The market is making an attempt to rebound after a corrective transfer, with Bitcoin value at this time trying a short-term bounce whereas the broader construction stays beneath stress.

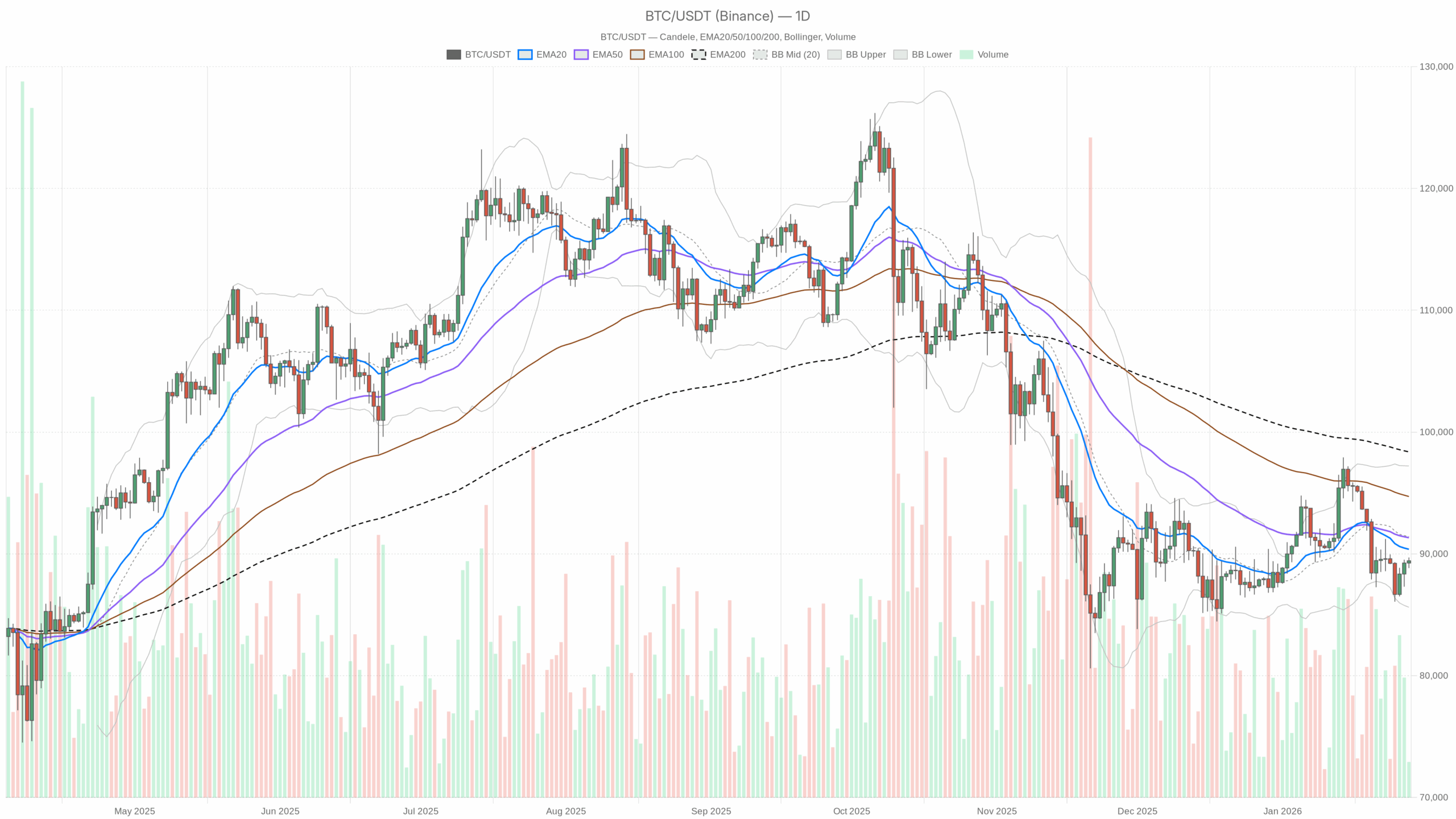

Macro Bias (Each day Chart – D1): Bearish Correction

The every day timeframe units the primary state of affairs: bearish / corrective.

