XRP worth retains operating into the identical ceiling, and we lastly know why. The main target stays locked on the $2 degree. XRP has touched it as soon as in early January 2026, reclaimed short-term development strains, and even briefly moved above it. But rallies hold failing. The actual situation isn’t whether or not XRP can attain $2. It’s whether or not the market can assist what sits slightly below it.

On the 12-hour chart, XRP trades round $1.87 and is down about 4% over the previous week. That weak point has come regardless of seen shopping for curiosity and repeated makes an attempt to reclaim key ranges. To know why these makes an attempt fail, the story has to begin with a key reclaim.

XRP’s EMA Reclaim Is the First Step, however Solely One Has Labored

On the 12-hour timeframe, an important short-term sign for XRP is the 20-period exponential shifting common. The 20-EMA tracks short-term development course. When worth reclaims it and holds with quantity, momentum often shifts increased.

Sponsored

Sponsored

XRP has reclaimed the 20-EMA a number of instances since December. Most of these makes an attempt failed, however one didn’t.

On January 1 and January 2, XRP reclaimed the 20-EMA on sturdy shopping for quantity. Extra importantly, the reclaim was adopted by higher-volume inexperienced candles, not rapid promoting. That affirmation mattered. Between January 2 and January 6, XRP rallied roughly 28%, marking the strongest transfer of the month.

That profitable reclaim reveals the EMA itself isn’t the difficulty. The problem is how the reclaim occurs.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Examine that to later makes an attempt. On December 9 and once more round December 20, XRP briefly moved above the 20-EMA, however quantity light instantly. Observe-through shopping for by no means appeared as promoting stress appeared, and the value slipped again beneath the typical. The identical sample repeated on January 28. XRP reclaimed the 20-EMA on reasonable quantity, however the subsequent periods didn’t construct on it. Promoting stress appeared.

The takeaway is straightforward. EMA reclaims want a powerful follow-up purchaser quantity. With out it, they’re short-term alerts, not development shifts. However even when quantity improves, XRP runs into one other drawback.

Sponsored

Sponsored

The Promote Wall Above the EMA Is Why Rallies Stall

As soon as the XRP worth reclaims the 20-EMA close to $1.94 (present positioning), the value would instantly transfer right into a heavy provide zone.

