Bitcoin’s sharp slide to $81,119 on January 30 got here with a derivatives-market intestine punch: pressured lengthy closures spiked to excessive ranges, but perpetual funding stayed decisively constructive. That blend is complicating a typical learn, whether or not the market has already “cleansed” leverage or continues to be arrange for repeat liquidation waves.

Is The Bitcoin Deleveraging Over?

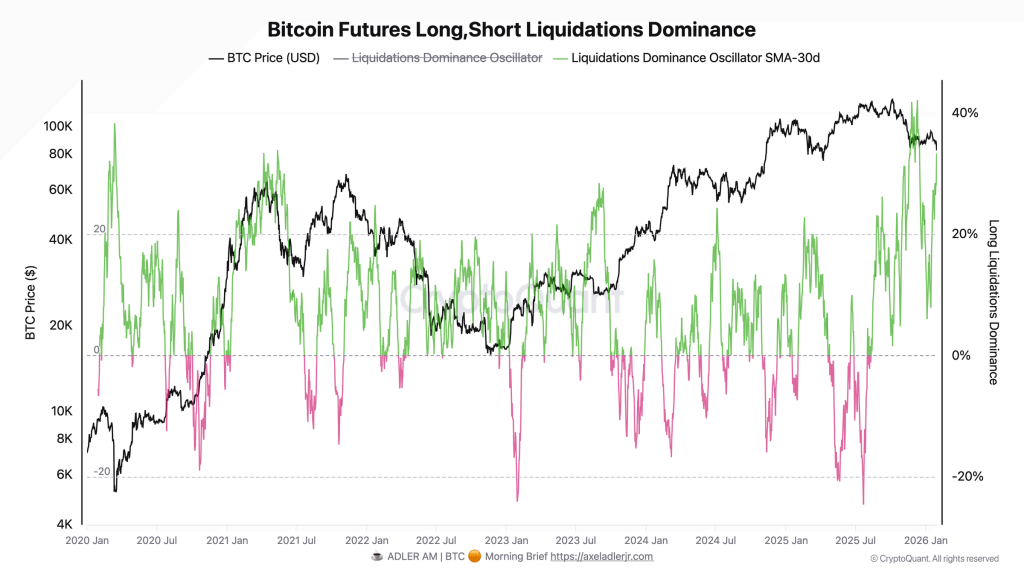

On-Chain analyst Axel Adler Jr., in his Morning Transient, pointed to a “cascade of pressured closures” over the previous 24 hours, with lengthy liquidations dominating the tape. His liquidation dominance oscillator monitoring the steadiness of lengthy versus brief liquidations, printed roughly 97%, whereas the 30-day shifting common rose to 31.4%. In plain market-structure phrases, that claims deleveraging strain has been closely one-sided, not simply on the day however as a sustained sample via the final month.

The rationale merchants watch extremes like that is the tendency for liquidation flows to cluster after which fade, creating room for near-term stabilization. Adler framed that dynamic cautiously, stressing that an “excessive” studying will not be the identical factor as affirmation that sellers are achieved.

Associated Studying

“Oscillator extremes usually coincide with the fruits of pressured promoting and might result in short-term stabilization. Nonetheless, this isn’t a reversal sign with out confirmations — for a sustainable ‘native backside’ situation, you will need to see at the very least normalization of the oscillator to zero or a decline within the 30-day common.”

That units the primary situation for calling the deleveraging cycle “over”: the liquidation imbalance has to chill, fairly than merely peak.

