Bitcoin and Ethereum’s weak point displays deleveraging and market construction, not a breakdown in long-term fundamentals.

Market analyst Garrett has provided his evaluation of why blue-chip crypto cash have lagged treasured metals and different danger belongings. Transferring away from widespread short-term worth evaluation, the analyst pointed to deeper structural market forces as the explanation for this development. In keeping with him, this disparity is pushed by market narratives slightly than the belongings’ fundamentals.

Garrett Says Bitcoin and Ethereum Lag Replicate Crypto Market Cycles, Not Weak Fundamentals

Merchants have been left annoyed by the motion of high crypto belongings, as many banked on them to trace rallies in shares and commodities. Garrett argues that present situations replicate a standard section inside an extended cycle slightly than a breakdown of core values.

A pointy decline that started final October triggered important losses for leveraged merchants, notably retail members. Within the aftermath of this occasion, danger urge for food dropped as heavy liquidations triggered a defensive market sentiment.

https://t.co/UuUDJZ962Y

— Garrett (@GarrettBullish) January 29, 2026

Curiously, capital rotated into Al-linked shares throughout Asia and the US. On the similar time, the concern drove traders to treasured metals like gold and silver. Retail traders, who nonetheless dominate crypto buying and selling, shifted funds into these markets as an alternative of digital belongings.

Garrett defined that crypto belongings additionally face boundaries that different asset courses don’t encounter. As an illustration, transferring funds between decentralized and conventional finance into digital belongings stays topic to regulatory and operational constraints. And this typically impacts customers’ belief.

Operationally, shares, commodities, and FX can all be traded from a single conventional brokerage account. Crypto often requires separate exchanges, wallets, and further setup, making it much less handy to maneuver cash out and in.

Institutional participation in crypto stays restricted, as many merchants lack sturdy analytical frameworks. And as such, this enables exchanges, market makers, and speculative funds to form sentiment. On the similar time, concepts just like the “four-year cycle” or seasonal curses proceed to unfold regardless of weak information backing.

In the meantime, easy explanations typically entice consideration. For instance, some crypto members attribute Bitcoin worth actions to forex actions, even when no deeper evaluation helps such a connection.

Garrett Rejects Bear Case as Bitcoin and Ethereum Maintain Lengthy-Time period Roles

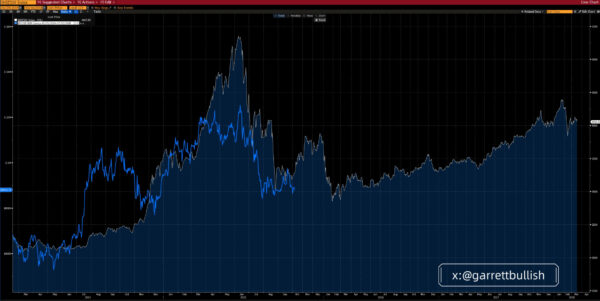

Bitcoin and Ethereum have lagged most main belongings over the previous three years, with Ethereum performing the worst throughout that interval. When stretched throughout a six-year timeframe, the market motion tells a special story. Each belongings have outperformed most markets since March 2020, with Ethereum main.

Garrett argues that short-term weak point displays imply reversion inside an extended cycle and ignoring time horizon results in flawed conclusions.

The analysts pointed to an identical sample in silver, which ranked among the many weakest danger belongings earlier than final 12 months’s quick squeeze. Now, the steel leads on a three-year foundation, exhibiting that rotation slightly than failure explains the transfer.

In keeping with the analyst, long-term underperformance is troublesome to justify so long as Bitcoin retains its store-of-value position and Ethereum stays tied to AI progress and real-world asset use.

Analyst Factors to China 2015 Playbook as Crypto Enters Late Deleveraging Stage

Garrett compares present crypto situations with China’s A-share market in 2015. Again then, a leverage-fueled bull market collapsed right into a basic A–B–C decline. After the ultimate leg, costs moved sideways for months earlier than a multi-year restoration.

Bitcoin and broader crypto indexes present related patterns in construction and timing. Shared traits embody excessive leverage, sharp volatility, bubble-driven peaks, repeated liquidations, and fading quantity. Futures markets now present contango, mirrored in reductions for crypto-linked equities reminiscent of MSTR.

Picture Supply: X/Garrett

A number of macro elements are bettering:

- Regulatory is advancing by measures just like the Readability Act.

- Businesses such because the SEC and CFTC help onchain fairness buying and selling.

- Financial coverage is easing by price cuts and liquidity help.

- Expectations for future central financial institution management are turning extra dovish.

- Valuations throughout crypto stay far under prior peaks.

Bitcoin and Ethereum Present Secure-Haven Traits Regardless of Market Volatility

Garrett rejects the view that Bitcoin and Ethereum behave like pure danger belongings, explaining their failure to comply with fairness rallies. Threat belongings have a tendency to maneuver sharply and react strongly to investor sentiment, which applies to shares, metals, and crypto.

Nevertheless, Bitcoin and Ether additionally present safe-haven traits at occasions. Resulting from their decentralized nature, these belongings can function exterior conventional methods during times of geopolitical stress.

As per the professional, unfavourable headlines typically weigh extra closely on crypto than on different markets, with commerce or navy dangers blamed for weak point even when different belongings ignore them. This creates a spot the place digital belongings fall shortly on unhealthy information however reply slowly when constructive developments emerge.