Briefly

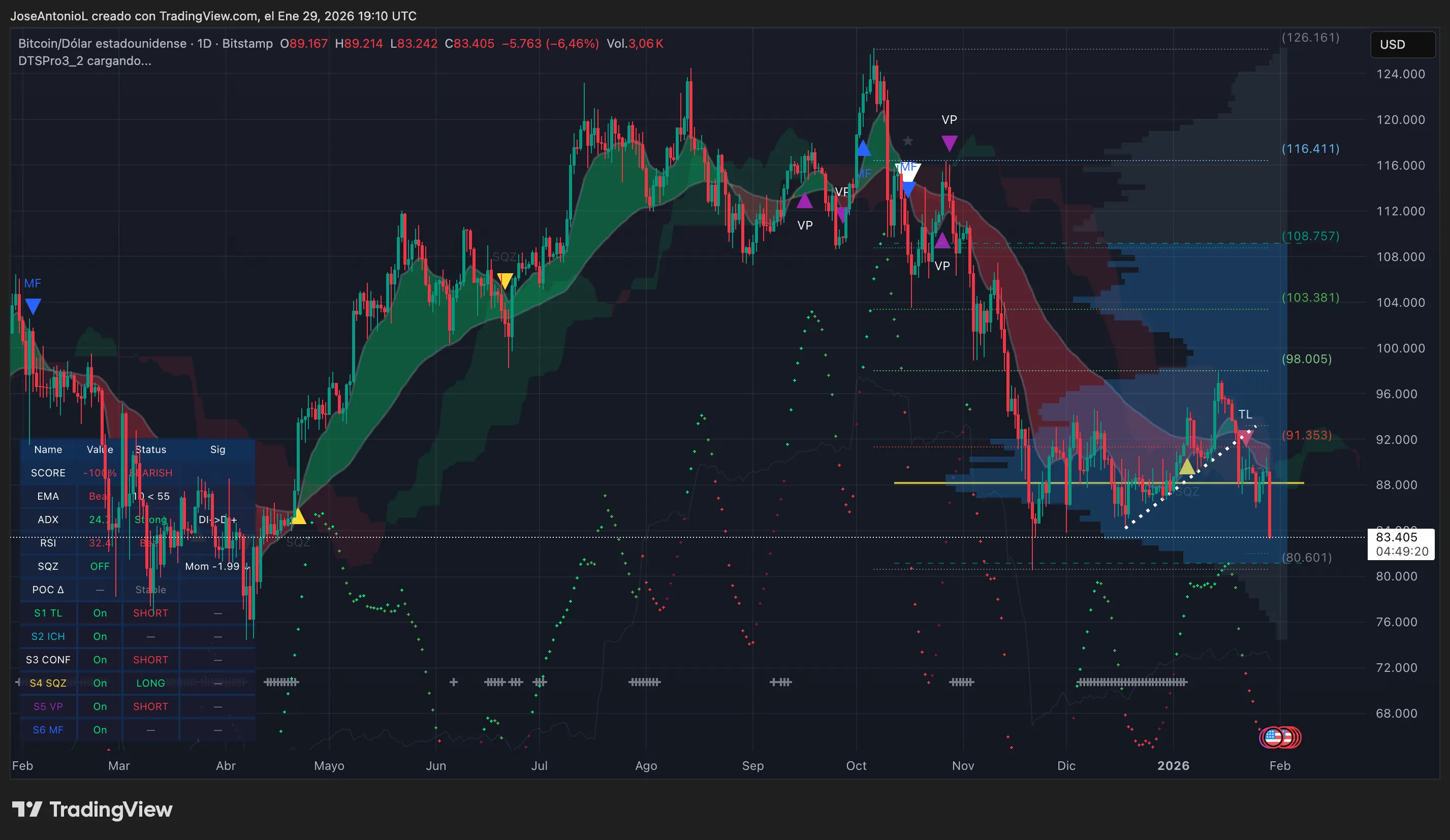

- Bitcoin plunged Thursday, with the 50-day EMA crossing under the 200-day EMA—a traditional dying cross sample that sometimes indicators sustained downward stress.

