Be a part of Our Telegram channel to remain updated on breaking information protection

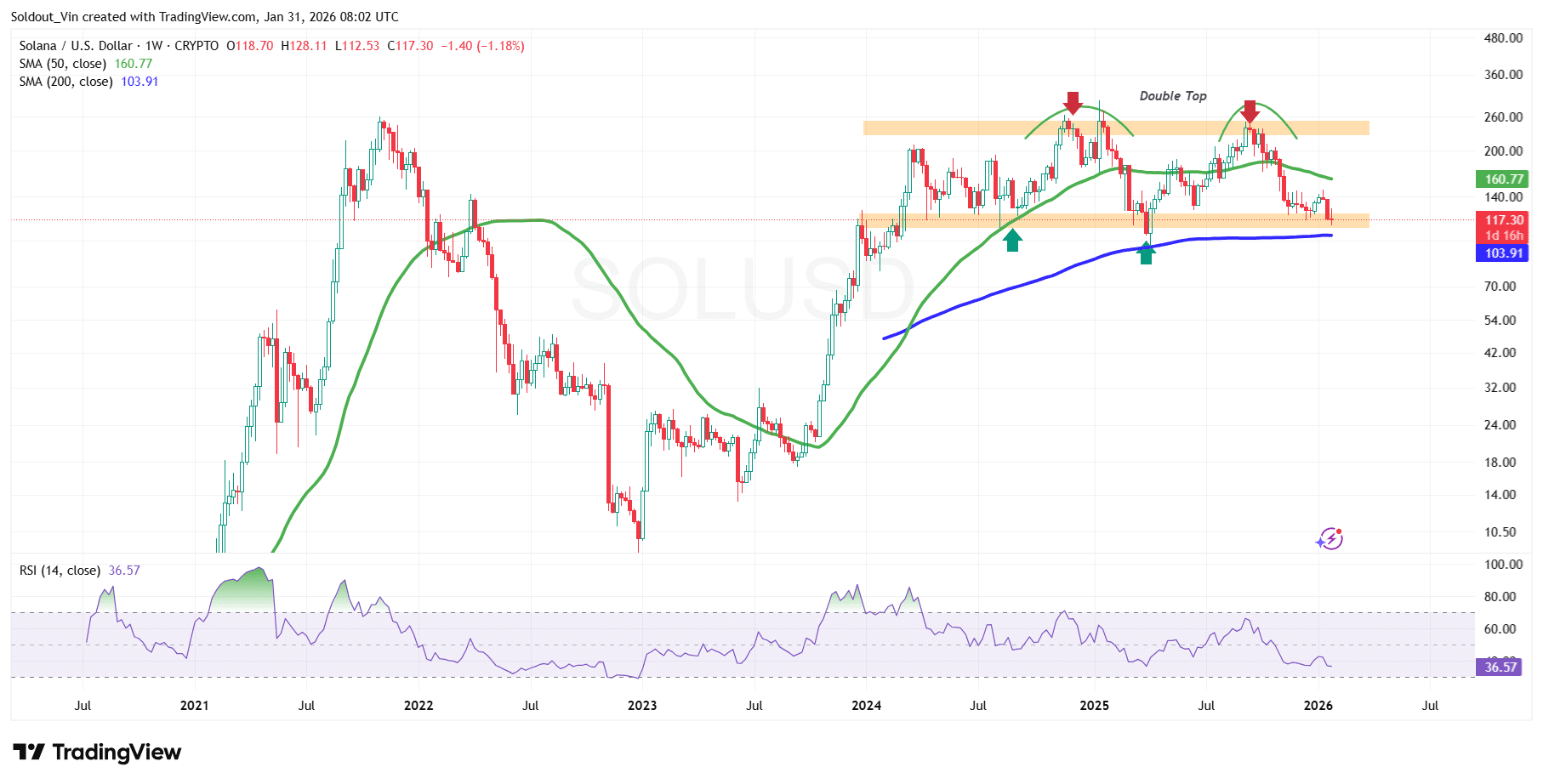

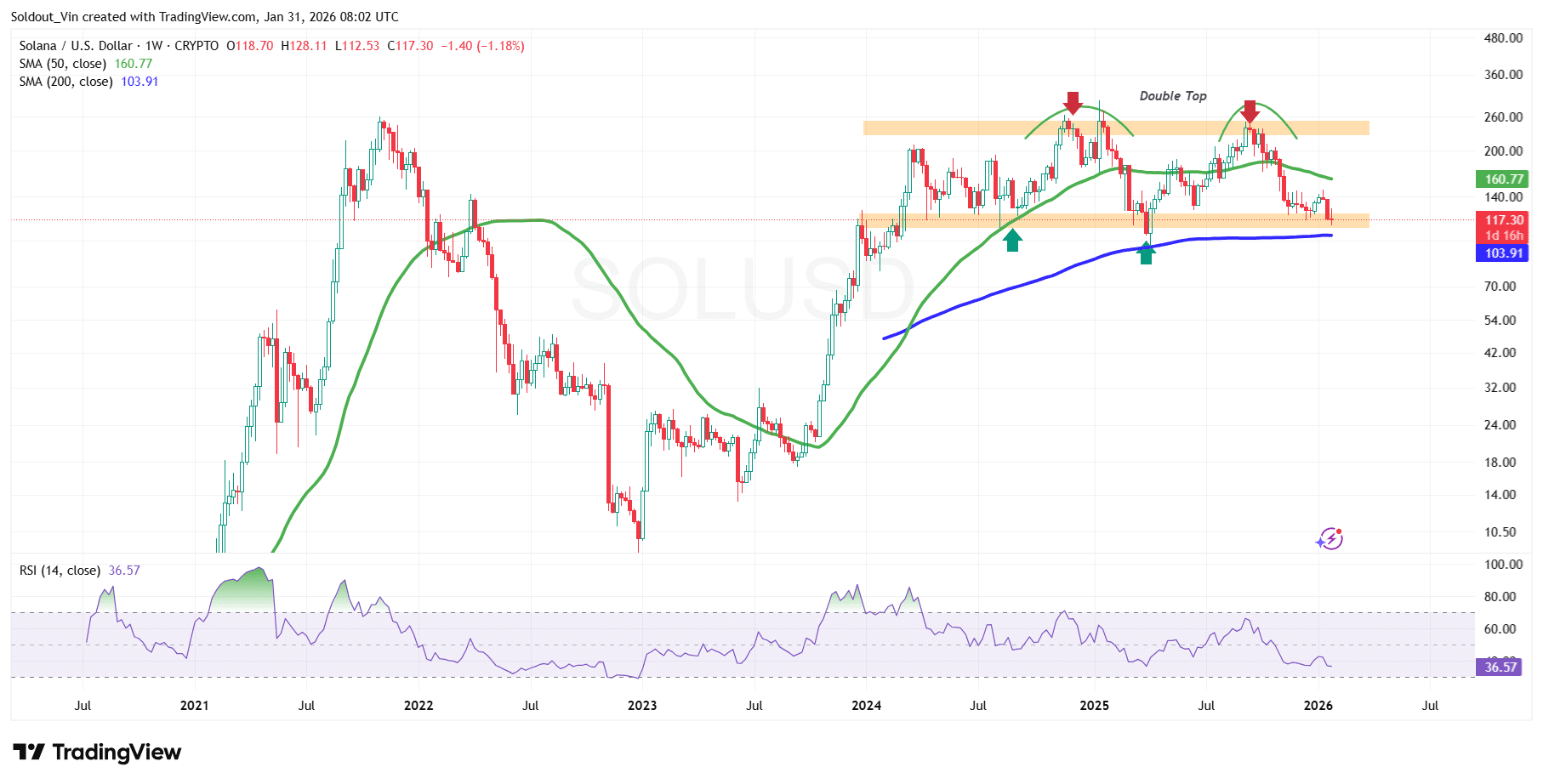

Solana’s value is caught in a technical bear market after falling by 59% from its highest degree in September final 12 months. Nevertheless, after forming a double-bottom sample, the SOL value appears to have reached a key assist degree round $113, a drop which got here amid a broader crypto market drop this week.

The crypto token is now trying a restoration, which is in tandem with the broader market, which edged up a fraction of a proportion to a $2.91 trillion market capitalization, in line with Coingecko information.

The Solana value has climbed 3.5% within the final 24 hours, regardless of being down 7.5% within the final week to commerce at $117.30 as of 03:02 a.m. EST. Nevertheless, buying and selling exercise has fallen dramatically, with SOL’s buying and selling quantity climbing 28% to $5.6 billion.

