- Solana controls a disproportionately giant share of DeFi relative to its market cap

- Quick-term value construction stays pressured beneath the $120 degree

- Lengthy-term charts counsel accumulation fairly than development breakdown

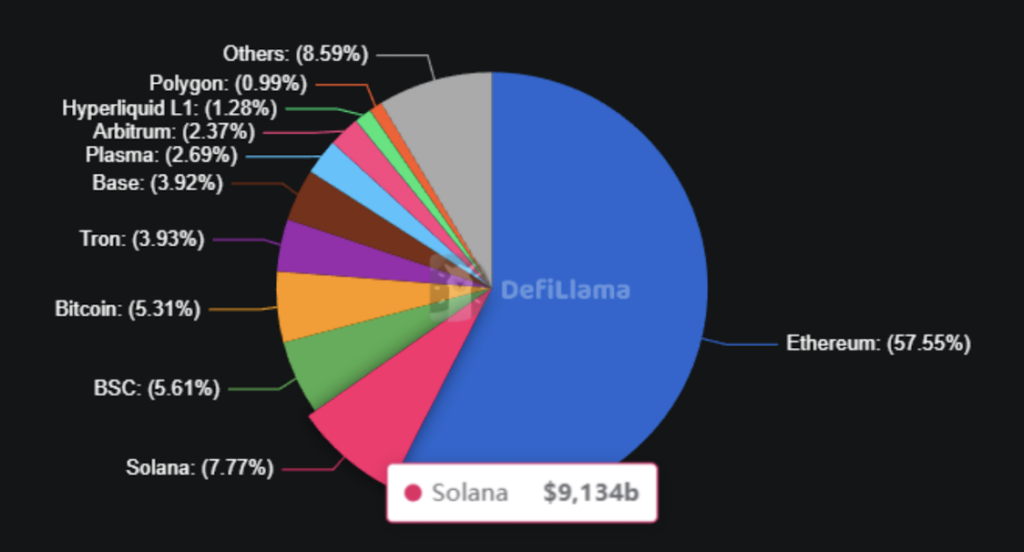

Solana continues to punch nicely above its weight in decentralized finance, whilst value motion stays beneath stress. The community now ranks because the second-largest blockchain by DeFi whole worth locked, holding roughly $9.1 billion, or about 7.7% of all capital deployed throughout DeFi. What makes that stand out is that Solana represents solely round 2.32% of the full crypto market cap.

That hole issues. It suggests Solana instructions greater than 3 times the DeFi share relative to its market worth, pointing to actual utilization fairly than passive holding. Capital isn’t simply sitting there, it’s getting used, moved, and redeployed on-chain, which retains demand lively even when value cools off.

SOL Value Slips, however Participation Stays Excessive

On the time of writing, SOL is buying and selling close to $116.54 after dipping about 1.08% over the previous 24 hours. On the week, losses add as much as greater than 9%, which hasn’t felt nice for short-term holders. Nonetheless, each day buying and selling quantity stays elevated above $7.3 billion, an indication that curiosity hasn’t vanished, even when sentiment feels shaky.

With roughly 570 million SOL in circulation, Solana’s market cap sits close to $66.1 billion. The latest decline appears extra like a value reset than an exit of capital. Merchants are lively, liquidity is there, and the community itself hasn’t gone quiet, not even shut.

Quick-Time period Construction Leans Bearish

Zooming into shorter timeframes, SOL has clearly misplaced the $120 vary ground, shifting near-term construction to the draw back. Value has slid into the $115 to $113 demand zone, the place patrons at the moment are attempting to stabilize issues. This space is doing the heavy lifting in the meanwhile.

In accordance with Crypto Tony, the $120 degree stays the road within the sand for momentum. A clear reclaim above it could sign a range-low restoration and will open the door towards $130. Till that occurs, sellers nonetheless management the tape. Earlier rejections within the $145 to $150 zone confirmed robust provide overhead, and up to date bounces have struggled to observe by means of, printing decrease highs as an alternative.

Instant assist sits close to $113. If that degree offers manner, deeper demand round $108 comes into view pretty shortly, particularly if broader market stress picks up once more.

Larger Image Factors to Accumulation

From a longer-term perspective, analyst BATMAN urges persistence. He views Solana as constructing a broad, multi-month base fairly than rolling over right into a full development reversal. Value has been oscillating between roughly $120 to $130 assist and $220 to $240 resistance, carving out a large consolidation vary.

Every protection of the decrease boundary strengthens the case for accumulation, whereas rejections close to the top quality stay corrective fairly than structural failures. This sort of conduct tends to reward disciplined positioning, not quick reactions. A decisive breakout above $240 would probably change the dialog fully, opening potential paths towards $300 and, long term, even the $450 to $600 area. Till then, consolidation is the sport.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.