21Shares has outlined a three-scenario worth outlook for XRP in 2026, arguing that the token is shifting from a litigation-defined commerce to at least one more and more priced on ETF-driven demand and measurable on-ledger adoption.

In a Jan. 23 analysis notice, 21Shares’ Matt Mena frames 2026 as a “defining turning level” during which XRP’s valuation turns into “anchored in institutional fundamentals” after the August 2025 settlement that ended the SEC case overhang. The agency says that decision eliminated a structural constraint that had restricted XRP’s upside “no matter underlying utility,” permitting the market to reprice to a brand new all-time excessive of $3.66 after which consolidate with the previous $2.00 ceiling performing as help.

XRP Worth Predictions For 2026

21Shares describes the post-settlement regime as a more durable setting for the asset: much less narrative optionality, extra accountability. With the authorized cloud cleared, the notice argues XRP “can not depend on courtroom hype or regulatory uncertainty to drive its valuation or excuse underperformance,” introducing a “promote the information” danger if utilization fails to scale and the market re-rates the asset on realized adoption quite than authorized aid.

Associated Studying

The agency’s view is that readability expands the addressable purchaser base and product floor space within the US “US-based establishments. Regulated funds and ETP issuers. Banks and fee firms.” In 21Shares’ telling, these channels had been beforehand constrained by compliance danger, and their re-entry units up a brand new section of worth discovery.

The second pillar is flows. 21Shares says US spot XRP ETFs have “basically rewritten” XRP’s demand profile, reaching greater than $1.3 billion in belongings underneath administration of their first month and logging a 55-day streak of consecutive inflows. The notice leans closely on a supply-demand argument, pairing ETF absorption with what it characterizes as unusually sticky retail positioning.

“Alternate reserves are at a seven-year low of 1.7 billion XRP. Institutional ETF demand is colliding with a group that refuses to promote.” That collision, the agency argues, is the “main engine” for a doubtlessly non-linear repricing, whereas additionally warning that reflexivity cuts each methods if inflows gradual.

To floor the reflexivity case, 21Shares factors to the primary yr of US Bitcoin spot ETFs as a template, citing practically $38 billion in internet inflows and a worth transfer from roughly $40,000 to $100,000 inside 12 months. The excellence, in its view, is liquidity overhead: XRP launched its ETF period at a a lot smaller market cap than Bitcoin did at its debut, implying a bigger marginal influence per greenback of internet shopping for, supplied these early seize charges persist by way of 2026.

Associated Studying

The third pillar is utility, with 21Shares positioning XRPL as “monetary plumbing” for tokenization and stablecoin settlement. The notice highlights RLUSD’s development to greater than 37,000 holders and a market cap improve of over 1,800% from $72 million to $1.38 billion in underneath a yr, alongside XRPL DeFi TVL increasing practically 100x over two years to above $100 million. It additionally factors to the Multi-Objective Tokens normal as a mechanism for establishments to difficulty RWAs with embedded metadata and compliance guidelines.

Nonetheless, 21Shares flags execution danger: progress is “evolutionary, not explosive,” and XRPL trails rivals on developer and consumer engagement, with competitors for RWA flows cited from Canton, Solana, and different ecosystems.

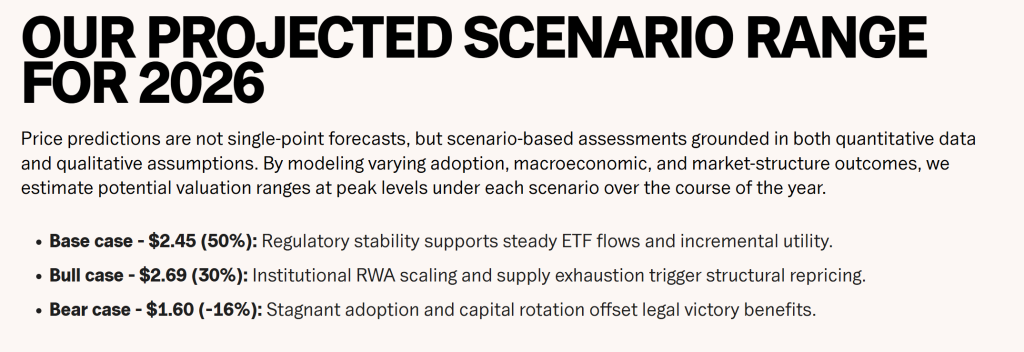

21Shares’ modeled peak ranges for 2026 put a base case at $2.45 (50% likelihood), a bull case at $2.69 (30%), and a bear case at $1.60 (implied -16%), with key swing components being sustained ETF inflows, significant tokenization volumes, and RLUSD sustaining institutional traction.

At press time, XRP traded at $1.8792.

Featured picture created with DALL.E, chart from TradingView.com