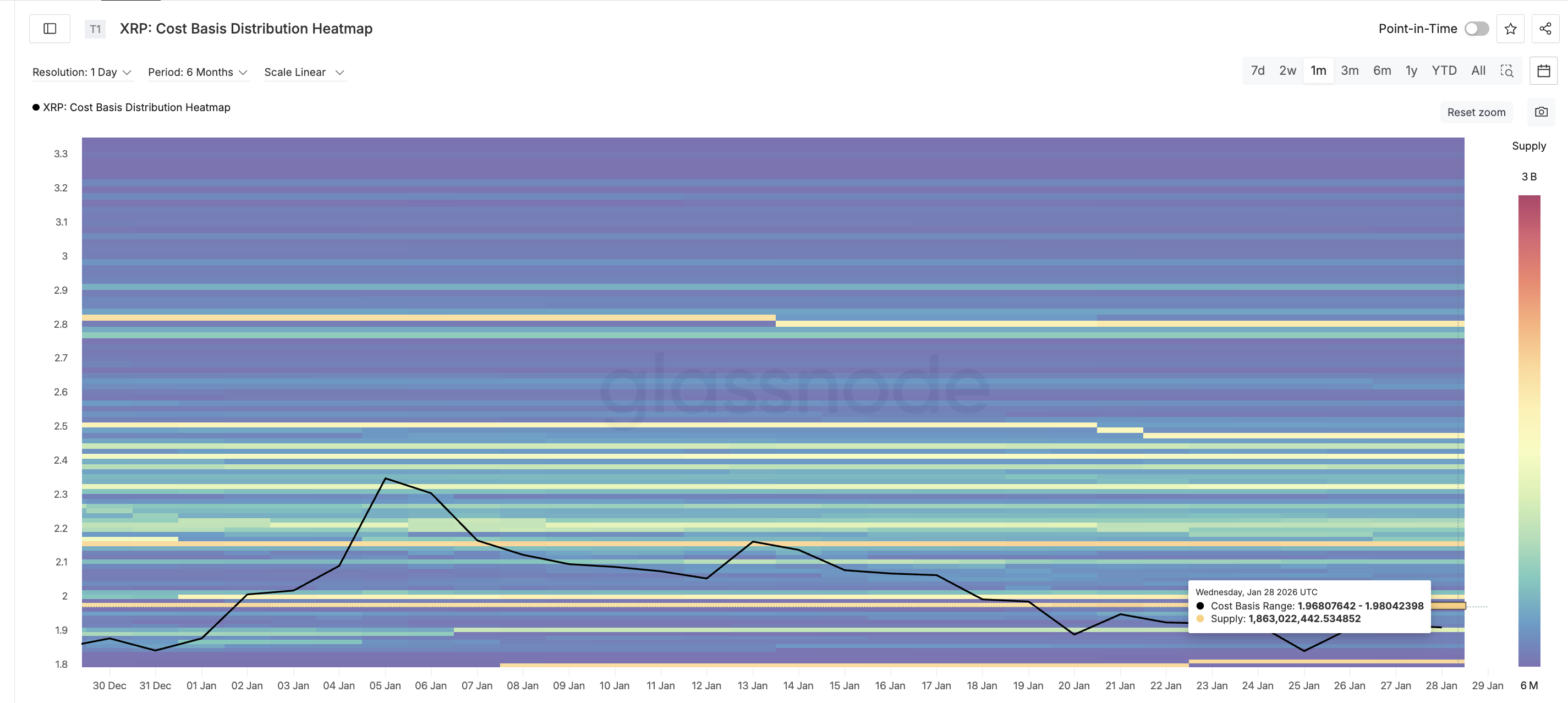

On-chain value foundation knowledge reveals a serious cluster between $1.96 and $1.98, containing roughly 1.86 billion XRP. This isn’t a psychological degree. It’s a focus of cash final purchased in that vary. When worth returns there, many holders promote to interrupt even or cut back publicity.

This is the reason reclaiming the EMA alone isn’t sufficient. The EMA reclaim pushes the value straight into this provide wall. If shopping for stress isn’t sturdy sufficient to soak up it, rallies would fail even after the reclaim.

Early January reveals the distinction. Throughout the January 1–6 rally, alternate outflows surged, indicating cash have been leaving exchanges quite than being despatched there to promote.

Outflows climbed from roughly 8.9 million XRP to about 38.5 million XRP. That sustained demand helped the value transfer via the provision cluster. Though the outflow was a lot decrease than the wall’s dimension, the over 330% surge in outflow suggests the holders could not have offered on the wall.

Sponsored

Sponsored

Current makes an attempt lack that assist and conviction. On January 28, alternate outflows briefly rose to about 18.1 million XRP, serving to the XRP worth push increased intraday. However by January 29, outflows fell again close to 5.4 million XRP.

This explains why XRP retains stalling slightly below $2. The market isn’t rejecting the quantity. It’s struggling to indicate the conviction wanted to soak up the provision behind it.

Whales Are Shopping for, however Demand Nonetheless Falls Quick

Whale conduct provides nuance, but it surely doesn’t change the conclusion.

