- Avalanche’s RWA TVL reached $1.3 billion, pushed by long-term infrastructure development

- Institutional adoption, together with BlackRock’s BUIDL growth, boosted utilization and credibility

- Stablecoin and tokenized fund development factors to utility-led demand reasonably than hypothesis

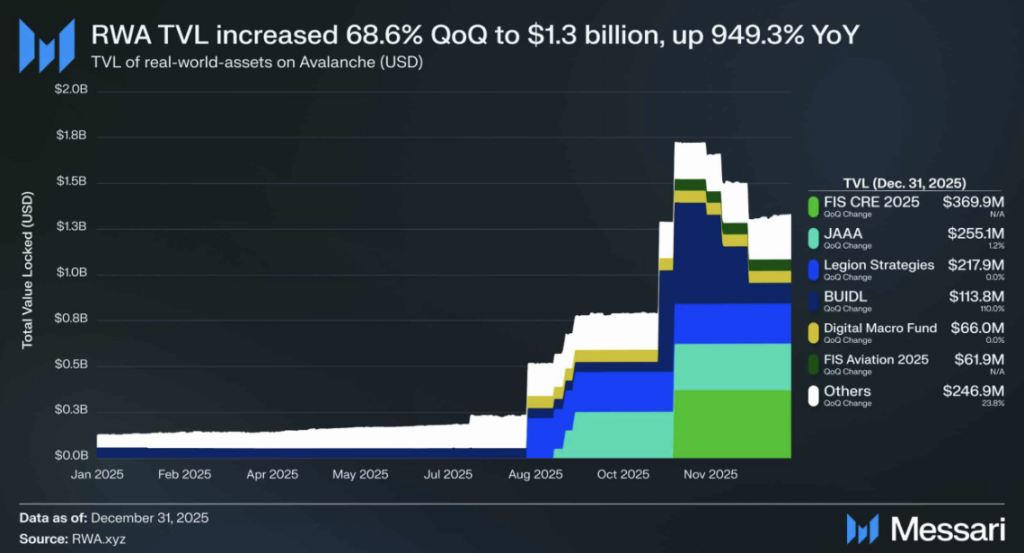

Avalanche’s real-world asset footprint has quietly reached a significant threshold. RWA complete worth locked on the community now sits round $1.3 billion, a determine constructed over years reasonably than months. This didn’t come from hype cycles or sudden inflows, however from infrastructure selections that steadily made the chain simpler to make use of at scale.

A giant a part of that story is Avalanche’s subnet structure. By isolating workloads, subnets cut back congestion, hold latency low, and permit throughput to scale with out every thing slowing to a crawl. That construction issues when utilization grows, particularly when establishments are concerned and tolerance for downtime is principally zero.

Institutional Capital Validates the Design

Avalanche’s compliance-friendly setup has additionally made it engaging to regulated gamers. That groundwork paid off in This fall 2025, when BlackRock expanded its roughly $500 million BUIDL fund onto Avalanche. The transfer immediately lifted TVL and, extra importantly, validated the community as a viable residence for big allocators.

Different tokenized property adopted. FIS tokenized actual property and aviation loans added depth, not simply quantity. As capital arrived, exercise picked up quick. Day by day C-Chain transactions climbed to round 2.1 million, pushed by RWAs, gaming, and enterprise use circumstances that don’t rely on retail hypothesis to outlive.

Wanting forward, the combo of increasing RWAs, new gaming and media-focused chains, and continued institutional adoption factors to development that feels sturdy. Not explosive, possibly, however regular in a method markets are inclined to reward over time.

Why Avalanche Stands Out in On-Chain RWAs

Avalanche has positioned itself in another way from many rival chains. As an alternative of optimizing for quick retail cycles, it’s constructed round institutional sturdiness. The subnet and Evergreen frameworks enable for personal or semi-private chains that may observe regulatory necessities, which is strictly what conventional finance wants for RWAs.

Efficiency backs that up. Avalanche presents sub-second finality, excessive throughput, EVM compatibility, and constantly low charges. At scale, these options cut back operational threat, one thing establishments care about excess of squeezing out marginal yield.

That mixture explains why Avalanche holds one of many largest RWA shares outdoors Ethereum, based on RWA.xyz, inside a world RWA market of roughly $19 billion. Capital retention additionally tells a narrative. Sturdy switch volumes and secondary liquidity on venues like Dealer Joe counsel property aren’t simply touchdown on Avalanche, they’re truly getting used.

Charges stay modest, however that’s nearly the purpose. Avalanche’s edge isn’t payment extraction, it’s infrastructure that doesn’t break when actual cash exhibits up.

Stablecoins Sign Actual Settlement Demand

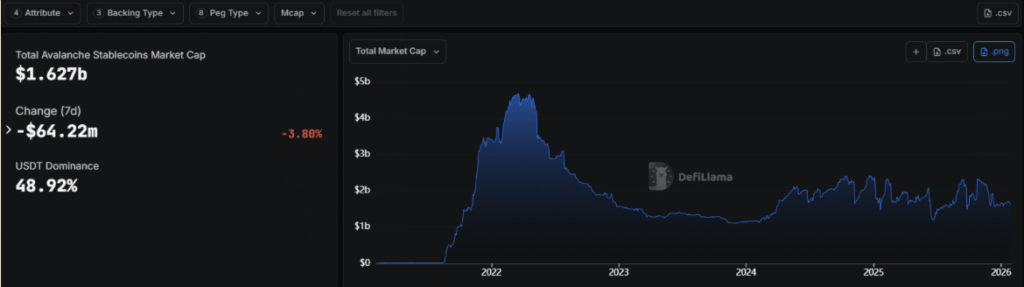

Avalanche’s stablecoin development provides one other layer. Whole stablecoin provide fluctuates between about $1.63 billion and $2.19 billion, relying on the snapshot, however both method the size is significant. USDT dominates, with roughly $796 million to $1.52 billion in circulation, representing about half the market.

USDC makes up one other 19 to 32%, round $516 million, a distribution that traces up with institutional liquidity preferences reasonably than meme-driven rotations. That blend issues.

Over the previous 30 days alone, stablecoin switch quantity reached roughly $69 billion, up 5.76%, pointing to sustained, high-value settlement exercise. Much more telling, mixed stablecoins and tokenized funds have grown greater than 70% since January 2024, now exceeding $2 billion in combination worth.

This isn’t the form of development tied to short-lived hype. It tracks utility, tokenized funds, cross-border funds, and enterprise settlement flows. Quiet, possibly, however exhausting to disregard.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.