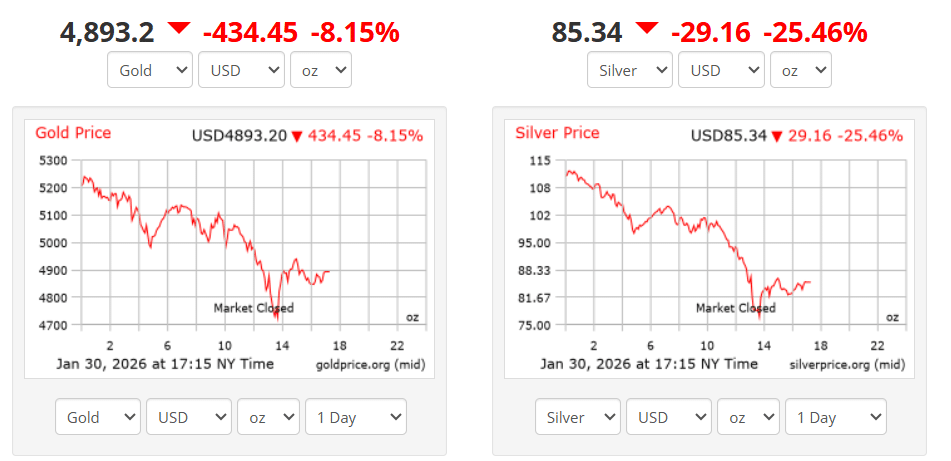

Gold, Silver Slide as Markets Weigh Trump Nominee

Wall Road’s predominant indexes closed decrease on Friday as traders seen President Donald Trump’s nomination of former Federal Reserve Governor Kevin Warsh as a hawkish option to succeed Federal Reserve Chair Jerome Powell.

In keeping with Trump and plenty of economists, Warsh is predicted to favor decrease rates of interest however cease in need of the extra aggressive financial easing linked to another potential nominees.

With Powell’s time period ending in Might, Warsh, if confirmed by the Senate, would take the helm of the central financial institution.

JUST IN: 🇺🇸 President Trump formally nominates pro-Bitcoin Kevin Warsh as the brand new Federal Reserve Chair!

That is bullish for $BTC and crypto! 🔥 pic.twitter.com/fAWgqelYBf

— CEO (@Investments_CEO) January 30, 2026

On prime of assessing the dangers from US tensions with international locations together with Iran, traders had been additionally apprehensive in regards to the prospect of one other US authorities shutdown after new boundaries emerged within the Senate to a deal that might guarantee continuation of funding for company operations.

The US authorities entered what is predicted to be a short shutdown on Saturday after the Senate did not approve a deal to maintain a large swath of operations funded forward of a midnight deadline.

In consequence, the Dow Jones Industrial Common fell 179.09 factors, or 0.36%, to 48,892.47, the S&P 500 misplaced 29.98 factors, or 0.43%, to six,939.03, and the Nasdaq Composite misplaced 223.30 factors, or 0.94%, to 23,461.82.

The speed-sensitive, small-cap Russell 2000 index has just lately been outperforming large-cap indexes, however on Friday it lagged with a 1.6% loss for the day.

Within the final 48 hours, over $7 trillion has been erased from the dear metallic market. Silver is down 29% and has dropped to round $85/ounce, whereas gold is down 8.15% to commerce at $4,893.2/ounce.

Amid these downtrends, can the Solana value proceed hovering after such a optimistic acquire within the final day?

SOL Worth Technical Evaluation Factors to a Sustained Drop

Solana value is buying and selling inside an intraday low of round $114.83 and a excessive of $118.61, simply throughout the highlighted neckline of the double prime sample, which typically acts as a bearish signal.

The bearish sentiment continues because the SOL value trades properly beneath the 50-day Easy Shifting Common (SMA) on the weekly chart, however is being held above the $113 assist by the 200-day SMA, now at $103.91. ‘

In the meantime, Solana’s Relative Energy Index (RSI) continues to be dropping on the weekly timeframe, presently at 36.57 and nonetheless dropping, which exhibits that bears are nonetheless in management in the long run.

The 200-day SMA now acts as a long-term cushion towards downward stress. If the bears handle to cross this assist space, the worth of SOL may nonetheless drop even additional.

Technicals now level to a continued drop because the market faces continued volatility. If this assist is breached, Solana faces a threat of a drop to the August 2023 resistance space round $47.3.

On the upside, the 50-day SMA at $160.77 acts as the subsequent key resistance and goal. Traditionally, consumers have used the $113 assist to stage a restoration. If consumers step in at this degree and break the 50-day SMA, the subsequent key goal would be the $229 degree to the upside.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection