- Normal Chartered warns stablecoins could pull $500 billion from U.S. financial institution deposits

- Regional banks face probably the most strain as deposits underpin their earnings mannequin

- Regulatory readability might speed up adoption somewhat than sluggish it

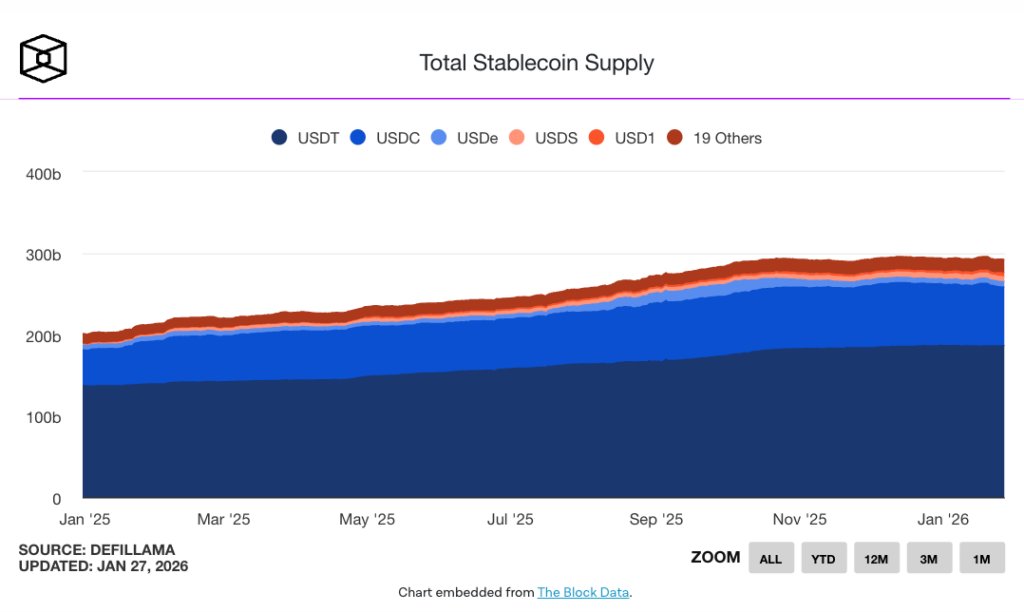

Normal Chartered’s warning confirms what many in conventional finance have been quietly acknowledging for some time. Stablecoins are not area of interest instruments used solely by crypto-native merchants. If even a modest share of on a regular basis funds and financial savings strikes on-chain, financial institution deposits don’t disappear in a single day, however they do skinny out over time. A possible $500 billion shift is just not a sudden run on banks, it’s a sluggish change in habits, occurring pockets by pockets.

This type of transition issues as a result of deposits are the inspiration of the banking system’s funding mannequin. When cash migrates elsewhere, the impression compounds steadily however meaningfully.

Why Regional Banks Really feel the Strain First

The weakest level is internet curiosity margin. Regional banks rely closely on deposits to fund loans and generate earnings. When funds sit in stablecoins as a substitute of checking or financial savings accounts, that margin narrows. Giant world banks have diversified income streams and stability sheet buffers that soften the blow. Brokerages and asset managers barely discover.

Regional banks, nevertheless, really feel the impression a lot quicker. This shift is just not pushed by speculative crypto exercise. It’s pushed by companies and people selecting quicker settlement, simpler cross-border transfers, and programmable cash that works past conventional banking hours.

Regulation Might Speed up Adoption, Not Gradual It

The talk in Washington highlights the true stress. Crypto corporations need stablecoins handled as trendy monetary infrastructure. Banks need guardrails that defend deposits and protect their position. Even main establishments have acknowledged that interest-bearing stablecoins might unlock market sizes far bigger than at the moment’s ecosystem.

As soon as guidelines are clearly outlined, uncertainty drops. Traditionally, that’s when adoption accelerates. Regulation could delay progress briefly, however readability usually acts as a catalyst somewhat than a brake.

The Issuer Mannequin Adjustments the Equation

One neglected issue is how stablecoin issuers handle reserves. Corporations like Tether and Circle maintain solely restricted parts of reserves as conventional financial institution deposits. Which means funds leaving banks don’t mechanically cycle again into the system. Whenever you add robust demand from rising markets, the impact turns into structural as a substitute of cyclical.

This dynamic reshapes how liquidity strikes by the monetary system and weakens the belief that deposits will at all times return dwelling.

Conclusion

This isn’t a demise sentence for banks. It’s a forcing operate. Establishments that adapt their funding fashions, combine with tokenized rails, and settle for new types of cash motion will regulate. Those who wait could discover that deposits not behave the best way they as soon as did, and by the point that turns into apparent, the shift could already be locked in.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.