The next is a visitor submit from Shane Neagle, Editor In Chief from The Tokenist.

With US presidential elections concluded, Bitcoin has been hitting new all-time highs practically on a weekly foundation throughout November. Having reached nearly $100,000 threshold on November twenty second, Bitcoin reinvigorated the altcoin market, now holding a $1.49 trillion market cap.

The frequent knowledge would recommend that altcoins will observe Bitcoin’s lead, as prior tendencies have proven. However what forms of altcoins ought to see important efficiency? Extra importantly, are there new fundamentals in play to contemplate this time?

First, let’s revisit the connection between Bitcoin and altcoins. It’s extra necessary than one would assume.

Why Does Bitcoin Lead the Crypto Market?

From the launch of Bitcoin mainnet in January 2009, to Bitcoin value breaching $10k threshold in November 2017, it took practically 9 years. Though Bitcoin step by step grew to become a family title, it nonetheless retained the standing of a novel, extremely speculative asset. That is comprehensible in a central banking system, the place cash is synonymous with authorities edicts – fiat (by decree) cash.

Due to this fact, perception in authorities edicts, and authorities’s software of drive, is what offers cash its worth. This has been the habituated frequent knowledge for generations. Furthermore, there may be the query of medium. If Bitcoin shouldn’t be a bodily paper token issued by a central financial institution, however digital, how can or not it’s trusted?

Blockchain fans already know the reply. The central financial institution, the Federal Reserve, additionally depends on an digital ledger, which may manifest its accounting as bodily tokens (paper cash) however not essentially. In distinction, the whole level of Bitcoin’s ledger is that its accounting is fortified towards arbitrary dilution.

That makes Bitcoin pseudo-digital. Its accounting is enforced by computing energy through its proof-of-work algorithm, which erects a bridge between the digital and bodily. The bodily being the power and {hardware} property wanted for computing energy. Consequently, Bitcoin units the altcoin market:

- As the primary cryptocurrency, Bitcoin’s sound cash facet is simple to know.

- Because the Bitcoin community’s computing energy grows, holders are extra assured within the inviolability of Bitcoin’s accounting (distributed ledger).

- As new altcoins seem, they’re traded towards Bitcoin, it being the market benchmark tethered to physicality of power and {hardware}.

- In occasions of uncertainty of altcoins’ valuations, holders revert to Bitcoin as a safer asset.

- Likewise, in occasions of rising Bitcoin value, holders spill over to small cap altcoins as a result of the revenue potential is bigger. In any case, it’s harder to maneuver a big market weight that Bitcoin holds.

Inversely, the massive Bitcoin market cap serves as a psychological cushion, at all times prepared to soak up fleeing altcoin capital in occasions of misery. However in a extremely nerve-racking panorama, that capital might flee Bitcoin itself.

The issue is, if sufficient altcoin capital spills over, the whole crypto market goes down as a result of many view Bitcoin as simply one other cryptocurrency, albeit one which has the primary mover benefit.

Altcoin-Bitcoin Pullback

The connection between the Federal Reserve and the crypto market is intrinsic. When the central financial institution elevated its stability sheet in extra of $6 trillion, between 2020 and 2022, the bloated liquidity spilled over into crypto property, prompting merchants to discover well-liked buying and selling methods to maximise alternatives.

Beforehand, crypto liquidity ballooned throughout the Preliminary Coin Providing (ICO) period, having peaked between 2017 and 2018. This period birthed high altcoins on the time; Ethereum (ETH), Cardano (ADA), EOS (EOS), Tezos (XTZ), Stellar (XLM), Algorand (ALGO), NEO (NEO), Filecoin (FIL), Tron (TRX), Chainlink (LINK), and lots of others.

Nonetheless, all liquidity is restricted. The growth of the altcoin market ate away Bitcoin’s market cap dominance. Merchants typically flip to buying and selling rooms throughout such pivotal shifts to share methods and insights into navigating market adjustments successfully.

Though the ICO growth spawned dozens of altcoins, additionally it is the case that most had been fraudulent or lifeless within the water. Consequently, Bitcoin regained some misplaced floor till the Fed’s unprecedented financial intervention throughout the pandemic narrative.

After the Fed’s cash printing spree, Bitcoin dominance shrank additional. Following the over-leveraged Terra (LUNA) collapse, tied to algorithmic stablecoin TerraUSD, the altcoin market suffered an estimated $60 billion loss.

