- The ISM is a enterprise exercise survey, not a dependable Bitcoin worth indicator

- Historic information reveals Bitcoin usually strikes reverse to ISM tendencies

- Supercycle narratives constructed on single macro indicators have failed earlier than

The ISM Manufacturing Index measures enterprise situations via surveys of buying managers, with readings above 50 signaling enlargement and beneath 50 contraction. It’s a helpful snapshot of company momentum, provide chains, and demand expectations. What it doesn’t do is predict speculative asset habits. Bitcoin is pushed by liquidity, leverage, and positioning way over manufacturing facility output or procurement sentiment.

But in 2026, the ISM has been elevated to near-oracle standing by merchants trying to find macro reassurance after a number of bullish narratives unraveled. That’s a harmful shortcut.

Historical past Reveals the Disconnect Clearly

The historic file doesn’t help the concept that a powerful ISM lifts Bitcoin. In 2014, the ISM climbed steadily whereas Bitcoin collapsed from over $700 to close $300. In 2015, the other occurred: the ISM fell into contraction whereas Bitcoin quietly ended its bear market and moved greater.

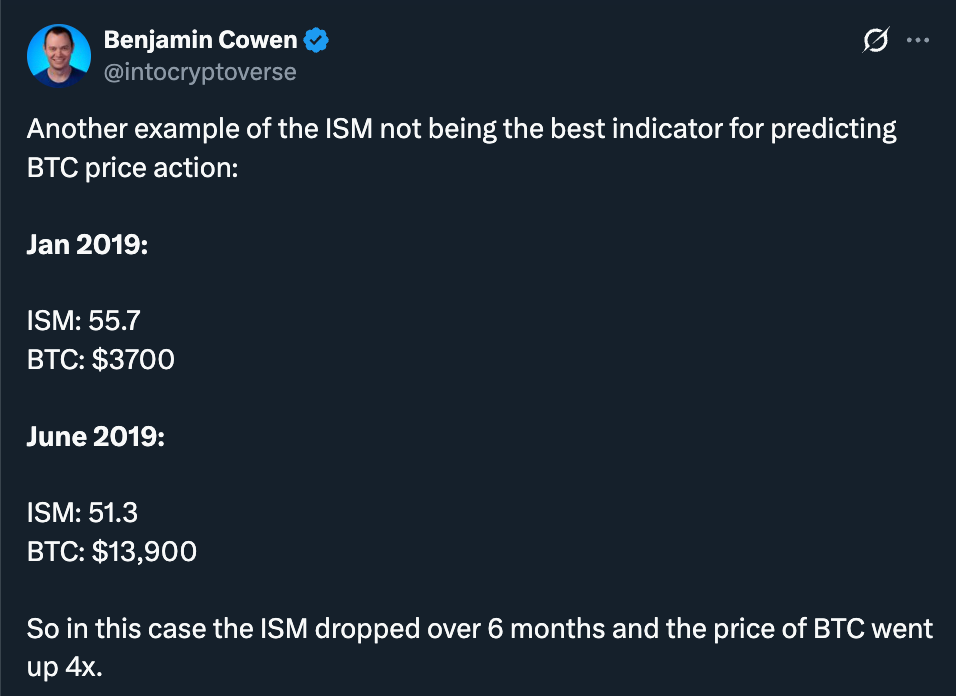

The sample repeats elsewhere. In 2019, the ISM weakened considerably whereas Bitcoin surged practically fourfold in six months. These weren’t edge instances. They had been full-cycle failures in each instructions.

Why 2026 Appears to be like Uncomfortably Acquainted

The ISM studying in January 2014 was 52.5. In January 2026, it sits at 52.6. That similarity issues as a result of it highlights how simply historical past can rhyme. There’s a very actual state of affairs the place enterprise surveys enhance this 12 months whereas Bitcoin continues to bleed, catching supercycle believers offside.

Anybody anchoring positions to at least one macro indicator is underestimating how advanced Bitcoin’s drivers really are.

The Actual Danger for Supercycle Believers

The hazard isn’t that the ISM is ineffective. It’s that merchants are utilizing it in isolation to justify high-conviction Bitcoin bets. Context at all times wins. Liquidity situations, leverage, regulation, and threat urge for food matter way over a single survey print.

Bitcoin has by no means moved in lockstep with the financial system. Treating it as a macro mirror fairly than a liquidity asset has price individuals fortunes earlier than.

Conclusion

A single information level doesn’t make a development. Utilizing the ISM to validate a Bitcoin supercycle isn’t evaluation, it’s hope dressed up as math. Bitcoin isn’t the financial system, and betting as if it had been is without doubt one of the quickest methods to get punished on this market.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.