- Dogecoin is testing a long-term trendline after breaking beneath $0.12

- ETF inflows have stalled fully, leaving DOGE depending on retail flows

- Persistent spot outflows and weak momentum preserve draw back dangers in focus

Dogecoin is buying and selling round $0.1128 right now after slipping beneath the $0.12 mark and drifting right into a check of a long-term trendline that has held since mid-2024. The transfer feels heavy, not dramatic, simply persistent. With ETF demand stalling and spot outflows persevering with, DOGE continues to be lacking a transparent catalyst to interrupt months of regular promoting stress.

Thus far, patrons haven’t stepped in with a lot conviction. Worth is hovering, ready, and the longer it stays right here, the extra fragile the construction begins to really feel.

ETF Demand By no means Actually Reveals Up

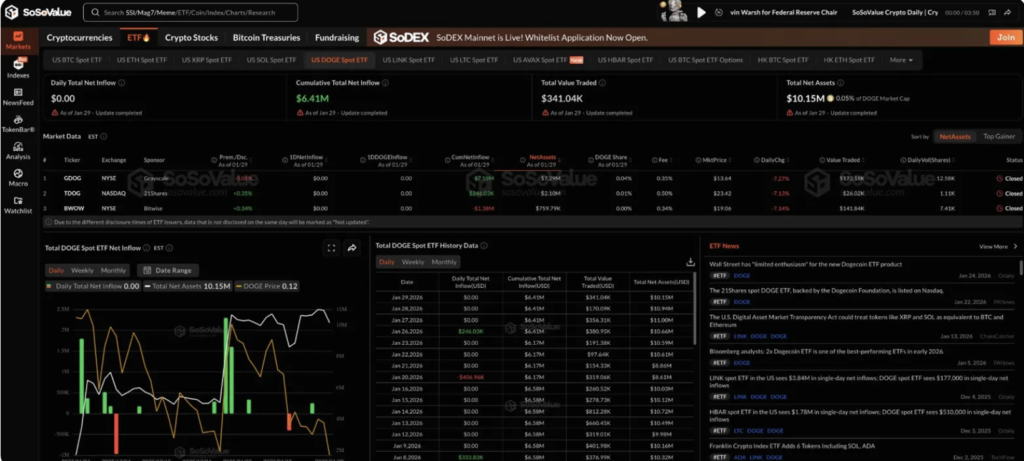

The long-anticipated Dogecoin ETF narrative hasn’t performed out the way in which bulls hoped. Knowledge from SoSoValue reveals zero inflows throughout all three DOGE spot ETFs on January 29, leaving whole internet belongings caught at roughly $10.15 million. Since launch, cumulative inflows sit at simply $6.41 million, a small quantity by virtually any comparability.

Different altcoin ETFs inform a really totally different story. XRP spot ETFs have pulled in round $1.26 billion, Solana funds roughly $884 million, and even Chainlink ETFs, a a lot smaller market, have gathered $73 million with belongings beneath administration close to $86 million. In opposition to that backdrop, DOGE stands out, and never in a great way.

The dearth of institutional participation retains Dogecoin closely reliant on retail sentiment and spot buying and selling. With out ETF-driven demand, worth has little assist when promoting stress reveals up, and currently, it has.

Spot Outflows Sign Ongoing Distribution

On the spot aspect, Coinglass knowledge reveals internet outflows of about $10.88 million on January 30 alone. That continues a broader distribution pattern that’s been in place for a lot of the final two months. Quite than accumulating dips, many holders seem like trimming publicity, slowly however constantly.

Dogecoin has additionally lacked a story spark. The meme coin rally that carried momentum into late 2024 has light, and Elon Musk, as soon as a dependable supply of sudden volatility, has been notably quiet on DOGE. With out that spotlight, and with out power throughout the broader crypto market, sellers have largely dictated the tape.

Lengthy-Time period Trendline Check Raises the Stakes

Technically, the image stays tilted to the draw back. On the day by day chart, DOGE trades beneath all main EMAs, with bearish construction intact. The 20-day EMA sits close to $0.1268, the 50-day at $0.1347, the 100-day round $0.1498, and the 200-day close to $0.1708. The Supertrend indicator additionally stays bearish, hovering round $0.1344.

Worth is now urgent towards an ascending trendline drawn from the July 2024 lows close to $0.09. This line has held by means of a number of pullbacks, appearing as a quiet anchor for the broader construction. A clear break beneath it could mark a shift from consolidation right into a extra decisive breakdown. In the meantime, a descending trendline from September 2024 continues to cap rallies, compressing worth right into a narrowing wedge that’s approaching its decision level.

Brief-Time period Momentum Affords Little Aid

Zooming into intraday motion, the weak point is extra apparent. On the 30-minute chart, DOGE has printed decrease highs since January 28, with every bounce rejected alongside a descending trendline. The most recent push despatched worth beneath $0.1130, holding stress firmly on the draw back.

RSI sits close to 31.3, flirting with oversold territory however not fairly there but. MACD stays detrimental, and the histogram continues to indicate bearish momentum fairly than exhaustion. Rapid resistance rests close to $0.1145 alongside the intraday trendline, whereas assist sits round $0.1120. Beneath that, the long-term trendline turns into the ultimate line of protection earlier than deeper draw back opens up.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.