However as a result of high altcoins already carried out higher than Bitcoin, resulting from their decrease market caps and better revenue potential, the speculative drive remained. This decreased Bitcoin’s dominance additional, however solely briefly.

In a basic domino toppling situation, by the top of 2022, the Fed-pulled liquidity rug ended up triggering the collapse of the over-leveraged FTX alternate, stunning the whole crypto market. Bitcoin was engulfed within the selloff panic, having dropped to its pre-2020 value stage of $16.5k.

Nonetheless, as the massive query mark loomed over the whole crypto market, Bitcoin began to get well. The US regional banking disaster, within the spring of 2023, helped the case for Bitcoin’s fundamentals. The approval of Bitcoin ETFs in early 2024 and the 4th halving, additional laid the groundwork for latest new all-time highs.

However how has the altcoin market advanced alongside Bitcoin?

Memecoin Dominance Is Telling

Many of the “old-guard” altcoins centered on blockchain infrastructure, decentralized finance (DeFi), and different efforts to tokenize human exercise through sensible contracts. Nonetheless, the crypto wipeout throughout 2022 seems to have left psychological scarring.

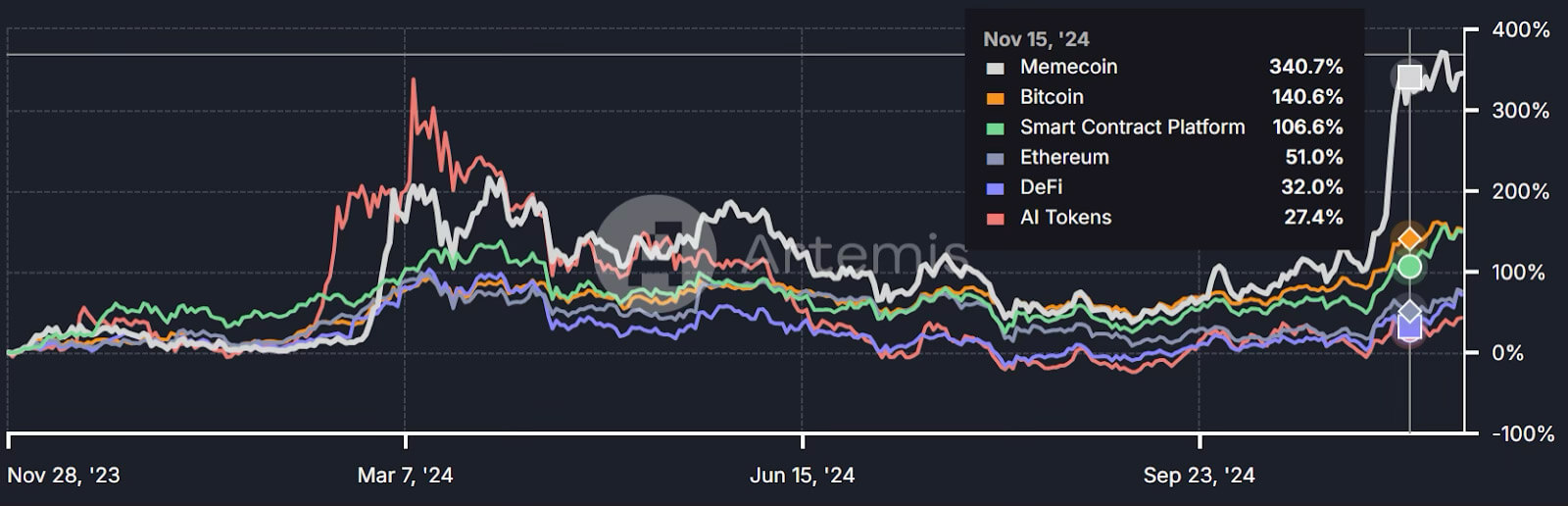

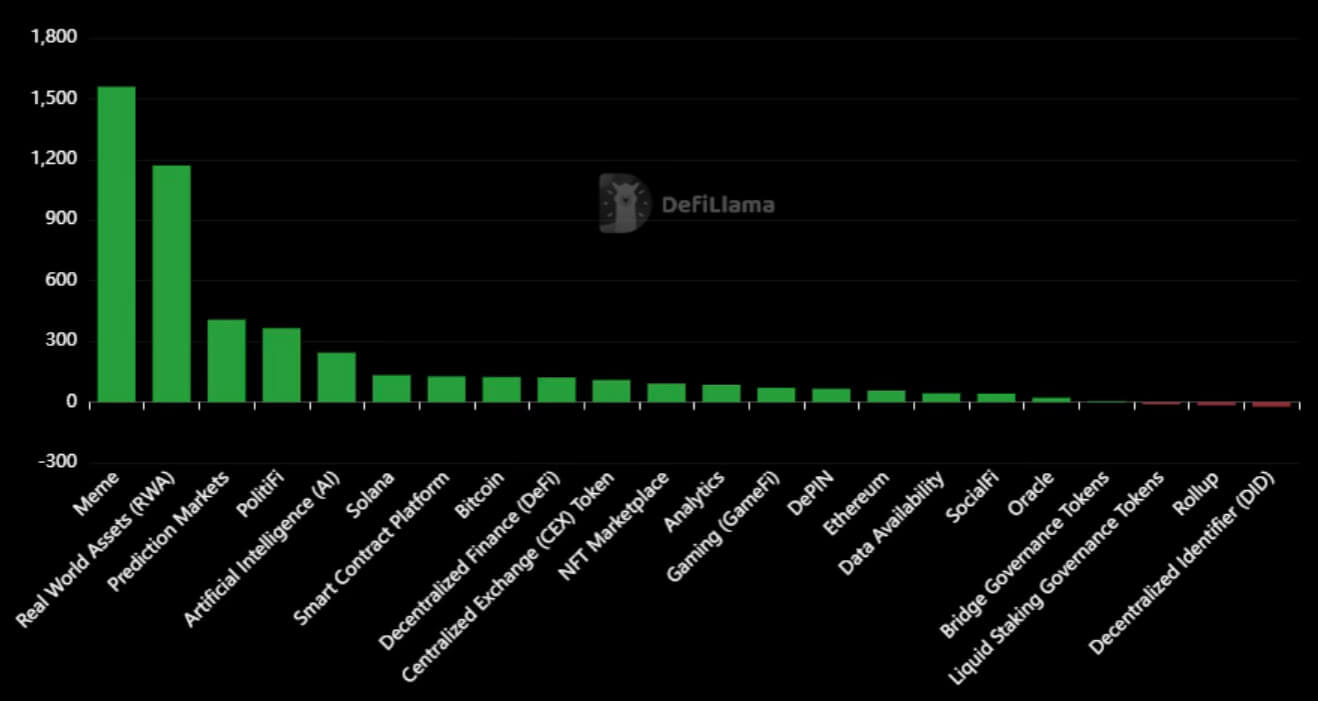

The lofty narratives of the earlier cycle had been largely outdated by hype-gambling by means of memecoins. Artemis knowledge reveals that memecoins have dominated the crypto market, with solely AI tokens surpassing their efficiency in early 2024.

By mid-November, memecoins returned 6x the worth than the crypto market common.

