- Hedera, Chainlink, and Avalanche lead Santiment’s newest RWA growth rankings

- Mid-ranked initiatives like VeChain and IOTA present renewed developer momentum

- RWA-focused protocols proceed to construct aggressively regardless of market volatility

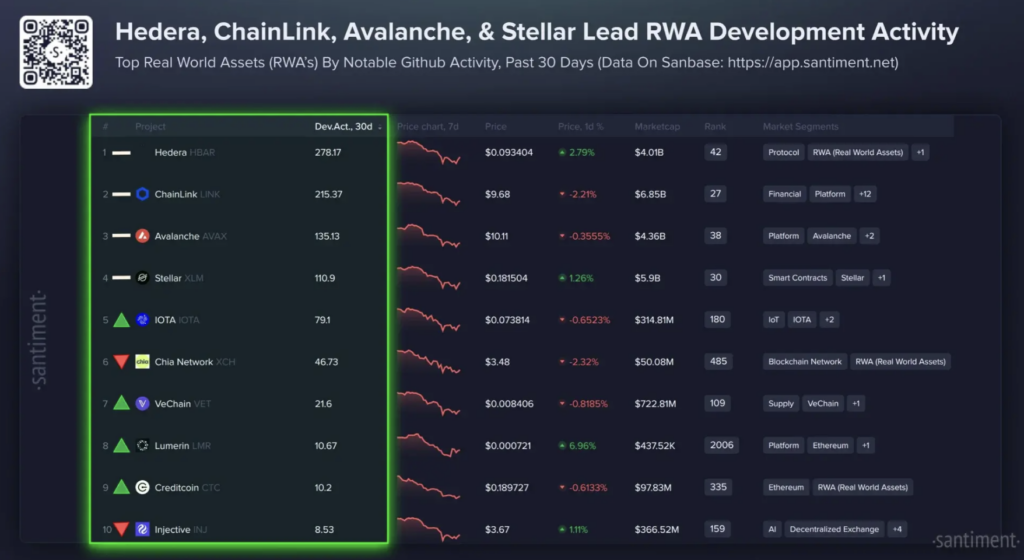

Analytics agency Santiment has launched its newest rankings monitoring crypto initiatives targeted on Actual World Property, a sector that continues to tug in each institutional curiosity and severe developer consideration. The information appears to be like at growth exercise throughout protocols engaged on tokenized finance, funds, and supporting infrastructure. It additionally exhibits how every challenge’s place has shifted since final month, providing a snapshot of the place momentum is quietly constructing.

Whereas costs throughout the market stay uneven, the underlying work hasn’t slowed. In actual fact, Santiment’s numbers recommend the alternative, with RWA-focused growth persevering with to speed up whilst merchants stay cautious. That distinction is turning into extra frequent throughout crypto proper now.

Hedera leads as enterprise focus stays robust

Hedera held on to the highest spot as soon as once more, reflecting its continued push into enterprise adoption and real-world tokenization frameworks. The community has spent years positioning itself as infrastructure-first, and that method seems to be paying off when it comes to sustained growth effort.

Chainlink adopted carefully in second place, which comes as little shock. Because the main oracle supplier, LINK performs a central function in connecting blockchains to off-chain knowledge, a requirement for many RWA use circumstances. Avalanche secured third, supported by latest integrations with banks and asset managers experimenting with tokenized funds and stablecoins.

Mid-table shifts sign renewed momentum

Stellar claimed fourth place, sustaining its long-standing give attention to funds and cross-border settlement. IOTA climbed into fifth, signaling renewed curiosity in machine-to-machine funds and finance tied to IoT ecosystems, an space that had gone quiet for some time.

Additional down the checklist, Chia slipped to sixth, whereas VeChain moved as much as seventh as exercise round provide chain tokenization picked up once more. Lumerin and Creditcoin additionally posted good points, touchdown in eighth and ninth positions respectively, suggesting extra builders are circling area of interest RWA use circumstances. Injective rounded out the highest ten, falling barely regardless of its robust footing in decentralized derivatives.

RWA growth retains accelerating regardless of volatility

Taken collectively, the rankings underline how Actual World Property have gotten a significant point of interest for blockchain growth. From tokenized treasuries to state-backed stablecoins and on-chain settlement rails, groups are racing to construct methods that bridge conventional finance with decentralized networks.

Santiment’s knowledge means that whilst crypto costs swing sharply, developer exercise round RWA protocols continues to climb. That regular progress may place these initiatives as key infrastructure gamers when the following part of adoption begins, each time the market decides to cooperate.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.