A contemporary whale on the XRP ledger moved a big chunk of tokens in a really quick time, and merchants are break up on what it means.

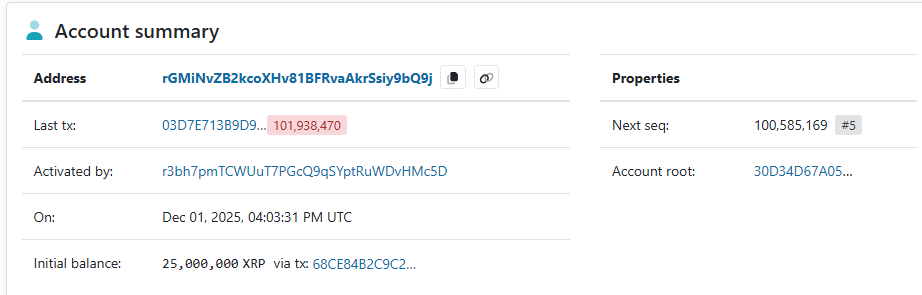

In response to on-chain data, a newly activated tackle acquired two equal transfers that collectively totaled $120 million XRP.

The transfers got here by way of an middleman pockets that shuffled the cash throughout a number of fast strikes.

Whale Exercise And The Movement Of Funds

Stories say the incoming batches had been two transfers of $60 million XRP every. The middleman took every batch and pushed them onward to a holding tackle inside the hour.

That receiving account now reveals a stability of $185 million XRP after including a leftover $35 million it already held. Trade tags are absent. No recognized custodial label seems subsequent to those addresses. That makes the path tougher to learn.

Why The Strikes May Be Routine

Massive holders transfer funds for a lot of causes. Custodians tidy up wallets. Exchanges consolidate holdings. Companies rotate funds locked in chilly storage for operational causes.

These are frequent explanations. Lively merchants watched the worth across the similar time. Stories notice XRP had slid to the low $1.70 vary, breaking under the $1.80 help and slipping about 10% since Jan. 29.

Alerts Merchants Need To See

If this had been a quiet buy-the-dip, market indicators would often present up. Value stabilization or an uptick would possibly comply with. Spot quantity may climb. Web outflows from alternate wallets is likely to be seen.

None of these clear, matching clues appeared immediately. As a substitute, the funds sat put. That raises the prospect this was inside reshuffling slightly than aggressive accumulation.

What The Middleman Sample Suggests

Routing by way of a central pockets is frequent. Some groups favor to funnel receipts right into a single tackle for accounting or safety checks earlier than dispersing them.

The tempo of transfers can look dramatic on a block explorer. However drama doesn’t equate to new cash getting into the market.

With out proof that the supply funds got here from outdoors exchanges, or that they had been bought on the open market, the transfer must be handled as ambiguous.

Stories have disclosed related on-chain exercise in previous months that later turned out to be both coordinated shopping for or routine housekeeping.

Featured picture from Unsplash, chart from TradingView