This coincides with Donald Trump securing his 2nd time period within the Oval Workplace. In flip, this factors to crypto holders getting accustomed to social media-driven hype cycles round communities quite than altcoin fundamentals.

Likewise, the AI revolution continues to be going sturdy. Aside from varied “ChatGPT with make-up” software program and suppliers providing hosted GPU servers, AI cryptos are additionally a scorching matter, with the much-awaited launch of AI brokers anticipated to spurn one other bullish interval.

Kaito AI, market insights platform, decided that one in 4 crypto buyers prioritize memecoin discourse. In different phrases, focus is extra on short-term earnings quite than long-term return of worth. This fits extra dynamic merchants who lookup crypto tendencies each day.

Narrative-wise, the next altcoin classes carried out forward of Bitcoin year-to-date: meme, actual world property (RWA), prediction markets, PolitiFi, AI, Solana and sensible contract platforms.

In complete, there are 15,713 cryptocurrencies in circulation, tracked throughout 1,178 exchanges and 494 classes. Such an unlimited quantity of digital property, throughout so many classes, creates a frightening psychological load to filter the wheat from the chaff.

Conversely, the recognition of memecoins is one manifestation of dealing with that psychological load. In any case, their simplicity and virality is itself a filtering mechanism. However one other coping manifestation is the reversion to the “outdated guard” altcoins.

Older Altcoins Return to a Friendlier Scene

The 2022 collapse of crypto costs was so extreme that it grew to become pointless to promote altcoins at such toppled costs. Consequently, it’s truthful to say that many losses had been unrealized, awaiting the brand new bullrun.