EMAs (pattern construction)

On D1, BTCUSDT trades at $89,433, beneath the 20-day EMA at $90,379, the 50-day EMA at $91,328, and effectively beneath the 200-day EMA at $98,374.

That stack – value beneath 20, 50, and 200 – is traditional downtrend habits. Brief- and medium-term pattern followers are nonetheless in management on the draw back, and the long-term pattern is flattening after the parabolic run. Nonetheless, till value can reclaim no less than the 20- and 50-day EMAs, rallies are technically simply bounces inside a broader correction.

RSI 14 (momentum)

The every day RSI is at 46.1, sitting slightly below the midline.

Momentum is not overheated, however it isn’t washed out both. This can be a mid-range RSI in a downswing: sellers have the sting, however there’s room each to increase decrease and to bounce. It matches the concept of a cool-off part after a robust prior uptrend, not a panic liquidation.

MACD (pattern momentum affirmation)

Each day MACD line is at -641.6, sign at -167.3, with a damaging histogram of -474.3.

The road beneath the sign and a fats damaging histogram affirm that draw back momentum remains to be lively on the upper timeframe. Bears nonetheless have follow-through, and any short-term rally is swimming towards this backdrop till we see the histogram shrink meaningfully or a cross again up.

Bollinger Bands (volatility & positioning)

On D1, the Bollinger mid-band (20-period foundation) is at $91,420, the higher band close to $97,221, and the decrease band round $85,619. Value is at $89,433, beneath the mid-band and above the decrease band.

Bitcoin is buying and selling within the decrease half of the band vary, however not hugging the decrease band anymore. That usually alerts a cooled-off selloff: bears drove value down towards the decrease band, and now the market is making an attempt to stabilize somewhat than free-fall. Volatility remains to be sizable, however we aren’t at excessive compression or excessive enlargement right here.

ATR 14 (every day volatility)

Each day ATR sits round $2,156.

A roughly $2k every day swing remains to be giant in absolute phrases however moderately modest relative to an roughly $89k value. The market stays risky, however this isn’t the wild blow-off or crash regime. As an alternative, it’s constant directional volatility, which pattern merchants like, however place sizing must respect it.

Each day Pivot Ranges

For the present every day session, the primary pivot is at $89,323, with first resistance R1 at $89,813 and first assist S1 at $88,943.

Value is hovering virtually precisely on the pivot. That’s textbook equilibrium for the day: neither facet has pressured a transparent breakout intraday but. The primary battle strains are tight – lose S1 decisively and sellers regain momentum; reclaim R1 and we begin speaking a couple of push towards the EMA cluster above.

Intraday Image (H1 & M15): Bounce In opposition to the Larger-Timeframe Downtrend

H1 – Brief-Time period Bias: Impartial to Barely Bullish

On the 1-hour chart, BTCUSDT is buying and selling round $89,401. Right here, the construction appears completely different from the every day.

H1 EMAs

Value is at the moment above the 20-hour EMA at $88,997 and the 50-hour EMA at $88,657, however sitting slightly below the 200-hour EMA at $89,619. Regime is tagged as impartial.

Intraday, consumers have managed to get again on prime of the quick and medium EMAs, which normally marks a short-term bounce. Nonetheless, the 200-hour EMA overhead is capping value. That is typically the place counter-trend rallies stall inside an even bigger downtrend. So the H1 is making an attempt to show up, however it has not damaged the bigger ceiling but.

H1 RSI & MACD

The 1-hour RSI is at 57.8.

Momentum on H1 leans to the upside however isn’t overheated. That is the candy spot for a managed grind increased somewhat than a blow-off spike. It’s supportive for scalpers and day merchants on the lengthy facet, so long as the every day bears don’t step again in aggressively.

H1 MACD line is at 272.0, sign at 266.1, with a small constructive histogram of 5.9.

We do have a bullish configuration right here, however the histogram is barely constructive, which tells you the upside momentum is fragile. Consumers are in cost intraday, however they aren’t steamrolling shorts. It’s a tentative benefit.

H1 Bollinger Bands & ATR

On the hourly chart, the Bollinger mid-band is at $88,980, with the higher band close to $90,017 and the decrease band close to $87,942. Value is buying and selling slightly below the higher band.

