- American Bitcoin has grown its BTC stack to just about 5,900 cash since late 2025

- The agency studies a triple-digit BTC yield since its Nasdaq debut

- Company Bitcoin accumulation continues to reshape public market publicity

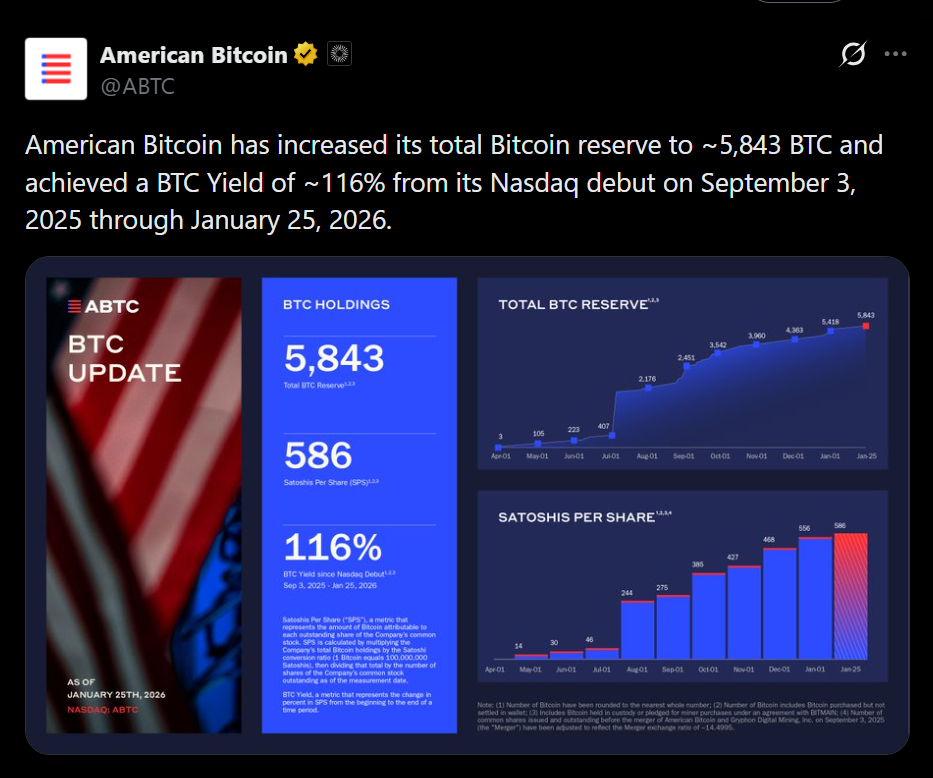

American Bitcoin, a publicly traded Bitcoin treasury firm backed by Donald Trump Jr. and Eric Trump, has added one other 416 BTC to its steadiness sheet, bringing whole holdings to five,843 Bitcoin. At present costs, that stash is valued at roughly $514 million, cementing the agency’s place as one of many extra aggressive company accumulators out there.

The acquisition highlights how rapidly American Bitcoin has scaled its treasury technique, doing so in simply 5 months since itemizing on Nasdaq in September 2025.

Triple-Digit Yield Alerts an Aggressive Technique

The corporate additionally disclosed a Bitcoin yield of roughly 116% between its Nasdaq debut on Sept. 3, 2025, and Jan. 25, 2026. That metric displays the agency’s capacity to extend its Bitcoin publicity relative to its fairness base, quite than easy worth appreciation alone.

This method mirrors methods utilized by different Bitcoin-focused public firms, the place accumulation pace and capital construction matter as a lot as market timing.

Climbing the Company Bitcoin Rankings

With its newest addition, American Bitcoin now ranks because the 18th-largest company holder of Bitcoin globally. Within the course of, it has overtaken firms like Nakamoto Inc. and GameStop Corp., underscoring how rapidly newer entrants can climb the leaderboard with a targeted accumulation plan.

The transfer reinforces a broader pattern the place Bitcoin treasuries are now not restricted to early adopters however are more and more being constructed by newer public companies with specific BTC-first mandates.

Inventory Efficiency Tells a Extra Cautious Story

Regardless of the Bitcoin accumulation, ABTC shares rose solely modestly in premarket buying and selling and stay down about 11% year-to-date. Ongoing geopolitical stress and macro uncertainty proceed to weigh on crypto-linked equities, whilst underlying Bitcoin publicity grows.

This divergence highlights a well-recognized sample: fairness markets typically lag treasury technique narratives during times of broader danger aversion.

Conclusion

American Bitcoin’s fast accumulation exhibits how rapidly a targeted crypto treasury technique can scale in public markets. Whereas short-term inventory efficiency stays blended, the agency’s rising Bitcoin place locations it firmly throughout the increasing class of firms treating BTC as a core reserve asset quite than a speculative add-on.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.