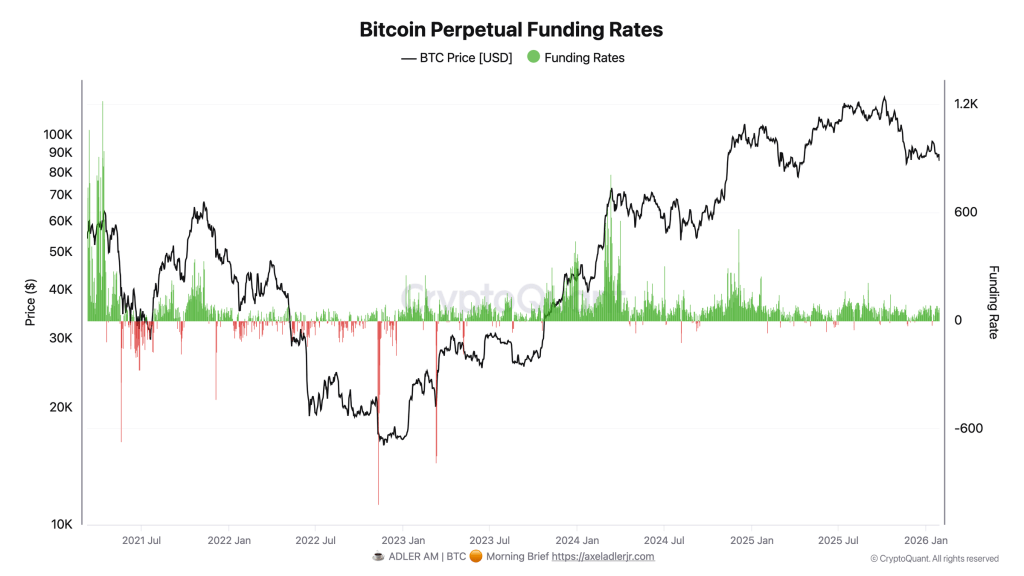

The larger rigidity in Adler’s learn is that even after the washout in worth and the liquidation cascade, funding remained constructive: 43.2% annualized on the day, by his figures. Whereas that’s properly beneath the 100%+ annualized ranges seen throughout October–November peaks, it nonetheless implies a market paying to remain lengthy fairly than getting paid to brief.

Funding doesn’t simply mirror sentiment; it displays positioning strain. If funding refuses to flip regardless of a selloff, it will probably imply longs are rebuilding publicity shortly, or that the market by no means absolutely unwound bullish leverage within the first place. Adler’s conclusion is that the latter threat continues to be on the desk.

“Constructive Funding amid large liquidations will increase the danger of repeated deleveraging: this implies the market is recovering lengthy positioning shortly sufficient or will not be prepared to completely unwind it. Full ‘derivatives capitulation’ is usually accompanied by Funding transitioning to impartial or detrimental territory — this has not occurred but.”

Associated Studying

In different phrases, the liquidation occasion could have been violent, however the incentives embedded in perps are nonetheless leaning towards lengthy demand. That issues as a result of it retains the identical fragility in place: a contemporary draw back impulse can flip newly reloaded longs into liquidation gas once more.

Adler summed up the mixed sign from the 2 charts as a washout that could be intense, however not essentially closing.

“Collectively, the 2 charts paint an image of seemingly incomplete deleveraging: liquidations hit longs extraordinarily laborious, however general positioning stays tilted bullish. The liquidation cascade (lengthy dominance ~97%) is a symptom of market overload with lengthy positions, however not essentially closing cleaning. Persistently constructive Funding (43% annualized) could point out that demand for lengthy publicity will not be damaged, and the deleveraging course of will not be full.”

Till these confirmations present up, the bottom case in his briefing is much less “closing capitulation” and extra “incomplete deleveraging”, a market that has already flushed leverage as soon as, however will not be achieved if lengthy urge for food stays intact via drawdowns.

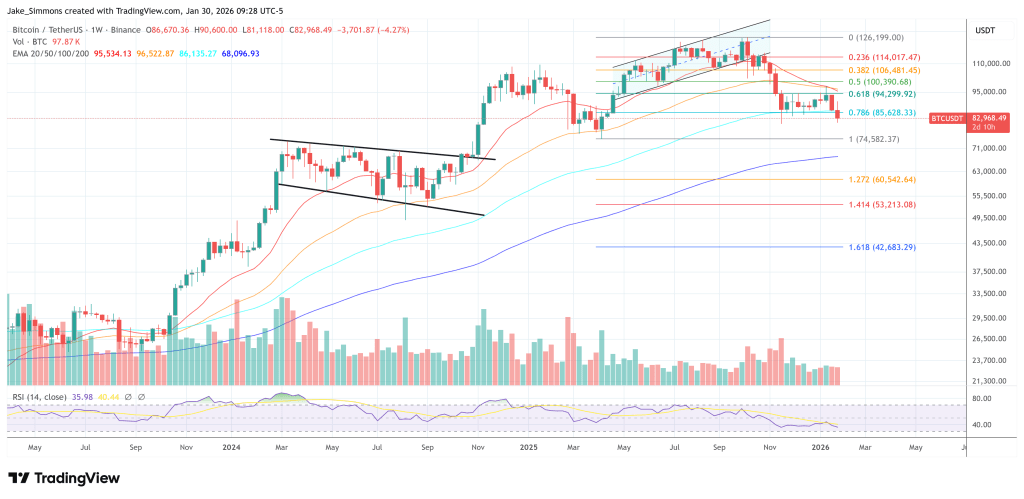

At press time, BTC traded at $82,968.

Featured picture created with DALL.E, chart from TradingView.com