- Gold and silver hit report highs whereas Bitcoin struggles, elevating questions on which belongings really perform as shops of worth throughout unsure occasions.

- Key help at $80,601 might break if bearish momentum continues, probably opening the door to a deeper correction towards $74,000.

The crypto market is dealing with an id disaster. Whereas gold blasted previous $5,600 per ounce and silver topped $121 this week, Bitcoin has been getting hammered. It is a painful reminder that when macro uncertainty hits, traders nonetheless attain for conventional secure havens first—and crypto second, if in any respect.

All three belongings are billed as shops of worth, hedges in opposition to foreign money debasement and authorities overreach. However gold and silver are casually including a whole bunch of billions in market worth in a matter of days whereas BTC bleeds.

Why? Rising odds of a U.S. authorities shutdown, Fed uncertainty, and the looming risk of Japanese yen intervention have traders scrambling for belongings with a long time of crisis-tested reliability.

Bitcoin’s 15-year monitor report simply would not reduce it when worry takes over, and the altcoin market is bleeding much more, with Dogecoin, XRP and different cash posting extreme losses.

Demise cross deepens the ache

Bitcoin was lately buying and selling at $83,405, down 6.46% or $5,763 from yesterday’s ranges. The worth has sliced via a number of help zones on its method down from January’s excessive close to $97,000, and the technical image suggests this is not over but.

The dying cross—when the 50-day Exponential Transferring Common crosses under the 200-day EMA—is Bitcoin’s most ominous long-term bearish sign.

Consider it like this: The short-term common represents the place merchants have been shopping for lately, and the long-term common exhibits the place traders have positioned over months. When the short-term mark dips under the long-term, it means latest consumers are underwater, and the market construction is popping decisively bearish. This sample has traditionally preceded main Bitcoin drawdowns, together with the brutal 2022 collapse and the 2018 bear market.

Do the mathematics. Watch the dying cross enhance after an unsuccessful try to bounce, and 2026 might show that historical past repeats itself, unleashing a crypto winter that follows the sample of three bullish years adopted by a bearish one.

The 50-day EMA sits round $88,000, performing as fast overhead resistance that bulls have didn’t reclaim. Bitcoin is now buying and selling effectively under each shifting averages, which creates a nasty ceiling that should break earlier than any significant restoration can begin.

The Common Directional Index, or ADX, reads 24—slightly below the 25 threshold that confirms a powerful development is in place. ADX measures development power no matter course, so readings above 25 inform merchants that there is actual conviction behind value strikes, not simply noise. At 24, the power of the worth correction from earlier weeks seems to be weakening quick.

Quantity has been elevated throughout this decline, which is an indication that this is not simply low-liquidity chop. Actual sellers are hitting the market.

The Squeeze Momentum Indicator exhibits “Off” standing, that means there is not any compression or coiling power constructing for an enormous transfer. If something, all the worth stress has been launched to the draw back. Mixed with the bearish value motion, this means Bitcoin might grind decrease reasonably than snap again with a pointy reversal.

If the $80,600 help fails, then the $74,000 zone could possibly be the subsequent main goal—the April 2025 lows the place Bitcoin beforehand bounced. A break there would open the door to an excellent uglier, however inconceivable state of affairs round $65,000 the place the 200-day EMA offers long-term help within the month-to-month charts.

For now, the trail of least resistance is down. Bulls must see a every day shut above $88,000 with rising ADX to counsel the tide is popping. Till then, anticipate extra chop, extra ache, and extra headlines about how gold is consuming Bitcoin’s lunch.

Key ranges to look at:

- Resistance:

- $88,000 (50-day EMA, fast)

- $92,000 (damaged help turned resistance)

- $108,757 (quantity profile zone)

- Assist:

- $83,381 (quantity profile zone)

- $80,601 (robust help)

- $74,000 (April 2025 lows)

Disclaimer

The views and opinions expressed by the writer are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Every day Debrief Publication

Begin on daily basis with the highest information tales proper now, plus unique options, a podcast, movies and extra.