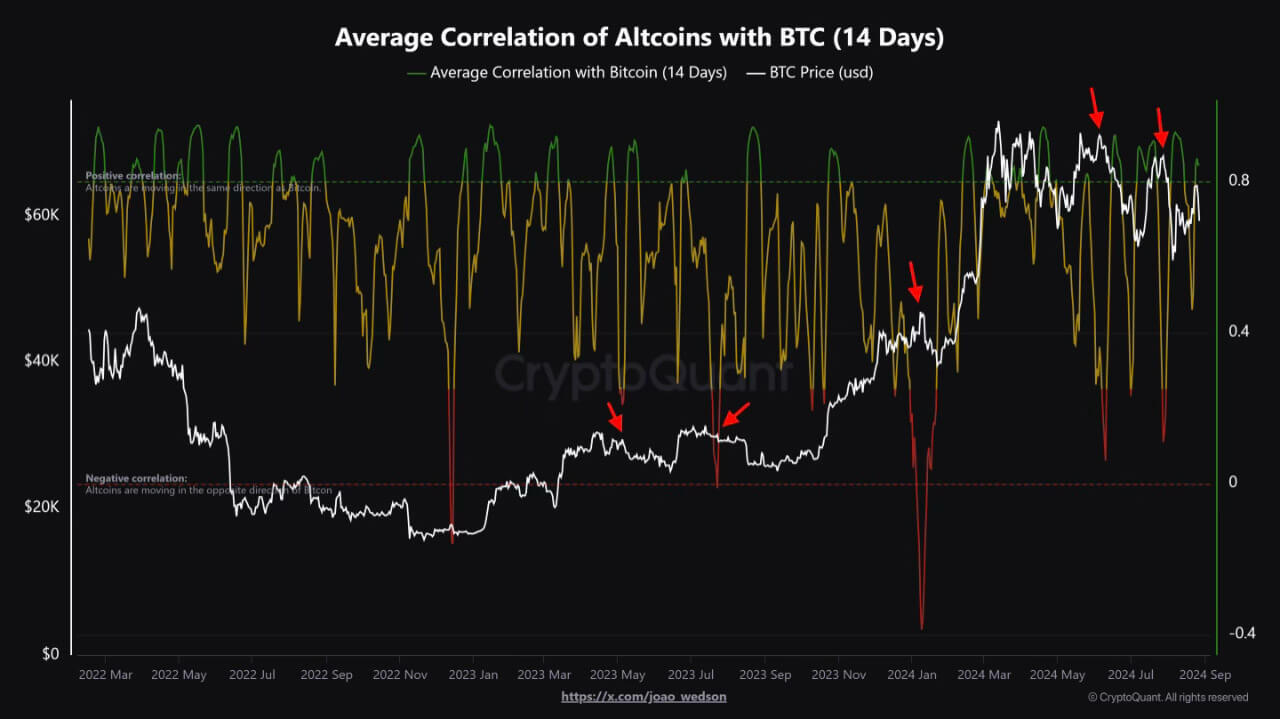

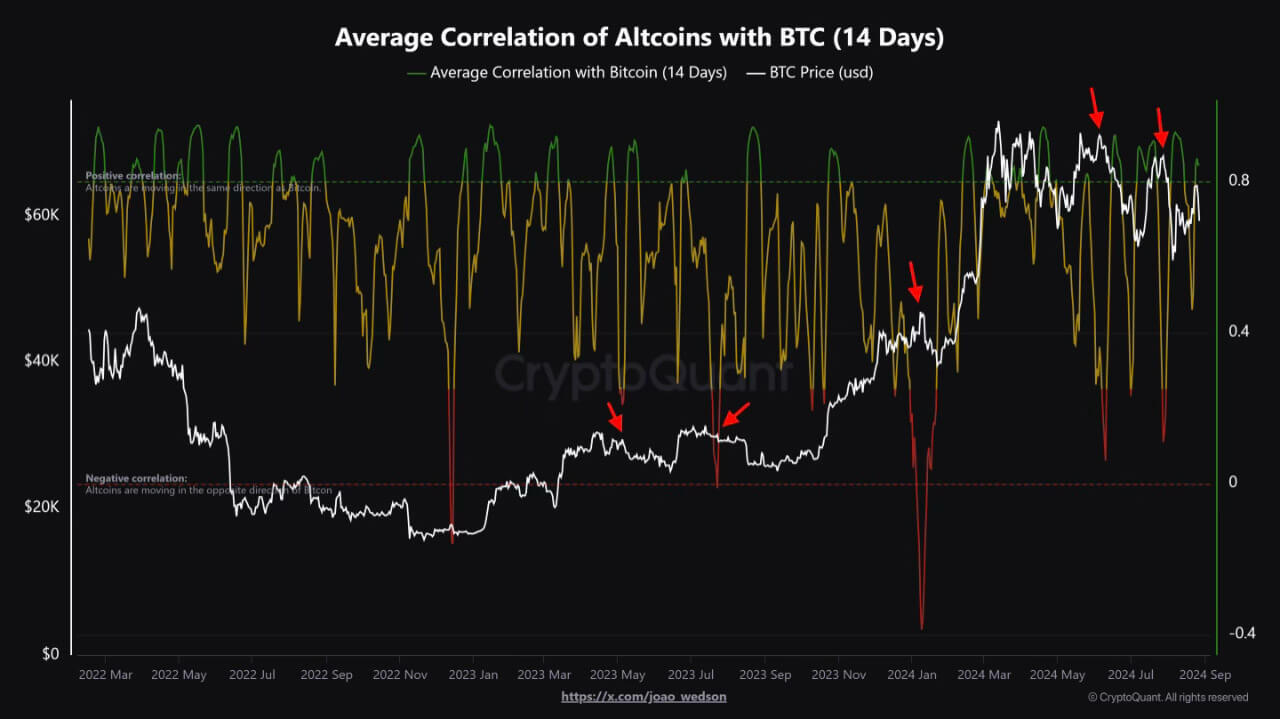

It seems that Bitcoin’s newest bullrun is triggering that cycle. On the finish of August, Joao Wedson of CryptoQuant noticed that the altcoin market is as soon as once more aligning with Bitcoin.

Inside the high 20 altcoins (excluding stablecoins) within the earlier cycle, throughout the peak of the November 2021 bullrun, 11 have remained. Though most of their costs are nonetheless distant from the prior tops, they’ve the potential to reclaim floor underneath the belief that that is simply the beginning of a brand new bullrun.

This may very well be the case if extra exchange-traded funds (ETFs) are permitted, which spurred Bitcoin to rally and acquire larger floor earlier within the yr. Working example, NYSE Arca lately filed for Bitwise 10 Crypto Index Fund, together with the next cash:

| Portfolio Asset | Image | Weight |

|---|---|---|

| Bitcoin | BTC | 75.10% |

| Ethereum | ETH | 16.50% |

| Solana | SOL | 4.30% |

| XRP | XRP | 1.50% |

| Cardano | ADA | 0.70% |

| Avalanche | AVAX | 0.60% |

| Chainlink | LINK | 0.40% |

| Bitcoin Money | BCH | 0.40% |

| Polkadot | DOT | 0.30% |

| Uniswap | UNI | 0.30% |

Curiously, the load of Bitcoin within the index is way higher than present Bitcoin dominance. As soon as once more, this factors to the crypto dilution downside. Regardless of altcoins being less expensive, there are such a lot of of them that it’s troublesome to gauge their truthful worth long-term.