Being close to the highest of the hourly band after a bounce reveals consumers have pushed the transfer so far as they moderately can on this first leg. It typically results in both a short consolidation or a shallow pullback earlier than the subsequent resolution. It doesn’t scream speedy reversal, however it does say you might be not shopping for an affordable dip on this timeframe.

H1 ATR is roughly $370.

Hourly swings of $300–$400 are vital for day merchants however regular at this value degree. It means intraday trades want room to breathe. Tight stops will get chopped up rapidly round key ranges just like the pivot and 200 EMA.

H1 Pivot Ranges

The hourly knowledge references a daily-style pivot: PP $89,502, R1 $89,603, S1 $89,300. Present value (round $89,401) is sitting between S1 and the pivot.

This reinforces the concept of a market caught in a slender resolution zone. Bulls have to reclaim and maintain above $89,500–89,600 to open up a push into $90k and past. Lose $89,300 with momentum, and the short-term bounce appears drained.

M15 – Execution Context: Brief-Time period Bullish

On the 15-minute chart, BTCUSDT can also be at $89,401, with a bullish regime printed.

M15 EMAs

Value is buying and selling above all key EMAs: the 20-EMA at $89,213, the 50-EMA at $89,082, and the 200-EMA at $88,585.

That is the cleanest uptrend construction throughout our three timeframes. For very short-term merchants, the trail of least resistance is at the moment up, with the 20-EMA as speedy dynamic assist and the 50 and 200 beneath as deeper ranges the place dip consumers would possibly step in.

M15 RSI & MACD

15-minute RSI is available in at 57.8.

Much like H1, that is bullish however not stretched. The intraday rally nonetheless has gasoline, however the simple a part of the transfer, from oversold to impartial, is probably going behind us. From right here it’s extra about whether or not consumers can maintain management.

M15 MACD line prints 72.8 versus sign at 30.9, with a constructive histogram of 41.9.

That may be a agency short-term bullish impulse. Intraday consumers have momentum on their facet. Until this begins rolling over, with the histogram shrinking after which flipping, shorting aggressively on this tiny timeframe is principally stepping in entrance of a shifting automobile.

M15 Bollinger Bands & ATR

On M15, the Bollinger mid-band is at $89,189, the higher band at $89,560, and the decrease band at $88,818. Value sits slightly below the higher band.

The native transfer is already urgent the short-term envelope. That usually results in sideways digestion or a light pullback, however in sturdy intraday tendencies, value can journey the band for some time. The hot button is the way it reacts on small dips again to the mid-band round $89,200.

M15 ATR is round $200.

Brief-term volatility is excessive sufficient that 0.2–0.3% swings can occur in just a few candles. For scalpers, that’s alternative; for overleveraged merchants, it’s a recipe for getting depraved out.

M15 Pivot Ranges

The identical pivot set applies right here: PP $89,502, R1 $89,603, S1 $89,300. On a 15-minute outlook, this zone acts as a really native battlefield.

Staying above $89,300 retains the short-term uptrend intact. Nonetheless, repeated failures beneath $89,500–89,600 would present that higher-timeframe sellers are leaning on this degree.

Market Context: Fearful Sentiment, BTC-Led Market

The broader crypto market capitalization is about $3.12T, up roughly 2.1% over 24h, with Bitcoin dominance at roughly 57.3%. Quantity is up about 6% within the final day.

So regardless of a corrective construction in BTC, cash isn’t fleeing the area; it’s rotating towards Bitcoin. Mixed with the Worry Index at 29, we’re in that acquainted zone the place buyers are nervous however nonetheless lively. Traditionally, that is the place medium-term bottoms can type, however solely as soon as value construction truly confirms it. Proper now the construction remains to be pointing to a downtrend on D1.

Placing It All Collectively: Situations

Timeframes are in stress: the every day is in a bearish correction, the 1H is making an attempt to stabilize, and the 15m is clearly bullish. That normally resolves considered one of two methods. Both the short-term power rolls over and joins the every day downtrend, or the intraday power grows right into a fuller every day mean-reversion rally.

Bullish State of affairs (Counter-Development Rally)

For bulls, the play is a continuation of the present intraday bounce right into a deeper every day retrace.

