Based on reviews, there was a steep sell-off within the digital asset market as Bitcoin and Ethereum got here beneath heavy liquidation strain. Knowledge offered by X account signifies that Bitcoin momentarily dipped under $76,000, and Ethereum adopted swimsuit within the total decline. This resulted in over $2.56 billion in liquidations in a span of 24 hours, which signifies intense leverage on distinguished buying and selling platforms. Market observers had been intently watching each digital belongings as volatility escalated within the markets.

Largest Liquidation Occasion Since October Crash Reported

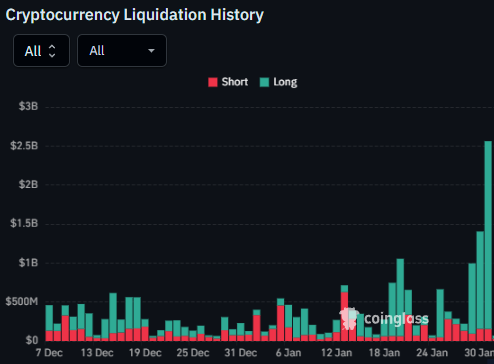

As reported in crypto information, the data offered by @coinbureau on X revealed that the quantity of $2.56 billion was the most important quantity of leverage worn out for the reason that market crash on the tenth of October. The earlier market crash resulted within the wiping out of greater than 19 billion {dollars} in leveraged positions on the tenth of October. Present statistics reveal that the losses had been borne by the lengthy positions, as depicted by the liquidation charts offered by the account.

Statistics reveal that the leverage was concentrated as the value declined. The worth of Bitcoin was the primary to say no, whereas the value of Ethereum reacted in the identical approach as a result of correlated nature of the belongings. The buying and selling quantity was excessive through the decline.

Bitcoin and Ethereum Tracked as Market Drawdown

Market watchers level out that the general market has misplaced $1.64 trillion in capitalization over a interval of 4 months. Based on information offered by X account, the general market capitalization decreased by round 38% as in comparison with the 2025 excessive. Bitcoin contributed a big half to this lower, and Ethereum additionally adopted an identical pattern.

Worth motion signifies that the market is revisiting ranges that had been beforehand touched as a result of “Liberation Day” tariff shock. Bitcoin and Ethereum touched consolidation zones.

Experiences Notes Leverage as Key Driver of Promote-Off

In a tweet by the crypto information account, they cites findings that leverage performed an element within the downward correction. The tweet explains that the leverage didn’t solely make the autumn within the costs steeper but in addition triggered the compelled gross sales. Liquidation charges on the most important exchanges had been triggered by the liquidation thresholds.

The liquidation charges have proven a continuing rise in January, with the final one going past $2.5 billion.

Market Circumstances Monitored After Liquidation Wave

Market contributors are nonetheless monitoring market conduct following the liquidation occasion. Bitcoin and Ethereum costs are nonetheless reacting to changes in leverage as traders assess their danger publicity. Analysts are monitoring derivatives funding charges and open curiosity metrics.

Present market focus is on supporting ranges following a compelled promoting part. Knowledge-driven market updates by completely different sources proceed to be key in monitoring present market circumstances.