Gold Costs are gaining market curiosity because the metallic failed to interrupt by way of essential resistance ranges. In accordance with the newest technical replace offered by X person, CFA, the gold value could endure a short lived correction earlier than resuming its bullish development. The evaluation is predicated on the value motion of the XAUUSD pair, with particular help and resistance ranges recognized for the near-term path. Gold Value Prediction is being offered because the market assesses the soundness of the gold value throughout lively European session hours.

The evaluation offered by the market analyst by way of social media updates signifies that the gold value is in a good market construction. The metallic continues to be bullish, however the current value motion signifies that the metallic could endure consolidation earlier than resuming its bullish development.

Gold Value Prediction Indicators Quick-Time period Consolidation Part

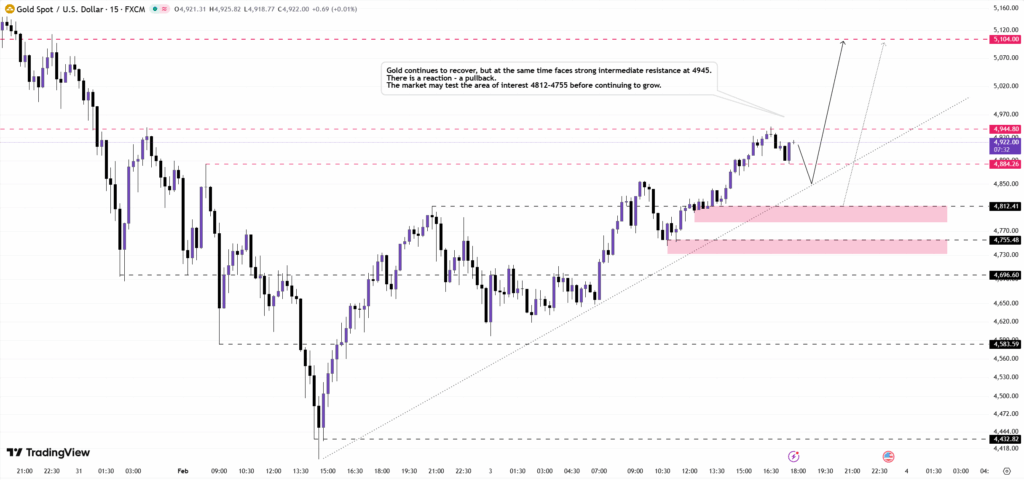

The present Gold Value Prediction signifies that gold costs may transfer in an outlined vary as momentum momentarily halts. After testing the resistance degree at $4,944, costs have been unable to maintain above it, leading to what technical analysts time period a false breakout. This has shifted market consideration to corrective patterns as an alternative of continuation.

Market construction means that gold costs may transfer in an outlined vary between ranges of $4,950 and $4,750. This might enable costs to realize momentum earlier than trying one other breakout. Analysts monitoring intraday charts recommend that it is a widespread part that follows a robust breakout, notably within the neighborhood of an outlined resistance degree.

European market hours may help this market construction. Buying and selling exercise throughout this time-frame typically units the tone for the rest of the buying and selling day. Consequently, market consideration is concentrated on whether or not costs will drift decrease towards help ranges or stay in an outlined vary.

Help Zones Information XAUUSD Value Outlook

Key help ranges stay an essential a part of the Gold Value Prediction mannequin. The analyst focuses on the $4,812 to $4,755 space as a major zone. This area corresponds with a technical help line that has been rising.

In case costs method this area, it might be essential to search for shopping for exercise. If costs stay above $4,755, it might keep the general construction. If costs fall under this degree, the subsequent degree can be close to $4,696, which has beforehand proven a response degree.

The help ranges are merely used as benchmarks. The response of costs with respect to those ranges can affect short-term market sentiment.

Resistance Ranges Outline Upside Boundaries

Resistance stays a limiting issue within the quick time period for gold’s upside potential. The Gold Value Prediction mannequin has recognized the primary degree of resistance at $4,884, adopted by the second degree at $4,944. The second degree has attracted curiosity as a result of value’s temporary spike above it earlier than declining once more.

For the long run, the extent of $5,100 is a resistance degree. It’s a degree that has a psychological and technical element. It’s a degree that may want important value momentum to problem. Subsequently, till the value approaches this degree once more, the main target continues to be on the reactions across the decrease resistance ranges.

Market Situations Form Gold Buying and selling Path

Market dynamics are additionally an integral a part of the general Gold Value Prediction situation. That is the place the analyst has recognized the presence of an total native uptrend, even because the pullback indicators are being despatched. On the identical time, the comparatively weaker U.S. greenback additionally continues to help the gold value.

This is without doubt one of the areas the place the foreign money performs an essential position, particularly in the course of the intraday buying and selling situations. A weaker greenback surroundings additionally gives help for the gold value, even in the course of the pullback phases.

It looks as if the general gold value is prepared for a consolidation part.