Este artículo también está disponible en español.

Aave (AAVE), the main decentralized finance (DeFi) lending protocol, has captured the highlight with a rare surge of over 200% since November 5. Outperforming the broader market, AAVE has reached its highest ranges since 2021, marking a exceptional restoration and reaffirming its dominance within the DeFi ecosystem.

Associated Studying

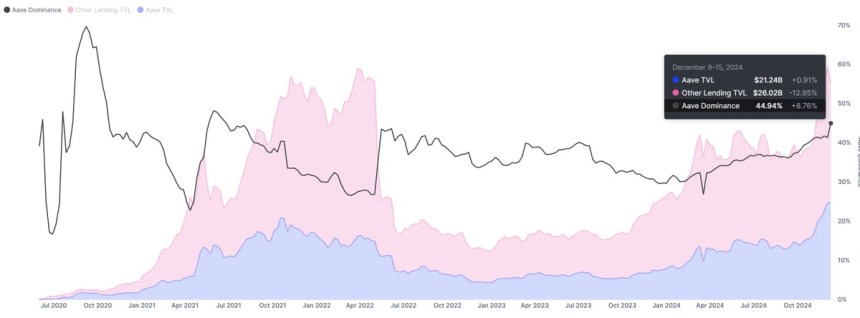

Key metrics from IntoTheBlock underscore AAVE’s unmatched place within the lending sector. With a formidable 45% market share, it stays the best choice for customers looking for decentralized borrowing and lending options.

With AAVE buying and selling at multi-year highs and on-chain knowledge suggesting strong exercise, the altcoin’s trajectory stays a focus for buyers and analysts alike. The query is whether or not the value can maintain this momentum and attain new all-time highs within the coming months.

AAVE Retains Rising

Aave (AAVE) has proven constant development over the previous 12 months, solidifying its place as a market chief within the DeFi lending sector. Identified for its revolutionary method to creating non-custodial liquidity markets, Aave permits customers to earn curiosity on equipped and borrowed belongings at variable rates of interest. This method has made Aave a go-to protocol for decentralized borrowing and lending.

For years, Aave has been on the forefront of DeFi innovation, regularly enhancing its platform and person expertise. Its success is clear in its market dominance. Metrics from IntoTheBlock spotlight Aave’s unmatched management, boasting a formidable 45% market share within the DeFi lending area.

This dominance is additional emphasised by Aave’s staggering whole worth locked (TVL), which stands at $21.2 billion—nearly equal to the mixed TVL of all different lending protocols.

Associated Studying

Such figures underline Aave’s crucial function within the DeFi ecosystem. Its established presence and strong infrastructure place it as a key participant within the occasion of a broader DeFi resurgence. Ought to the sector warmth up within the coming weeks, Aave is more likely to appeal to vital consideration from buyers and merchants.

Worth Targets Recent Provide Ranges

Aave (AAVE) is presently buying and selling at $366, following a surge to a multi-year excessive of $396 simply hours in the past. The altcoin continues its upward momentum because it approaches the crucial $420 resistance degree, a threshold final held in September 2021. This mark is seen as a pivotal space for AAVE’s subsequent part of value motion, with many analysts anticipating a big response as soon as examined.

If AAVE manages to carry its present ranges and maintain the bullish momentum, the subsequent logical goal can be the $420 resistance zone. Breaking above this degree might sign a continuation of its multi-month rally, setting the stage for even greater value targets as investor confidence builds.

On the draw back, failure to keep up help above the $320–$340 vary might result in a broader correction. A transfer under this zone may push the value decrease, erasing a few of its current positive factors and dampening bullish sentiment within the quick time period.

Associated Studying

AAVE stays in a powerful place for now, however merchants are intently monitoring its value motion close to these key ranges. Whether or not it might probably maintain its upward trajectory or faces a pullback will rely on its means to interrupt and maintain above vital resistance zones.

Featured picture from Dall-E, chart from TradingView