What bulls wish to see:

First, intraday, BTC must maintain above $89,300 (S1) and flip the $89,500–89,600 zone (pivot plus R1 and H1 200 EMA space) into assist. That will sign that short-term consumers should not simply scalping, they’re truly absorbing provide from higher-timeframe sellers.

Subsequent, a push towards the every day 20-day EMA at roughly $90,400 and the 50-day EMA at about $91,300 can be the logical upside extension. That space is a heavy confluence: EMAs plus the Bollinger mid-band round $91,400. If bulls can break and shut every day candles above that cluster, the character of this transfer adjustments from a dead-cat bounce to a real try and resume the bigger uptrend.

On indicators, you’d count on:

- Each day RSI pushing again above 50 and climbing.

- Each day MACD histogram shrinking in absolute worth, turning into much less damaging, then curling increased.

- Value strolling again towards the Bollinger mid-band as a substitute of residing within the decrease half.

What invalidates the bullish state of affairs?

If BTC fails to reclaim $89,500–89,600 and begins closing beneath $88,900–89,000 (round S1 on D1, and again into the decrease hourly band), the concept of a constructive bounce weakens. A swift break beneath the every day decrease band assist close to $85,600 with increasing ATR would outright kill the short-term bullish view and put bears firmly again in management.

Bearish State of affairs (Each day Downtrend Resumes)

The bearish thesis is that what we’re seeing now could be only a aid rally into resistance earlier than one other leg decrease.

What bears are searching for:

Intraday, failure across the $89,500–90,000 band is vital. If the 15m and 1H RSI begin rolling over from the high-50s towards 50 and beneath, and MACD on these timeframes flips again down, that will present momentum turning.

A clear rejection from the H1 200 EMA, close to $89,600, adopted by a break again beneath $89,000 can be the primary sturdy trace that the every day downtrend is reasserting. From there, bears might be eyeing:

- The every day assist band between the present value and the decrease Bollinger band at roughly $85,600.

- A potential volatility spike, with rising ATR, on breaks of native assist, signaling pressured unwinds somewhat than orderly profit-taking.

If promoting accelerates and value begins using the decrease every day band, the subsequent part of the correction is underway. Each day RSI drifting from the mid-40s into the high-30s would affirm that momentum has flipped firmly again to the draw back.

What invalidates the bearish state of affairs?

For bears, a robust every day shut again above the $91,000–91,500 cluster, together with the 20 and 50 EMA plus the Bollinger mid, can be a significant warning signal. That will imply the market has reclaimed the core of the prior breakdown space. Comply with-through that pushes value towards the 200-day EMA close to $98,400 would all however invalidate the near-term bearish construction and shift the narrative again to pattern continuation.

The best way to Suppose About Positioning Now

The Bitcoin value at this time setup is caught between a fearful macro temper and a still-resilient crypto complicated, with BTC dominance excessive and intraday charts hinting at a bounce.

For merchants, the hot button is to respect the timeframes:

- Brief-term individuals, resembling scalpers and day merchants, are buying and selling a bullish intraday tape, however they’re buying and selling into heavier resistance above.

- Larger-timeframe individuals are nonetheless taking a look at a corrective every day construction, the place rallies into the EMA cluster are suspect till confirmed in any other case.

Volatility is elevated however not excessive. The market can transfer a few thousand {dollars} in a day with out altering the larger image, which suggests leverage and cease placement matter greater than regular. Neither course is a layup proper now: bulls are combating the pattern, and bears are combating rising proof of dip demand.

As all the time, any technique must be sized for the chance that each eventualities above are fallacious within the quick run, particularly in a market working on excessive notional costs, a fearful sentiment backdrop, and really lively derivatives flows.

If you wish to monitor markets with skilled charting instruments and real-time knowledge, you may open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We might earn a fee at no extra value to you.

Disclaimer: This evaluation is for informational and academic functions solely and relies solely on the info supplied. It doesn’t represent funding, buying and selling, or monetary recommendation, and it shouldn’t be the idea for any funding resolution. Cryptoassets are extremely risky and carry vital threat, together with the danger of complete loss. All the time conduct your individual analysis and contemplate your threat tolerance earlier than participating in any buying and selling or investing exercise.

In abstract, value motion displays a every day corrective downtrend challenged by intraday bullish flows, with sentiment fearful however capital nonetheless rotating towards BTC somewhat than exiting the market solely.