- Chainlink broke under its $12–$15 vary regardless of ETF inflows and new partnerships

- Institutional demand stays regular, however sellers nonetheless management short-term worth motion

- Oversold situations might spark bounces, although construction stays firmly bearish

Chainlink is buying and selling round $10.83 as we speak after slipping under a consolidation vary that held for practically two months between $12 and $15. The breakdown has shocked some merchants, particularly given the regular stream of constructive developments across the challenge. ETF inflows are nonetheless coming in, and a brand new institutional partnership was introduced this week, but worth retains grinding decrease.

That disconnect between fundamentals and worth motion is changing into tougher to disregard. For now, sellers are clearly in management, even because the long-term narrative continues to strengthen within the background.

Turtle Partnership Provides Utility, Not Momentum

On Wednesday, Turtle introduced a strategic partnership with Chainlink geared toward bringing institutional liquidity absolutely on-chain. Below the settlement, Chainlink’s CCIP and Information Feeds change into required infrastructure for Turtle’s liquidity stack, successfully embedding LINK into cross-chain capital market flows.

Turtle at present connects greater than 410,000 wallets and works with a whole bunch of institutional liquidity suppliers throughout a number of ecosystems. The partnership deepens Chainlink’s position in pricing, danger modeling, and cross-chain rebalancing for institutional dealflow. Michael Mendes, Head of DeFi at Chainlink Labs, described the transfer as a serious step towards defining how liquidity strikes throughout on-chain markets.

Regardless of that, the market barely reacted. Worth continued decrease, suggesting merchants stay targeted on construction slightly than headlines, no less than for now.

ETF Inflows Keep Optimistic as Spot Worth Drops

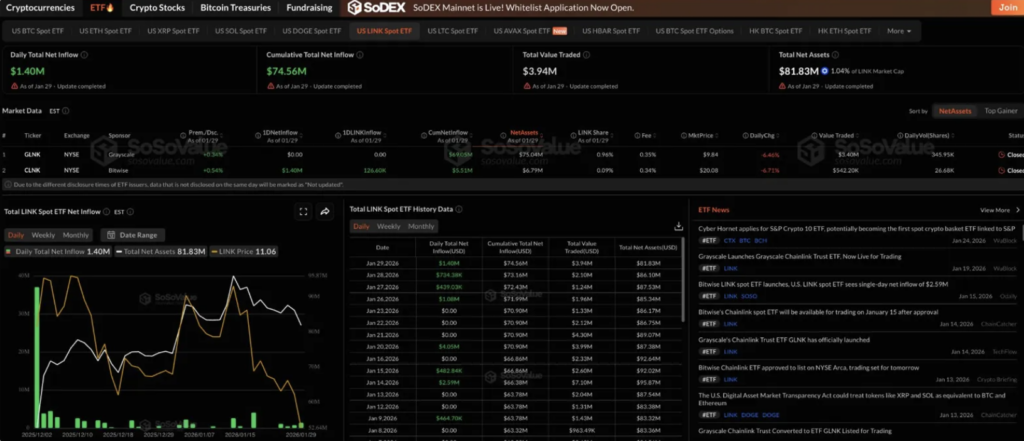

ETF information provides one other layer to the divergence. Chainlink spot ETFs recorded $1.4 million in internet inflows on January 29, pushing cumulative inflows to $74.56 million. Complete internet property now sit round $81.83 million, with each Grayscale and Bitwise funds persevering with to draw institutional capital.

Curiously, LINK ETFs now maintain practically ten instances the property underneath administration of DOGE ETFs, highlighting stronger institutional conviction in Chainlink’s utility-driven thesis in comparison with meme-based publicity. Even so, ETF demand has not translated into rapid spot worth help, a reminder that flows and worth don’t at all times transfer in sync.

Vary Breakdown Shifts the Technical Image

From a technical standpoint, the injury is obvious. On the day by day chart, LINK trades under all 4 main EMAs, confirming a bearish construction. The 20-day EMA sits close to $12.26, adopted by the 50-day at $12.91, the 100-day at $14.09, and the 200-day close to $15.45. That stacked resistance overhead makes any restoration try troublesome.

The December–January vary between $12 and $15 has now damaged decisively. Worth failed a number of instances to clear the $15 space earlier than rolling over, and the lack of $12 help signaled a shift in management towards sellers. RSI has dipped to round 29.8, coming into oversold territory for the primary time since November. Whereas that may result in short-term bounces, it doesn’t assure a reversal by itself.

Hourly Chart Confirms Persistent Promoting Stress

Zooming into the hourly timeframe, the downtrend appears orderly however relentless. LINK has been making decrease highs for the reason that January 18 peak close to $14, with every bounce offered into. The Parabolic SAR stays bearish round $11.09, and worth continues to commerce under session VWAP close to $10.85.

Rapid help sits close to the decrease VWAP band at $10.76. Worth briefly depraved all the way down to $10.62 earlier within the session earlier than bouncing, hinting at some demand across the $10.60 space. Nonetheless, the regular slide from $14 to roughly $10.80 over lower than two weeks displays sustained distribution slightly than a single panic transfer.

Till LINK can reclaim damaged ranges and present energy above the previous vary, worth motion stays weak, even with robust fundamentals quietly constructing beneath.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.