In short

- Vitalik Buterin defined that he likes to guess in opposition to prevailing excessive market sentiment on Polymarket.

- The Ethereum co-founder claimed he made $70,000 doing this throughout 2025, on a stake of $440,000.

- He additionally highlighted different points impacting betting markets, such because the accuracy of the “oracles” they depend on.

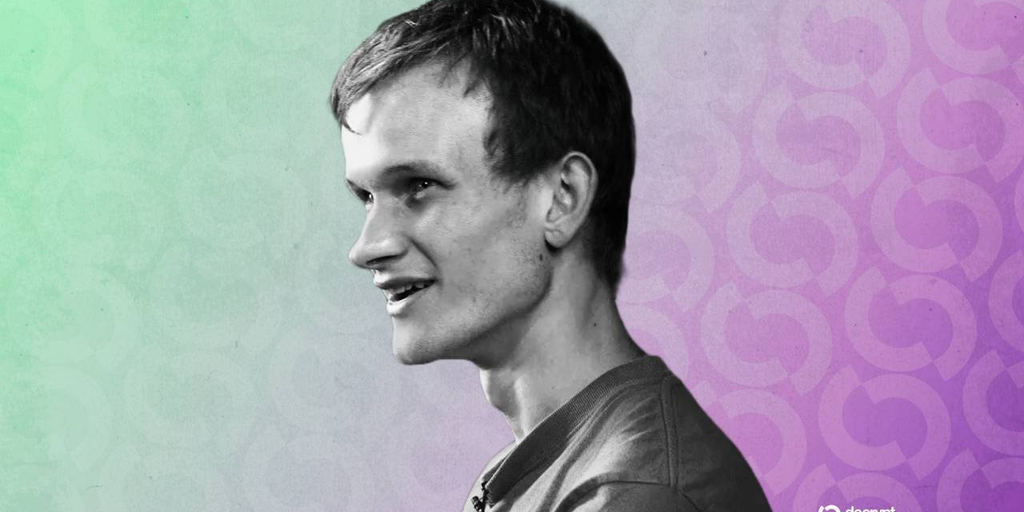

Ethereum co-founder Vitalik Buterin has disclosed the technique he makes use of on the prediction market Polymarket in a latest interview.

Buterin informed Foresight Information that he appears for markets in what he calls “loopy mode” and bets that “loopy issues received’t occur.”

“For instance, there’s a market betting on whether or not Trump will win the Nobel Peace Prize,” he stated. “Or some markets predict the greenback will go to zero subsequent yr in periods of utmost panic.”

Buterin claims he has made $70,000 on Polymarket in 2025 on a stake of $440,000, representing a acquire of roughly 16%.

The Ethereum founder added that his technique of betting in opposition to excessive market sentiment “often makes cash.” He inspired bettors to hunt out markets “the place individuals are caught up in loopy and irrational predictions” in the event that they wish to revenue.

Loxley Fernandes, CEO at prediction market Myriad (owned by Decrypt’s father or mother firm Dastan), argues that Buterin’s profiting predicting that “clearly loopy issues wouldn’t occur” is “essentially the most sincere endorsement of prediction markets you may get.”

“When irrational sentiment and emotional extremes leak into markets, rational actors don’t simply become profitable, they pull costs again towards actuality,” he stated, including that, “That is the social operate that prediction markets are designed to serve, to offer sign within the midst of noise.”

Prediction markets and oracles

Within the interview, Buterin additionally mentioned what he sees as key points at the moment affecting betting platforms like Polymarket, significantly round how oracles operate. These oracles are third-party providers that act as bridges, connecting actual world knowledge to the blockchain.

He cited an instance involving a prediction market tied to the Russia—Ukraine battle, which guess on whether or not the Russian military would management a selected metropolis—on this case, Myrnohrad.

The oracle for the market was anchored to maps from the Institute for the Research of Battle (ISW), a U.S. nonprofit analysis establishment, which had been posted on X, which outlined “management” primarily based on which military managed the town’s prepare station.

After the institute’s X account was hacked, its maps had been all of a sudden up to date to indicate Russian troops controlling the prepare station. The offending info was then eliminated the subsequent day, in response to an apology from the Institute. The precise quantity of payouts was not formally disclosed, however Ukrainian native media reported that some bettors might have had payouts over 33,000%, with buying and selling quantity of roughly $1.3 million.

Buterin highlighted circumstances like this as proof that prediction market oracles have “far too low safety” requirements.

“They by no means imagined {that a} single message they posted would decide the possession of $1 million on the blockchain,” he informed Foresight.

Buterin proposed a number of approaches to addressing oracle points. The primary, which he described as a centralized mannequin, would contain trusting a good information supplier equivalent to Bloomberg to provide knowledge.

The second strategy entails token-based voting programs, equivalent to these utilized by UMA.

“A dependable oracle is essential as a result of virtually each DeFi venture now requires one,” Buterin stated. “If you wish to develop real-world purposes—equivalent to placing actual property on-chain or predicting elections—you want an oracle.”

Day by day Debrief E-newsletter

Begin daily with the highest information tales proper now, plus authentic options, a podcast, movies and extra.