- Ethereum’s market shock

- Shiba Inu’s unhappy begin to 2026

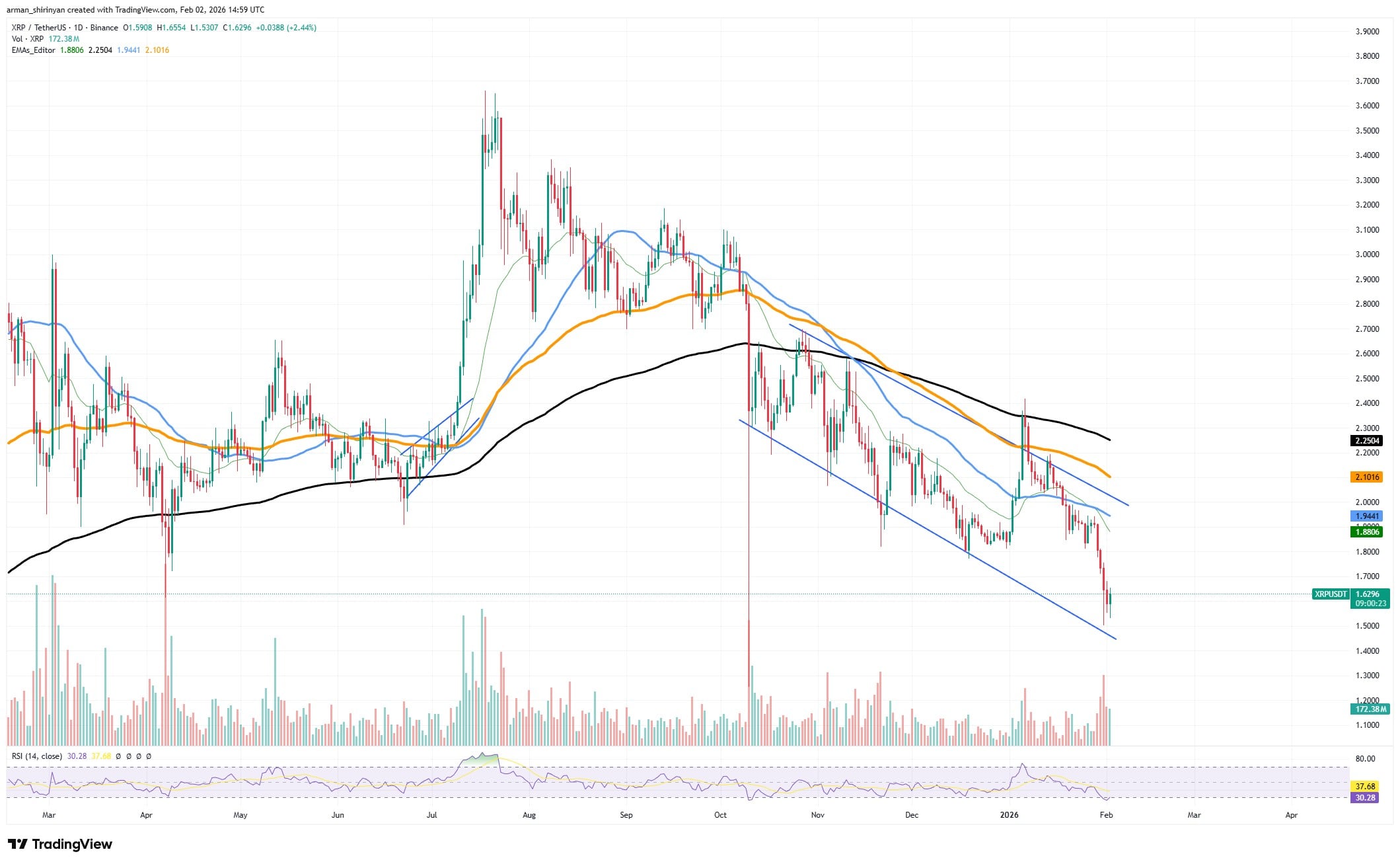

The newest worth motion for XRP signifies that the bullish momentum has principally vanished, making the asset susceptible because the market continues to be dominated by promoting stress. XRP now appears to be firmly within the arms of sellers, with bulls demonstrating little capability to defend necessary worth zones following a number of unsuccessful makes an attempt at restoration in latest weeks.

The purchase facet is clearly exhausted. As seen by the day by day chart, XRP stays trapped in a persistent downtrend, constantly forming decrease highs and decrease lows. Every rebound try has been weaker than the earlier one, indicating declining confidence amongst patrons. Moreover, the asset has fallen considerably beneath its key transferring averages, such because the 50-day and 100-day ranges, which now function dynamic resistance fairly than assist.

XRP is now at ranges not seen in months because of latest worth motion that delivered yet one more steep decline; even temporary rallies are unsuccessful and shortly face stress to promote. Quantity spikes that coincide with declining traits present extra proof that market gamers are nonetheless promoting fairly than shopping for. Technically, XRP additionally broke out of a descending construction solely to break down once more, exhibiting that makes an attempt to reverse momentum have repeatedly failed.

Such false restoration indicators usually speed up bearish sentiment as merchants who entered anticipating a breakout are compelled to shut positions at a loss. Compared to some main property, XRP’s relative efficiency signifies even stronger promoting, however the general weak point of the cryptocurrency market has solely elevated stress.

Until bulls rapidly reclaim key resistance ranges and rebuild upward momentum, XRP dangers drifting additional decrease. The subsequent battlefield is perhaps psychological assist zones, however these may also be tough to take care of within the absence of recent buying curiosity.

Ethereum’s market shock

Ethereum has suffered a pointy market shock after a sudden explosion in buying and selling quantity triggered a heavy worth decline, wiping out key assist ranges and sending ETH tumbling inside hours. The transfer displays what seems to be the compelled liquidation or the fast exit of a number of giant whale positions, amplifying promoting stress throughout the market.

After weeks of regular declines, Ethereum had been having bother staying steady above the $2,800 assist space on the day by day chart. Value motion repeatedly did not reclaim main transferring averages, and bullish makes an attempt had been constantly rejected. When an enormous spike in sell-side quantity hit the market, that brittle construction lastly gave approach, driving ETH firmly beneath assist and quickening the downward momentum.

Giant leveraged positions had been in all probability liquidated as costs broke decrease primarily based on the amount spike, and automatic liquidations and panic-selling exacerbated the decline as soon as necessary assist zones fell, pushing ETH rapidly towards the $2,300-$2,400 vary.

These actions incessantly present that whales, or main institutional gamers, had been compelled to promote their positions both because of margin calls or deliberate de-risking within the face of normal market weak point. Technically talking, transferring averages have gotten overhead resistance, and Ethereum is presently buying and selling effectively beneath essential development ranges.

Whereas momentum indicators additionally stay weak, sellers nonetheless preserve management within the brief time period. Oversold circumstances could encourage temporary rallies, however restoration could take a while as a result of hurt completed to the market’s construction.

Shiba Inu’s unhappy begin to 2026

Shiba Inu has skilled its worst decline in 2026 thus far, basically destroying all hopes of traders for a correct market retrace as a substitute of a weak motion upward.

On the day by day chart, SHIB just lately broke down from a consolidation construction, triggering one other wave of promoting that pushed the token towards recent native lows. In the course of the decline, buying and selling quantity spiked, suggesting compelled promoting and panic exits fairly than gradual distribution. The value now sits effectively beneath key transferring averages, confirming that the broader development stays bearish.

Nonetheless, one necessary sign is especially noteworthy: the Relative Power Index (RSI) is now in extraordinarily oversold territory. The market usually sees at the least a short reduction bounce; every time SHIB’s RSI has fallen to those ranges prior to now, sellers develop weary and shrewd patrons intervene. Oversold circumstances usually precede stabilization durations or temporary restoration makes an attempt, however they don’t guarantee an prompt reversal.

Psychological positioning is a further important issue, and traders ought to stay cautious as the general development continues to be damaging and restoration would require SHIB to reclaim close by resistance zones and maintain above them. Nonetheless, the acute oversold readings imply draw back momentum could also be dropping energy, opening the door for a rebound or consolidation section.

After such a pointy drop, many weak arms have already exited the market, decreasing speedy promoting stress, which creates circumstances the place even average shopping for exercise can push costs increased, particularly if broader crypto sentiment begins to enhance.