-focused DeFi community

Crypto treasuries are quietly altering roles, shifting from passive steadiness sheets into energetic protocol individuals, and Sui is a clear instance of how briskly that transition is occurring. In earlier cycles, corporations like Technique, previously MicroStrategy, or Metaplanet handled crypto property as static reserves meant to sit down untouched. Immediately, merely holding isn’t sufficient, deployment and participation really matter now.

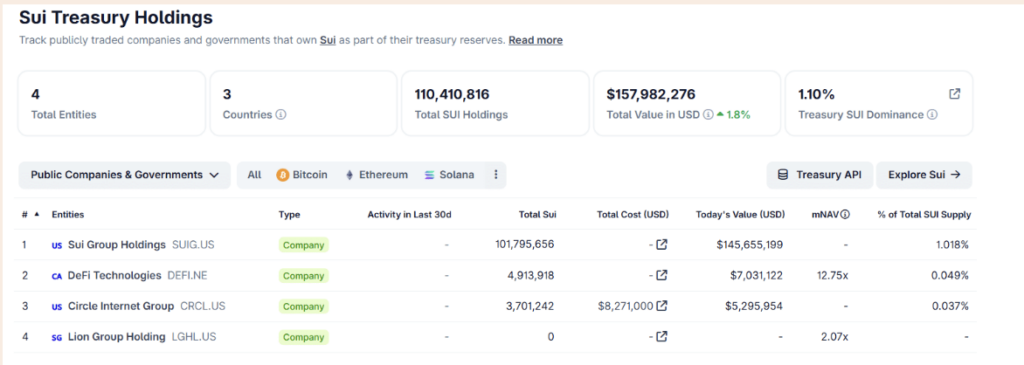

On Sui, foundation-controlled wallets stay the biggest holders, however on-chain information exhibits treasury wallets tracked through Explorer holding a concentrated 108 million SUI, roughly 3% of circulating provide. On the similar time, analytics level to rising holder focus amongst high wallets, which hints at coordinated, long-term positioning quite than scattered hypothesis. This setup isn’t nearly value help or liquidity anymore, it more and more touches governance participation and yield era, which means treasuries are beginning to run protocols as an alternative of merely storing tokens.

Sui token circulation stays regular regardless of unlocks

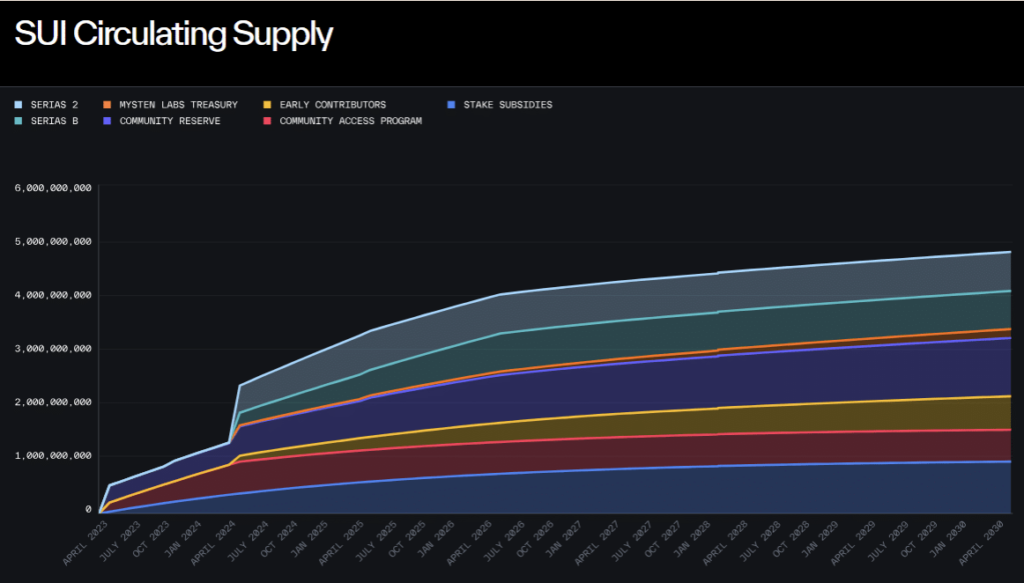

Sui’s circulating provide continues to increase in a managed, predictable approach quite than by way of sudden shock-driven releases. As of late January 2026, circulating provide sits close to 3.79 billion SUI, or about 38% of the ten billion most provide. Unlocks are following a predefined vesting curve, with no uncommon spike occasions disrupting the market.

Due to this construction, provide progress has largely been absorbed the place holdings matter most. Information from token schedules exhibits that the Sui Basis and Mysten Labs nonetheless management sizable allocations, however a lot of that offer stays locked for long-term improvement, staking incentives, and ecosystem funding. In observe, this appears much less like Bitcoin-style shortage and extra like Solana-style ecosystem bootstrapping, the place retention helps progress over time. CoinGecko information additionally exhibits institutional holdings exceeding 110 million SUI, reinforcing a technique targeted on yield-enabled utilization quite than short-term turnover.

Stablecoin progress displays energetic treasury conduct

Stablecoin growth on Sui intently mirrors the rise of energetic crypto treasuries, and the 2 traits feed into one another. By late January 2026, Sui’s stablecoin market cap reached roughly $500 million, with USDC accounting for over 70% of that complete. This liquidity more and more fuels lending, buying and selling, and yield methods throughout DeFi protocols on the community.

On the similar time, treasury-linked entities have moved past merely holding SUI. By deploying capital by way of stablecoins as an alternative, they deepen liquidity swimming pools, generate charges, and affect protocol utilization with out including spot promote strain. Treasuries are now not sitting on the sidelines, they’re working contained in the Sui economic system itself. This convergence factors to a broader shift from asset custody towards execution and management on the protocol degree.

Yield dynamics clarify why this issues

Yield circumstances throughout Sui DeFi have strengthened steadily, reflecting deeper liquidity and bettering capital effectivity. In late January 2026, lower-risk methods provided yields within the 3% to 10% vary, whereas incentive-heavy swimming pools pushed previous 50%, supported by over $500 million in stablecoin liquidity and rising TVL. These aren’t static numbers both, they transfer with utilization.

Lending platforms like NAVI Protocol and Suilend have delivered roughly 5% to 7% APY on USDC, whereas DEXs comparable to Cetus have pushed yields above 70% by way of buying and selling charges and incentives. Yield progress pulls in capital, improves liquidity depth, and reinforces Sui’s id as an energetic, yield-driven DeFi ecosystem quite than a passive Layer 1.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.