- Dogecoin has large model energy and liquidity, however an inflationary provide that pressures long-term worth progress

- Institutional curiosity and fee apps might enhance utility, although adoption continues to be unsure

- DOGE stays extremely speculative, with worth pushed extra by sentiment than fundamentals

Dogecoin began as a joke again in 2013, however in some way it was some of the talked-about cryptocurrencies on the planet. On the time of writing, DOGE trades across the $0.10 stage, with every day buying and selling quantity sitting within the low billions, which isn’t small by any measure. Its circulating provide is near 170 billion cash, putting it among the many largest crypto property by market worth, regardless that it was by no means designed to be taken this critically.

That large provide can also be a part of the story. In contrast to Bitcoin, Dogecoin has no arduous cap, that means new cash enter circulation each single yr. This setup places fixed strain on worth progress, as a result of demand has to maintain climbing simply to take care of present ranges, not to mention push larger. It’s not deadly by itself, but it surely does change how DOGE behaves over time.

Latest Developments Bringing Dogecoin Again Into Focus

Over the previous few months, Dogecoin has seen renewed curiosity from establishments and companies, which caught many individuals off guard. NASDAQ just lately launched a Dogecoin-focused funding product, giving skilled traders a regulated strategy to achieve publicity. That alone alerts a shift in how components of conventional finance now view meme cash, even when cautiously.

There may be additionally rising consideration round a Home of Doge-backed fee app known as “Such,” anticipated to launch in early 2026. The thought is easy, make Dogecoin simpler to make use of for on a regular basis funds. If retailers really undertake it and the consumer expertise is clean, DOGE might lastly see real-world utilization broaden. Nonetheless, that consequence is way from assured, and adoption has at all times been the arduous half.

Strengths That Maintain Dogecoin Related

Dogecoin’s greatest benefit is its model and neighborhood. Few cryptocurrencies are as recognizable, and that issues greater than folks prefer to admit. Public figures, particularly Elon Musk, have performed an enormous function in conserving DOGE within the highlight, and social media hype can nonetheless transfer the value quick, generally inside hours.

On a technical stage, Dogecoin additionally has low transaction charges and comparatively fast transfers. These options make it appropriate for small funds and tipping, at the very least in concept. If adoption will increase, DOGE might operate moderately nicely as a digital fee coin, not only a speculative asset, which is one thing many meme cash can not declare.

Weaknesses and Lengthy-Time period Dangers to Watch

The inflationary provide mannequin stays considered one of Dogecoin’s greatest weaknesses. With no most cap, new cash dilute the availability yearly. This implies demand should continue to grow simply to forestall gradual worth erosion over time, which isn’t simple to maintain with out robust, constant utilization.

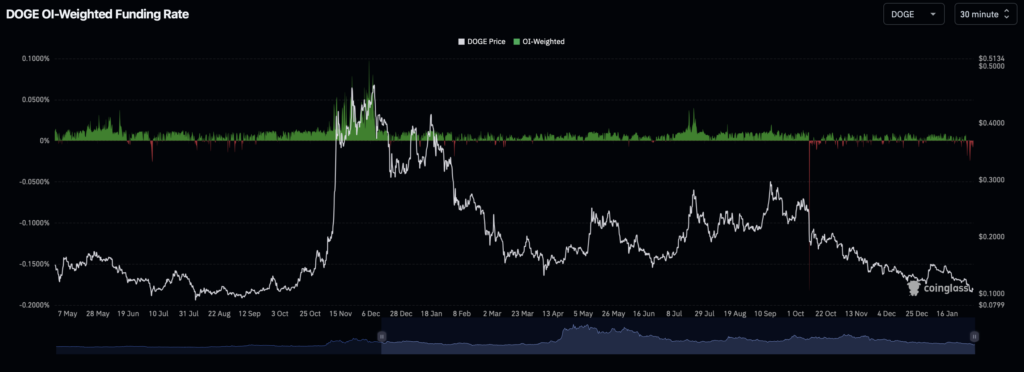

Dogecoin’s worth historical past is one other concern. It tends to surge on hype, then fall sharply as soon as consideration fades. These strikes are pushed extra by emotion, headlines, and on-line tendencies than by fundamentals or upgrades. For long-term holders searching for regular progress, that type of conduct might be irritating, and dangerous too.

Macro Situations and Regulatory Strain

Like most meme cash, Dogecoin is closely influenced by the broader crypto market. Rates of interest, total liquidity, and ETF flows can affect DOGE extra aggressively than bigger property like Bitcoin or Ethereum. When threat urge for food drops, Dogecoin typically falls sooner, generally with out a lot warning.

Institutional merchandise do add legitimacy, however wider adoption would possible require simpler entry for retail traders as nicely. Till that occurs, a lot of DOGE’s worth motion will stay speculative and pushed by information cycles, not long-term fundamentals.

Bubble or Actual Alternative?

Dogecoin sits in an uncomfortable center floor between hypothesis and potential utility. Brief-term merchants can discover alternative because of volatility and sudden rallies pushed by information or social media buzz. Lengthy-term worth, nevertheless, relies upon virtually totally on actual adoption, particularly fee use circumstances.

If instruments just like the “Such” fee app achieve traction and precise customers begin spending DOGE, the coin might keep relevance for years. If that adoption fails to materialize, worth progress might proceed to depend on hype cycles, which just about at all times finish with sharp corrections.

Remaining Ideas on Dogecoin’s Future

Dogecoin is neither a assured bubble nor a protected funding. It gives alternative, but it surely additionally carries actual threat. Present knowledge reveals robust market presence, with billions in every day buying and selling quantity and a provide nearing 170 billion cash, but its inflationary design and hype-driven conduct stay severe issues.

In the end, DOGE’s future worth will rely on adoption, regulation, and whether or not new instruments flip it into one thing greater than a meme. With out significant progress on these fronts, Dogecoin might proceed transferring in emotional market cycles, making it unpredictable for severe long-term traders.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.