Likewise, their shortage shouldn’t be assured. As extra centralized initiatives, their inflation fee may very well be a topic of change. As an example, Solana’s present inflation fee of SOL tokens is 4.886% whereas the long-term proposition is 1.5%.

Nonetheless, now that the anti-crypto SEC Chair is on the best way out, whereas the purportedly crypto-friendly Trump admin is incoming, the crypto market is more likely to deepen its liquidity pool. Moreover, the latest verdict that sanction towards Twister Money was illegal is more likely to have extensive reaching implications.

The court docket successfully acknowledged that dApps are a brand new kind of asset, missing sanctionable possession as a sensible contract code. To place it otherwise, the court docket reinstated frequent sense that open-source can’t be property.

The Backside Line

Even with historic cash provide increase, liquidity is finite. Bitcoin managed to seize most crypto liquidity, because it pushed a wholly completely different method of viewing cash. This financial potential spurred numerous altcoins into existence, increasing the utility of sensible contracts.

However as an alternative of growth, the crypto market underwent constriction resulting from large fraud and over-leverage, flattening Bitcoin with it. In a cleaner market and extra bullish regulatory panorama, Bitcoin is now poised to set off a brand new altcoin bullrun.

Amid the daunting altcoin numerosity, 1st gen altcoins resurfaced, trying to anchor worth to established familiarity.