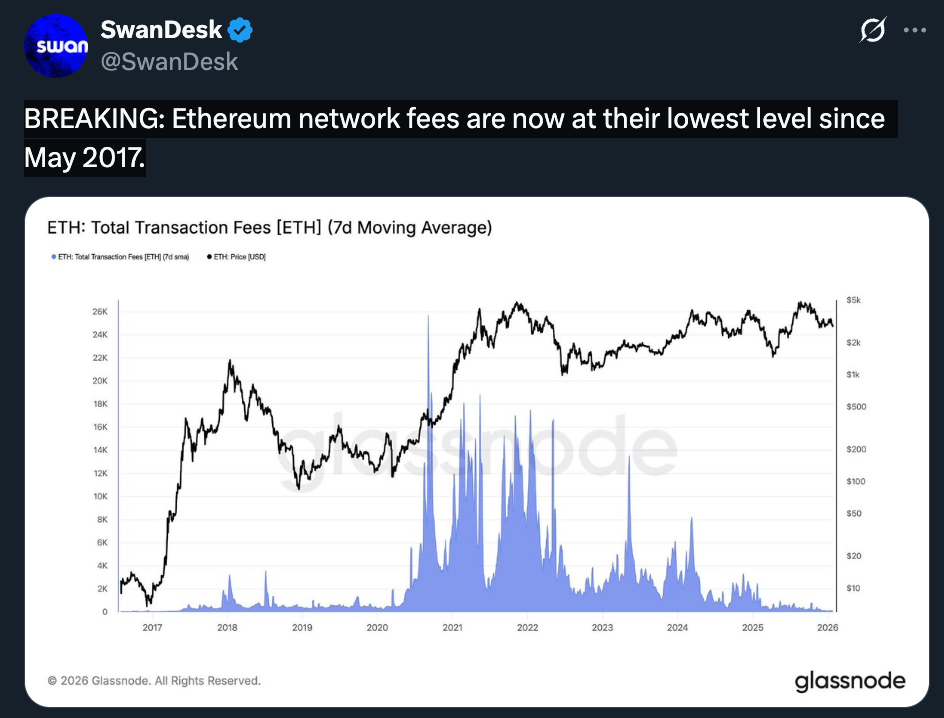

- Ethereum transaction charges have fallen beneath one cent, the bottom ranges since 2017

- Community utilization stays excessive, signaling actual effectivity beneficial properties moderately than weak demand

- Layer-2 adoption and up to date upgrades are reshaping how Ethereum scales

Ethereum transaction charges have slipped to their most cost-effective level since Could 2017, averaging underneath $0.01. For years, excessive fuel prices had been the community’s largest ache level, usually pricing out smaller customers and experiments. What makes this second completely different is that charges collapsed with out utilization collapsing alongside them.

Every day transactions reached roughly 2.9 million in January, a stage that beforehand would have despatched charges hovering. As a substitute, prices stayed minimal, suggesting Ethereum’s bottlenecks are lastly loosening moderately than demand merely disappearing.

Why Upgrades and Layer-2s Matter Extra Than Ever

This shift is basically the results of technical progress. Capability-focused upgrades like Fusaka, mixed with the explosive development of Layer-2 networks, have moved an enormous share of exercise off the bottom layer. Much less congestion means cheaper transactions with out sacrificing safety.

For builders, this opens the door to constructing functions that had been beforehand impractical resulting from fuel prices. For customers, it makes on a regular basis actions like transfers, small DeFi trades, and even NFTs really feel cheap once more as a substitute of punitive.

The Tradeoffs Behind Cheaper Transactions

Decrease charges are nice for adoption, however additionally they change Ethereum’s economics. With fewer charges being burned by means of EIP-1559, ETH’s deflationary stress weakens. That shifts the narrative away from payment shortage and towards long-term utilization, software development, and Layer-2 ecosystems as the first drivers of worth.

How ETH accrues worth in a low-fee surroundings stays an open query, particularly if demand accelerates once more.

Conclusion

Ethereum’s payment collapse isn’t just a short-term anomaly. It indicators that years of scaling work are lastly paying off. If the community can maintain charges low whereas supporting excessive demand, Ethereum turns into much less about costly settlement and extra about usable infrastructure. That transition might quietly reshape how crypto is constructed and adopted.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.