Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin edged barely greater on Tuesday, however nonetheless stays rangebound under the $90,000 mark, now hovering not removed from its one-month lows, as merchants remained cautious after Trump threatened a 25% tariff hike on South Korea and forward of the Federal Reserve’s coverage assembly.

BTC value edged up a fraction of a proportion over the past 24 hours to commerce at $88,269 as of 03:18, because it continues to battle to regain notable momentum after sharp losses final week and underperforms different belongings.

The crypto market additionally noticed a slight soar to a market capitalization of about $3.07 trillion.

Commerce Tensions Spike as Trump Hits South Korea with 25% Tariffs

US President Donald Trump introduced he’s elevating tariffs on South Korean imports to 25% after accusing the nation of failing to dwell as much as a commerce deal reached final yr.

Beneath the deal in October 2025, Seoul pledged $350 billion of investments into strategic US industries in return for tariffs being capped at 15%.

Nonetheless, the federal government famous that “it’s unlikely” that the funding might start within the first half of this yr, citing administrative causes and foreign money market volatility.

In a social media put up, Trump stated he would improve levies on South Korean imports to 25% throughout varied merchandise, together with vehicles, lumber, prescribed drugs, and “all different Reciprocal TARIFFS.”

Trump: I Am Hereby Growing South Korean Tariffs on Autos, Lumber, Pharma, and All Different Reciprocal Tariffs From 15% to 25% – $QQQ $SPY pic.twitter.com/eMFvEjB1fk

— Hardik Shah (@AIStockSavvy) January 26, 2026

In line with Trump, South Korean lawmakers have been sluggish to approve the deal, whereas the US has acted swiftly to scale back its tariffs in step with the transaction agreed to.

After Trump threatened to impose 100% tariffs on Canada over the weekend, and now South Korea, merchants stay cautious, driving safe-haven belongings like gold and silver to all-time highs.

Merchants Watching The Federal Reserve Choice

So as to add to the market’s indecision, focus has shifted to the Federal Reserve’s two-day assembly, which begins at present, January 27, and ends on January 28. Economists are broadly anticipating the policymakers to maintain rates of interest unchanged on Wednesday.

Merchants are watching carefully on the Fed’s assertion and Chair Jerome Powell’s press convention for clues on the timing of potential fee cuts and the central financial institution’s inflation outlook.

💥 BREAKING

🇺🇸 THE FEDERAL RESERVE ANNOUNCES ITS INTEREST RATE DECISION THIS WEDNESDAY AT 2:00 PM ET

THE DOLLAR INDEX IS SLIDING SHARPLY, AND ALL EYES ARE ON THE FED.

WILL THEY PULL THE TRIGGER ON A RATE CUT? 👀 pic.twitter.com/0sF2lOiPp2

— Mr. Crypto Whale 🐋 (@Mrcryptoxwhale) January 26, 2026

Any shift in Powell’s tone might affect threat sentiment and liquidity circumstances, each of that are key drivers of threat belongings like Bitcoin.

With Bitcoin down 4.5% over the past 2 weeks, can it get well above $90,000?