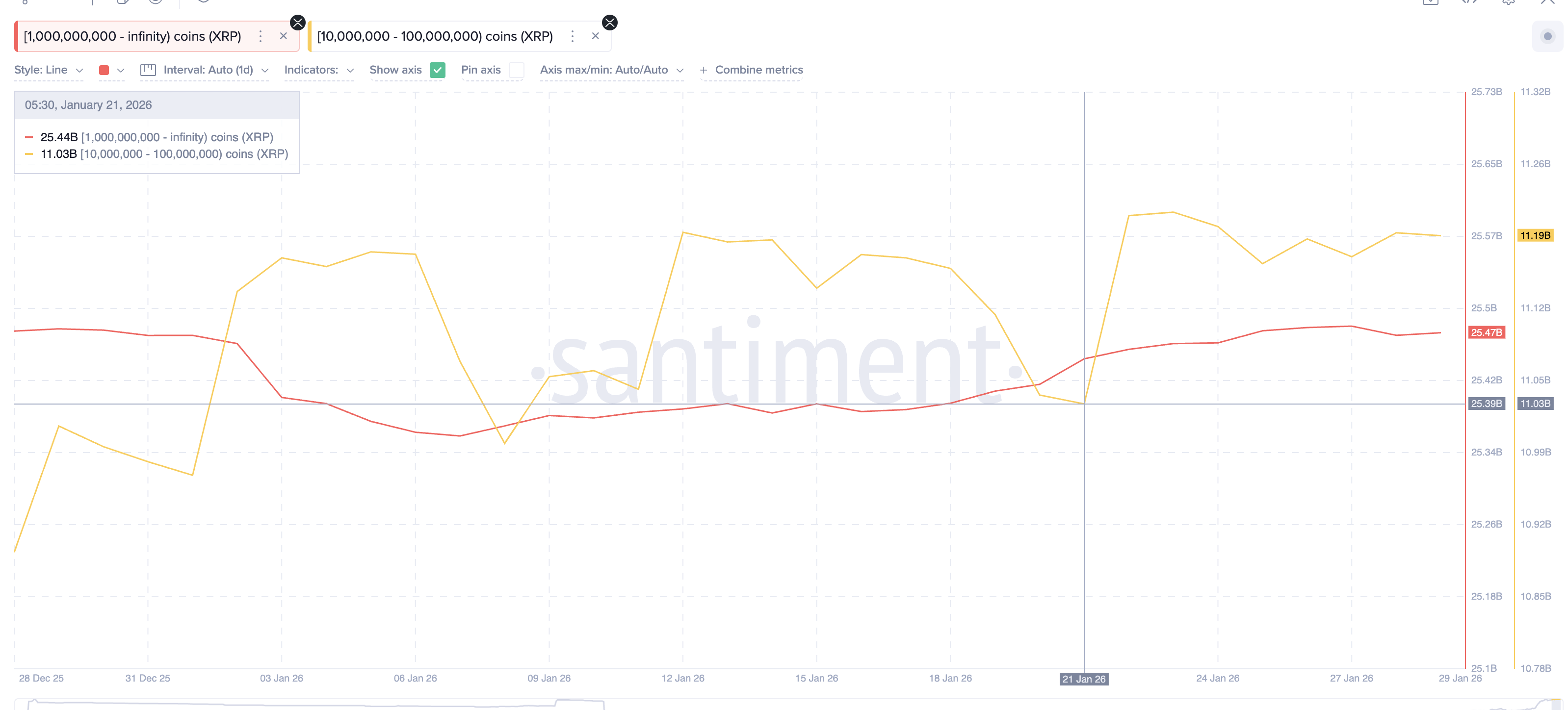

Wallets holding 10 million to 100 million XRP elevated their balances from roughly 11.03 billion to 11.19 billion XRP since January 21, virtually 160 million. That reveals accumulation. Bigger wallets holding over 1 billion XRP have proven blended conduct, with holdings going up by a marginal 30 million.

Sponsored

Sponsored

This tells us whales are positioning, not forcing worth.

When in comparison with a 1.86 billion XRP promote wall, present whale accumulation and spot demand should not massive sufficient to overwhelm provide. Shopping for exists, however it’s uneven and short-lived. With out sustained alternate outflows, whale addition, and quantity enlargement, the wall stays intact.

The Ranges That Determine Whether or not XRP Value Breaks or Fails Once more

The roadmap is now clear.

- $1.94–$1.95: First step. A clear reclaim places XRP again above the 20-EMA.

- $1.99: The actual set off. A powerful 12-hour shut above this degree would break the provision cluster.

- Above $1.99, follow-through turns into extra possible, because the promote wall thins out, focusing on $2.04 and even $2.19.

- On the draw back, a 12-hour shut beneath $1.80 would invalidate the setup and sign renewed weak point.

XRP doesn’t must show it will possibly contact $2. It has executed that already. It wants sustained shopping for sturdy sufficient to soak up 1.86 billion XRP sitting slightly below that degree. Till that occurs, each rebound will hold operating into the identical wall.