Tether closed out the 12 months with numbers that turned just a few heads in finance circles. Experiences say the agency posted web earnings above $10 billion for 2025 whereas the stablecoin USDT grew to roughly $186 billion in circulation — a brand new excessive for the token and an indication of how central it has turn out to be to crypto markets.

Robust Stability Sheet And Massive Reserves

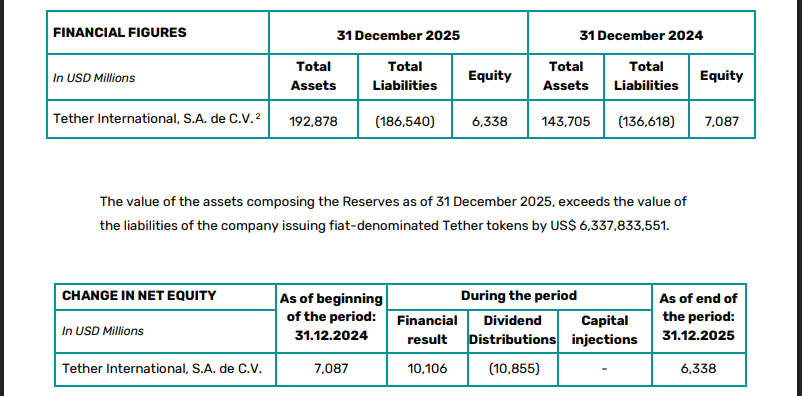

Experiences observe that Tether’s steadiness sheet reveals strong backing after dividends and payouts. The issuer reportedly ended the 12 months with a number of billion in extra reserves and whole belongings that comfortably outmatched liabilities. That cushion has calmed buyers who fear about backing for a lot stablecoin.

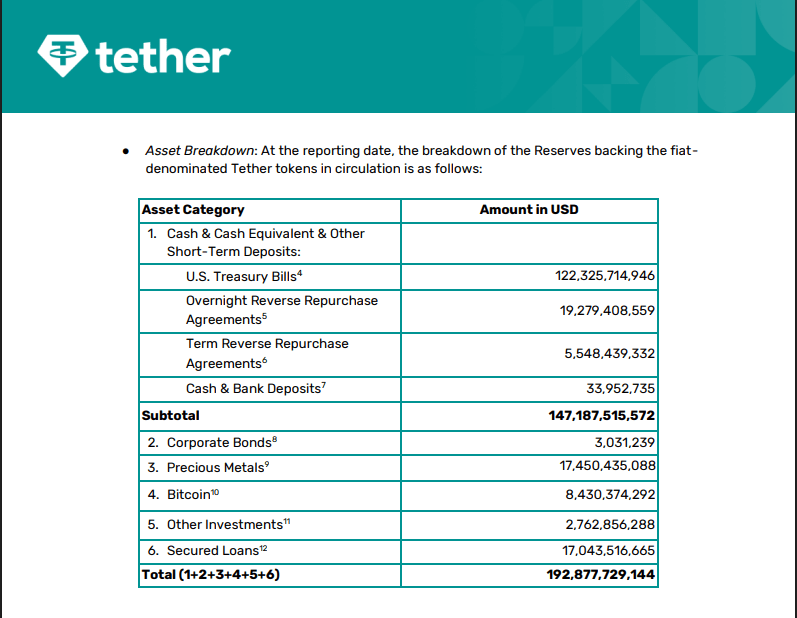

Tether’s money and short-term holdings are heavy on US Treasury publicity. Based mostly on stories, a big slice of its reserves sits in Treasuries and related devices that generate regular curiosity revenue. That revenue helped drive the big revenue quantity, whilst the corporate moved into different belongings.

The numbers got here from Tether’s most up-to-date annual attestation, ready by impartial accountants at BDO, highlighting the corporate’s standing as one of many prime earners within the digital asset sector.

Gold Buys And A Shift In Combine

Experiences say Tether has been rising its holdings of bodily gold alongside Treasuries. Latest filings and public feedback present roughly 27 tons of gold bought within the remaining quarter of the 12 months, and the agency has mentioned it might intention for between 10% and 15% of its portfolio in gold over time. That transfer is supposed to diversify reserves and trim publicity to any single market.

Inventory And Market Results

The revenue and the rise within the USDT provide have spillover results. Market makers and exchanges often use Tether as the first greenback substitute within the crypto market, and the elevated USDT provide improves buying and selling and fee liquidity.

Alternatively, some score businesses and analyst companies have identified some considerations. There are potential points with transparency and danger if markets flip towards them as a result of elevated allocations to non-Treasury belongings.

What This Means For Customers And Regulators

For customers, the very first thing to notice is that the elevated provide of USDT out there usually means improved on-ramps for buying and selling and shifting worth between platforms.

For regulators and massive lenders, the numbers underline why stablecoins entice scrutiny. Experiences observe that watchdogs need clearer, repeatable disclosures to match the dimensions of those holdings.

Tether’s latest efficiency frames a bigger story about how crypto handles dollar-like liquidity in observe.

The corporate says its reserves and reporting meet its personal requirements, whereas impartial commentators push for nonetheless better readability.

Both approach, USDT’s function has grown, and the dialog about danger, disclosure, and the place these backing belongings sit is barely getting louder.

Featured picture from Unsplash, chart from TradingView