Bitcoin Worth Evaluation: BTC Holds Robust Above Help

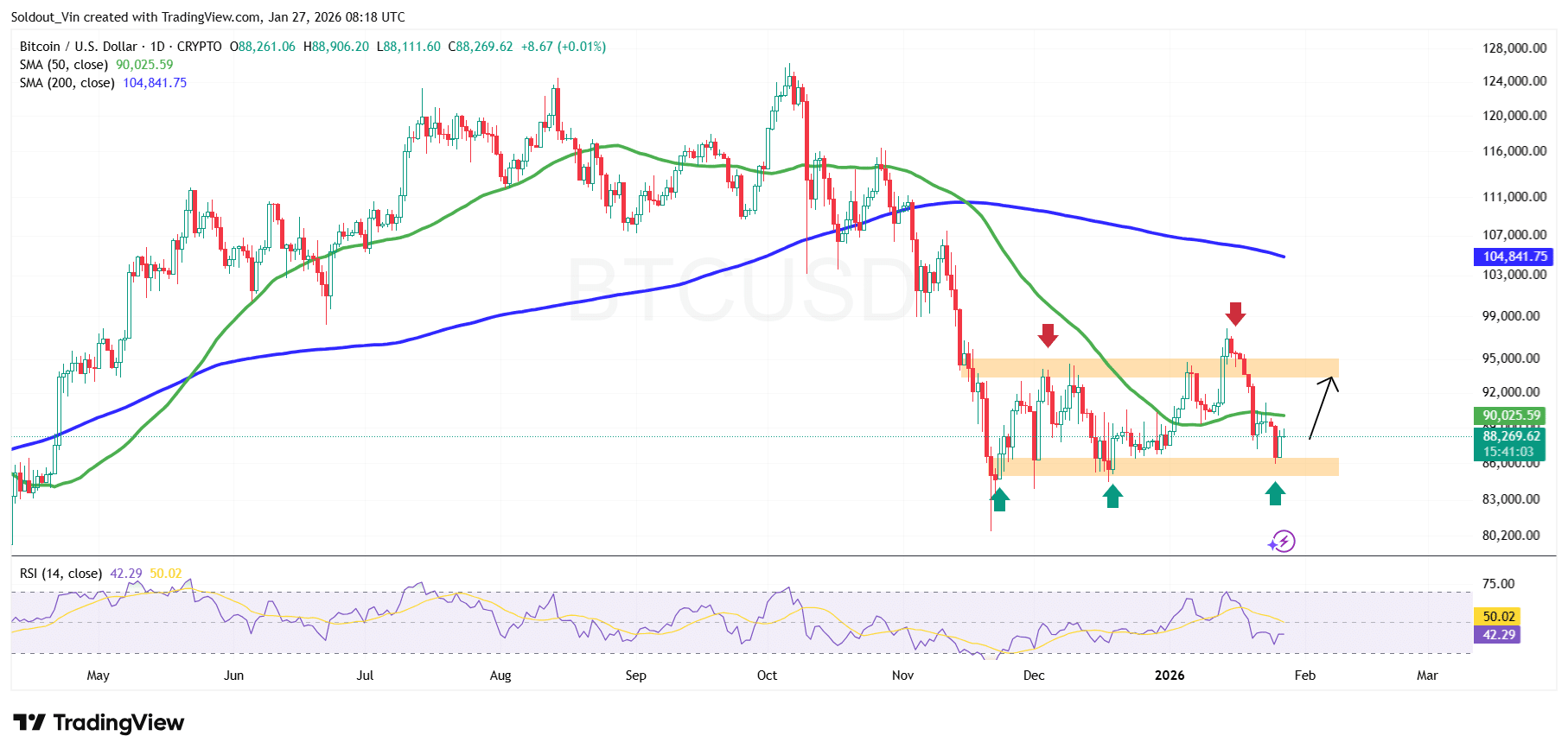

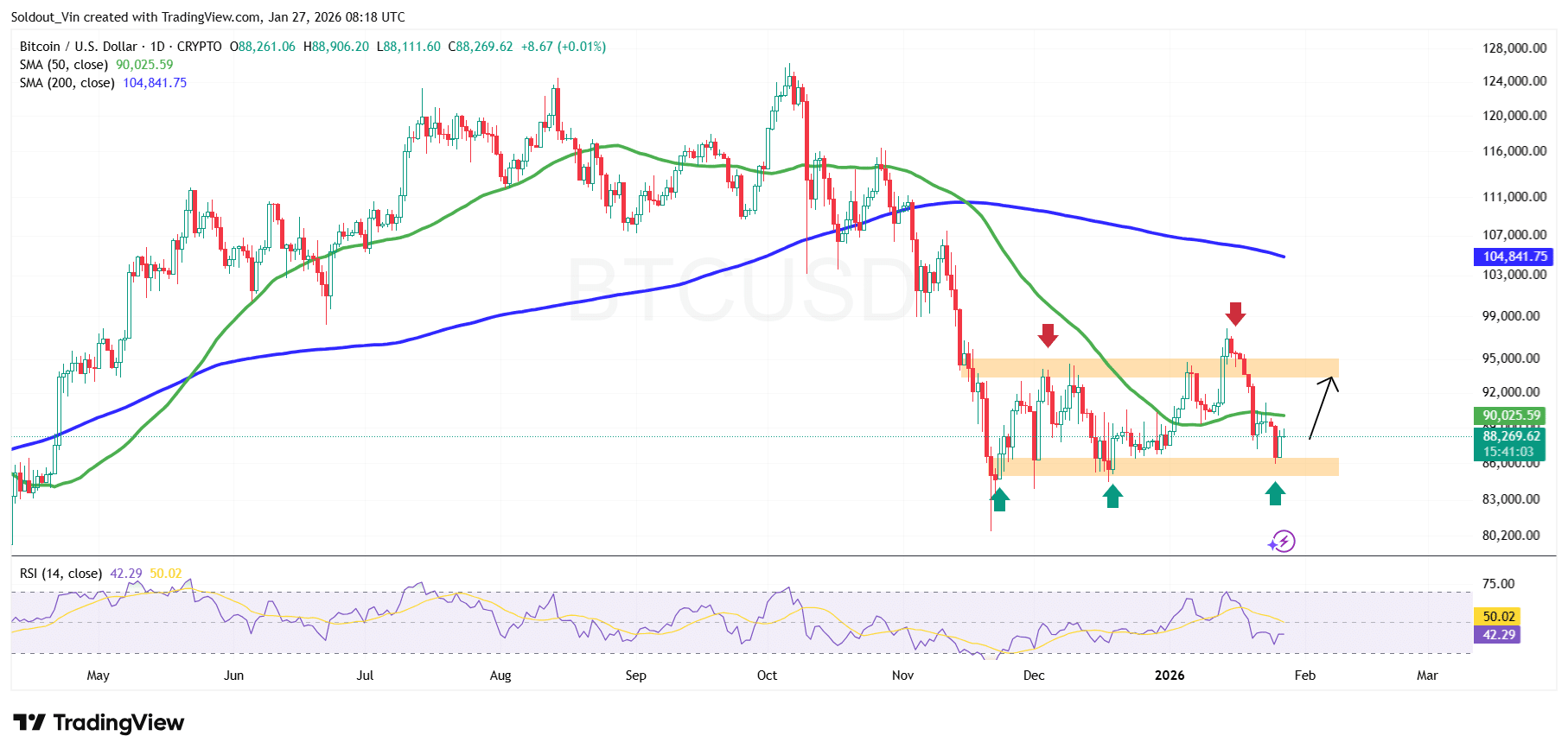

Bitcoin is at the moment buying and selling inside a well-defined consolidation vary, in a sideways sample, with the asset holding close to the $86,500–$89,000 help zone after a pointy pullback from the late-2025 highs.

This space aligns with a earlier demand zone in December, as BTC fashioned a robust help. BTC value now sits under the 50-day Easy Transferring Common (SMA) ($90,025) and the 200-day SMA round $104,800, which continues to replicate the broader long-term uptrend.

Following a robust rally earlier in 2025, Bitcoin established a collection of upper highs earlier than momentum stalled close to its all-time excessive round $126,000. This rejection led to a sustained value correction to round $80,500.

Since that drop, the worth of BTC motion has shifted right into a range-bound construction, with consumers repeatedly stepping in close to the $86,000 space, as highlighted by a number of draw back rejections. This habits suggests underlying demand continues to be in play, whilst upside makes an attempt proceed to face resistance.

Every push towards the $93,000–$95,000 area has been met with promoting, confirming this zone as an energetic provide space.

Momentum indicators echo this cautious tone. The day by day RSI is at the moment hovering close to 42, under the impartial 50 degree. This reveals diminished bullish momentum and a tilt towards vendor management, although RSI is just not but in deeply oversold territory.

BTC Worth Prediction: $90,000 in Sight

From a technical view, the Bitcoin value is approaching a call zone. Holding above the $86,000–$88,000 help area might permit BTC value to stabilize and try one other push towards the $93,000–$95,000 resistance zone.

A sustained day by day shut again above the 50-day SMA would enhance the bullish narrative and improve the likelihood of a restoration towards the $100,000–$104,000 space, close to the 200-day SMA and prior breakout ranges.

On the draw back, a confirmed breakdown under the present help vary across the $86,000 space would invalidate any bullish makes an attempt. On this situation, the following doubtless help zone and a cushion towards downward strain could possibly be the $84,475 degree, which has beforehand acted as a requirement space.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection